Table of Contents

- I. Welcoming You to the World of Mutual Funds in India

- II. Why AMFI Matters: Protecting and Guiding Indian Investors

- III. How AMFI Works: Behind the Scenes for Your Benefit

- IV. AMFI’s Role in Educating Indian Investors: Making You Smarter

- V. Understanding Your Mutual Fund Options: AMFI’s Classification System

- VI. Practical Steps: How AMFI Helps You Invest Smartly

- VII. Common Pitfalls and How AMFI Helps You Avoid Them

- VIII. Important Tools and Resources from AMFI for Indian Investors

- IX. The Future of Mutual Funds in India: AMFI’s Vision

- X. Conclusion – Your Path to Confident Investing with AMFI’s Support

- XI. Frequently Asked Questions (FAQ) About AMFI and Mutual Funds in India

- 1. What exactly is AMFI?

- 2. How does AMFI protect my money in mutual funds?

- 3. Is "Mutual Funds Sahi Hai" an AMFI campaign?

- 4. Can AMFI help me choose the best mutual fund?

- 5. What is the AMFI Registered Mutual Fund Distributor (ARMFD) exam?

- 6. Where can I complain if I have a problem with a mutual fund or distributor?

- 7. What's the difference between AMFI and SEBI?

- 8. Do all mutual funds in India have to be part of AMFI?

- 9. What are "fund fact sheets" and "offer documents" and why are they important?

- 10. Is it safe to invest in mutual funds through online platforms like Groww or Zerodha in India?

Are you new to mutual funds?

Or maybe you’ve heard about them but aren’t sure where to start?

In this simple, step-by-step guide, we’ll walk you through everything you need to know about AMFI (Association of Mutual Funds in India).

We will also learn more about the role of AMFI in Mutual Funds and what it does to make your mutual fund journey safe, easy, and trustworthy.

By the end of this article, you’ll understand:

- What mutual funds are and why they’re becoming more popular than FDs and PPFs.

- Who AMFI is and how they protect your investments.

- How AMFI works with SEBI to keep the market fair for everyone.

- Tools and resources that help you make smart investment decisions.

- Common mistakes to avoid—and how AMFI helps prevent them.

- And much more!

Let’s get started!

I. Welcoming You to the World of Mutual Funds in India

1. Understanding Mutual Funds Simply

A. What Are Mutual Funds?

Think of Mutual Funds as a Basket of Investments.

Let me explain this with something you can easily relate to — imagine you want to buy different fruits like apples, bananas, and oranges, but buying each one separately is expensive.

So what do you do? You team up with a few friends or family members, pool your money together, and buy all the fruits at once. Then you divide them equally among everyone.

That’s exactly how mutual funds work!

A mutual fund is like a big basket where many people invest small amounts of money together. This pooled money is then invested in things like shares of big companies (like Reliance or Infosys), government bonds, or other assets. But here’s the best part — it’s managed by professional experts who know what they’re doing.

As these investments grow over time, so does your money.

This means even if you only have ₹500 or ₹1,000 to invest, you can still own a small piece of top Indian companies or safe government-backed bonds — all thanks to mutual funds.

B. Why Are Mutual Funds Popular in India?

For years, most Indians preferred traditional savings options like Fixed Deposits (FDs) and Public Provident Fund (PPF). These are safe, yes — but they also give limited returns.

Now, more and more people are choosing mutual funds, and here’s why:

- Better growth potential: Unlike FDs and PPFs that give fixed returns (say around 6–7%), mutual funds — especially equity funds — can give much higher returns over time (sometimes 12% or more).

- Expert management: You don’t need to be a stock market expert. The fund manager takes care of everything for you.

- Flexibility: Whether you’re saving for your child’s education, planning to buy a house in 5 years, or preparing for retirement, there’s a mutual fund to match your goal.

- Spreads your risk: This is called diversification — instead of putting all your money into one company, your investment is spread across many companies and sectors, which lowers your risk.

And here’s the good news:

Organizations like AMFI make sure everything stays safe, simple, and clear for every investor in India.

2. Getting to Know AMFI: Your Friendly Guide

A. What Does AMFI Stand For?

AMFI stands for Association of Mutual Funds in India.

AMFI was started in 1995 as a non-profit organization. Think of it as the central body that brings together all mutual fund companies in India and makes sure they follow fair practices.

AMFI doesn’t manage your money directly, but it plays a big role in making sure the entire mutual fund system works smoothly and fairly for every investor — including you.

B. Why Is AMFI Important for You?

Think of AMFI as Mutual Fund Industry’s Helpful Big Brother.

Confused? Let me explain with a simple example.

Imagine the mutual fund industry is like a big group of friends who run different shops — each shop sells something a bit different, but they all follow the same rules and want to help customers.

Now, just like how a big brother helps keep things fair and smooth at home, AMFI acts like the “big brother” of all these mutual fund companies.

You might wonder, “Why should I care about AMFI?”. Correct?

Well, here’s why:

- 🛡️ AMFI sets the rules: Just like a big brother might set ground rules during a game so everyone plays fairly, AMFI creates clear guidelines so all mutual fund companies treat investors like you with honesty and care — no matter where you invest.

- 🧐 AMFI checks if everyone follows the rules: If someone isn’t playing fair — like charging extra fees or hiding important info — AMFI steps in and says, “Fix this!” So you don’t have to worry about being treated unfairly.

- 📚 AMFI teaches people like you: With fun and simple campaigns like “Mutual Funds Sahi Hai”, AMFI helps everyday Indians (like you and me!) understand how investing works — without confusing words or hard-to-read stuff.

- 🤝 AMFI makes sure advisors are trustworthy: Before someone can guide you on mutual funds, they must pass exams and get certified. AMFI ensures only trained and honest people give you advice — so you can feel safe and supported.

- 💰 AMFI protects your money: By making sure everything is open and honest, AMFI helps keep your hard-earned money safe and makes sure it’s used responsibly. You can trust that things are working the right way!

In short, AMFI acts as a guardian for mutual fund investors in India. It ensures fairness, guides you through the process, and builds confidence — especially if you’re new to investing.

3. Real-Life Example

Let me tell you a quick story. A friend of mine wanted to start investing but didn’t know where to begin. He had heard of mutual funds but was confused between two similar-sounding funds — one high-risk, one low-risk.

He almost picked the wrong one until he saw an ad from AMFI explaining how to choose based on your goals and risk level.

After watching the video, he took his time, read the facts, and chose the right fund for his needs.

Thanks to AMFI’s guidance, he made a better choice — and now his investment is growing steadily.

4. Summary

- Mutual funds let you invest small amounts and still enjoy big benefits — like owning shares of top companies.

- They’re becoming popular because they offer higher returns, flexibility, and less stress than old-style savings options like FDs and PPFs.

- AMFI is the organization that keeps the whole system fair, safe, and easy to understand.

- With tools like “Mutual Funds Sahi Hai”, AMFI helps millions of Indians take smart steps toward their financial goals.

II. Why AMFI Matters: Protecting and Guiding Indian Investors

1. Main Role of AMFI in Mutual Funds: Keeping Things Fair and Clear

A. Setting Rules and Good Practices for Fund Houses (AMCs)

Let me explain this with a simple example.

Think of your local market — if there were no rules, one shopkeeper might charge more than others for the same item, or someone might not give you the correct weight. That wouldn’t be fair, right?

The mutual fund industry is similar.

There are many Asset Management Companies (AMCs) — these are the companies that run mutual funds in India, like HDFC Mutual Fund, ICICI Prudential, SBI Mutual Fund, etc.

Just like how we need rules in a market to keep things fair, AMFI creates guidelines that all these AMCs must follow.

These guidelines help make sure:

- Funds are managed properly

- Fees charged to investors are clear and reasonable

- You get timely and accurate updates about where your money is invested

This way, every AMC follows the same standards — so you know you’re being treated fairly, no matter which fund you choose.

B. Making Sure Everyone Follows the Rules and Guidelines

Now that AMFI has created the rules, it doesn’t stop there.

It also makes sure everyone plays by those rules.

If an AMC isn’t doing things the right way — like charging extra fees without telling investors or delaying returns — AMFI steps in and tells them to fix it.

You don’t have to worry about anyone secretly breaking the rules behind your back. AMFI acts like a monitor who checks whether everything is happening the way it should.

This helps build trust and keeps the whole system clean and reliable for every investor like you.

2. Making Sure Your Investment is Protected

A. How AMFI Protects Your Money

Think of AMFI as a safety net for your mutual fund investment journey — it makes sure things stay fair, safe, and clear for you, even if something goes wrong.

When you invest in a mutual fund, your money is not kept with the company’s own money.

Instead, it is held separately in a trust, like putting your money in a safe locker. Even if the fund house (the AMC) faces any trouble, your investment stays protected.

AMFI supports this system and makes sure all fund houses follow strict rules when handling investor money.

So even if something goes wrong with the company managing your fund, your hard-earned money remains safe.

B. What Happens if Something Goes Wrong? (Understanding Investor Complaints and Resolution)

Sometimes, small issues may come up — like delays in getting your money back after selling your mutual fund units, or incorrect charges on your account.

If that happens, AMFI works together with SEBI (the main regulator of financial markets in India) to help solve your problem.

They also ask fund houses to set up proper systems so they can handle complaints quickly and fairly.

For example, my cousin once had a delay in getting her redemption amount from a fund. She reached out to the customer care team of the AMC, but didn’t get a reply for a week.

She then filed a complaint through SEBI’s SCORES portal (which AMFI also encourages), and within a few days, the issue was resolved.

That’s how the system works — and AMFI plays a big role in making sure things go smoothly for you.

3. Boosting Confidence in Mutual Funds Across India

A. Building Trust in the Indian Investment Market

Thanks to AMFI’s efforts, more and more Indians are now choosing mutual funds over older options like FDs and PPFs.

Why?

Because people feel confident that their investments are safe, and that the rules are being followed.

AMFI’s work helps create a sense of trust and fairness in the entire system — and that makes more people willing to invest.

B. Encouraging More People to Invest Safely

One of the biggest ways AMFI builds trust is by educating people.

Through programs like “Mutual Funds Sahi Hai”, AMFI spreads awareness across India — especially in smaller towns and cities — about how mutual funds work and why they can be a good option.

In fact, I remember a friend from Jaipur who used to only invest in gold and FDs. He thought mutual funds were too risky or complicated.

But after watching some short videos from AMFI explaining how SIPs work and how diversification lowers risk, he started investing small amounts regularly.

Today, he’s happy with his growing portfolio — and he feels more financially secure.

That’s the kind of change AMFI is bringing across India — helping everyday people learn, trust, and grow through smart investing.

4. Summary

- AMFI sets clear rules for all mutual fund companies so you get treated fairly.

- They check that everyone follows these rules and takes action if they don’t.

- Your money is kept safe and separate from the fund house’s own money.

- If something goes wrong, AMFI helps resolve your complaints along with SEBI.

- Through education and awareness, AMFI is helping more Indians trust and invest in mutual funds confidently.

III. How AMFI Works: Behind the Scenes for Your Benefit

1. AMFI and SEBI: A Powerful Partnership for Indian Markets

A. SEBI (Securities and Exchange Board of India): The Main Regulator

Let me explain this in a simple way.

Think of SEBI as the traffic police of the financial market in India. It’s their job to make sure everything runs smoothly, safely, and fairly.

SEBI stands for Securities and Exchange Board of India, and it is the main body that makes rules for how mutual funds work in our country.

These rules are made to protect your money and make sure you get clear information about where you’re investing.

So whenever there’s a new rule or law related to mutual funds — like how fees should be charged or how investors should be treated — SEBI is the one who sets it.

B. How AMFI Works Hand-in-Hand with SEBI

Now that SEBI has made the rules, someone needs to make sure they are followed by all mutual fund companies.

That’s where AMFI comes in.

You can think of AMFI as the class monitor who helps the teacher (SEBI) keep an eye on the class (mutual fund companies).

While SEBI creates the laws, AMFI makes sure everyone follows them.

For example:

If a fund house tries to charge extra fees without telling investors, or if they delay giving returns, AMFI steps in and tells them to fix it.

Together, SEBI and AMFI make sure the whole system stays clean, fair, and open for every investor like you.

This partnership means you don’t have to worry about hidden charges or unfair practices — because both these bodies are working to protect your interests.

2. Who Is Part of AMFI?

A. Understanding AMFI Membership

AMFI is not just a single office — it’s a group/association of all the mutual fund companies in India.

Every company that offers mutual funds to the public — like HDFC Mutual Fund, ICICI Prudential, SBI Mutual Fund, Axis Mutual Fund, and others — is a member of AMFI.

That means every mutual fund you see in India is part of AMFI.

B. How Membership Helps You

Because all mutual fund companies are part of AMFI, they all follow the same rules and standards.

No matter which fund you choose — whether from a big bank or a private company — you can expect:

- Clear and honest communication

- Fair treatment

- Transparency in how fees are charged

- Protection of your investment

So even if you’re new to investing, you can feel confident knowing that all funds follow the same quality checks thanks to AMFI membership.

3. Key Functions and Divisions Within AMFI

A. Different Teams, One Goal

Inside AMFI, there are different teams working together toward one goal — making mutual fund investing safe, easy, and beneficial for you.

Some of the key areas they focus on include:

- Investor education: Teaching people like you how mutual funds work.

- Distributor certification: Making sure financial advisors are trained and trustworthy.

- Fund classification: Grouping funds into categories so it’s easier for you to compare them.

- Grievance handling: Helping investors when something goes wrong.

Each team plays a role in improving your experience as an investor.

B. How Their Work Directly Benefits Your Investments

The work AMFI does affects your investment journey at every step.

For example:

- When AMFI educates you through campaigns like “Mutual Funds Sahi Hai,” you learn how to invest wisely.

- When they certify distributors, you can trust the advisor helping you.

- When they classify funds, you can easily find the right one based on your goals.

- If you face a problem with your investment, AMFI helps ensure there’s a process to resolve it quickly.

In short, everything AMFI does is meant to make your life easier and your investments safer.

4. Real-Life Example

Let me share a quick story. A friend of mine once had a complaint about his mutual fund — he didn’t receive confirmation after investing online.

He was confused and worried, but then I told him to check if the distributor had an ARN number (which AMFI gives to certified advisors).

We also guided him to file a complaint through SEBI’s SCORES portal, which AMFI supports.

Within a week, the issue was resolved.

That’s the power of having strong systems like AMFI and SEBI in place — they make sure you’re protected and heard.

5. Summary

- SEBI makes the rules, and AMFI ensures they are followed, keeping the mutual fund market safe and fair.

- All mutual fund companies in India are members of AMFI, which guarantees quality and transparency no matter which fund you choose.

- Inside AMFI, different teams work together to help you — from educating you to protecting your rights.

- Because of these efforts, you can invest with confidence, knowing there’s a strong support system behind every decision you make.

IV. AMFI’s Role in Educating Indian Investors: Making You Smarter

1. The Power of “Mutual Funds Sahi Hai” Campaign

A. What Is “Mutual Funds Sahi Hai”?

Let me tell you about something you may have already seen — the “Mutual Funds Sahi Hai” campaign.

This is a big awareness drive started by AMFI back in 2007 to help everyday Indians understand how mutual funds work.

You might have seen these ads on TV or YouTube — real people sharing their stories about how they grew their money through small, regular investments in mutual funds.

It’s not just an ad — it’s a movement to help more and more Indians feel confident about investing.

B. How This Campaign Helps Beginners Understand Investing

If you’re new to investing, terms like SIP, diversification, or equity funds can sound confusing.

That’s where this campaign helps.

It breaks down complex ideas into simple, easy-to-understand messages. For example:

- It shows how even small amounts invested regularly (like ₹500 per month) can grow over time.

- It explains why putting all your money in one place is risky and how spreading it across different funds lowers that risk.

- It encourages long-term thinking instead of trying to get rich quickly.

I remember my uncle watching one of these videos and asking me, “Is investing really this simple?” I told him yes — and now he invests through SIPs every month without fear.

The “Mutual Funds Sahi Hai” campaign has helped millions of Indians take that first step toward building wealth.

2. Simple Learning Resources from AMFI for Indians

A. Where to Find Easy-to-Understand Information

AMFI makes learning about mutual funds very easy.

They offer free resources such as:

- amfiindia.com: Their official AMFI website where you can check daily NAV updates, read fund details, and watch educational videos.

- Brochures and guides: These are written in simple Hindi and English and explain everything from what a mutual fund is to how to choose one.

- Short explainer videos: Available on YouTube and social media, these break down investment topics into short, easy clips.

These tools are made keeping you in mind — whether you’re completely new to investing or want to learn more before making your next move.

B. Why These Resources Are Great for Your Financial Learning

All of AMFI’s materials are created with the average Indian investor in mind.

They use examples that match your life — like saving for your child’s education, planning for a house, or preparing for retirement.

For instance, if you’re wondering how to start investing but don’t know where to begin, you can go look up beginner guides in the Investor Corner by AMFI, and follow along step-by-step.

And best of all, everything is free and available in both Hindi and English — so no matter where you’re from, you can learn at your own pace.

3. Making Sure Financial Advisors Are Qualified

A. The NISM Certification is Your Advisor’s “License”

When you go to buy mutual funds, you often meet a financial advisor or distributor.

But how do you know if they really know what they’re talking about and are authorized to guide you?

Well, before someone can legally sell or advise on mutual funds in India, they must pass a specific exam called the NISM Series V-A: Mutual Fund Distributors Certification Examination. Check out the screenshot of the exam details below:

This Mutual Fund Distributors Certification Examination is conducted by NISM (National Institute of Securities Markets), which is an educational initiative of SEBI.

Once they pass this NISM exam, they can then apply to AMFI for their official registration number, called an ARN.

This ensures they understand the basics of investing, different types of mutual funds, and their responsibilities to you, minimizing the chances of wrong or unsuitable advice.

B. Why This NISM Certification and AMFI Registration Is Important for You

Passing the NISM Series V-A exam is a big deal!

It shows that an advisor has studied and understood the rules and products of the mutual fund world. Once they clear this NISM exam, they get their AMFI Registration Number (ARN), which is like their official ID card issued by AMFI.

Together, this NISM certification and AMFI registration make sure that anyone advising you on mutual funds knows their stuff and will act ethically.

This certification also needs to be renewed every three years, ensuring advisors stay updated.

So, when you talk to an advisor who has both this NISM certification and an AMFI ARN, you can be more confident that they’re giving you honest and helpful suggestions – because they’ve been properly tested and registered by the bodies designed to protect your interests.

It gives me peace of mind knowing that my own advisor has these credentials; it’s like knowing your doctor has their license!

C. Understanding the ARN (AMFI Registration Number) and How to Verify It

Every qualified mutual fund distributor or advisor gets a unique number called ARN, which stands for AMFI Registration Number. This is like their official ID card issued by AMFI, confirming their authorization to distribute mutual funds.

To verify if your advisor holds a valid ARN and is officially recognized, simply follow these exact steps:

- Get the ARN: Ask your mutual fund advisor or distributor for their ARN. They should readily provide this to you.

- Visit the Official AMFI Website: Open your web browser and go to the official AMFI website: www.amfiindia.com.

- Navigate to the Distributor Search Tool: On the AMFI homepage, look for a section like “Distributor Corner” or “Locate a Mutual Fund Distributor.” A direct link you might find is: https://www.amfiindia.com/locate-your-nearest-mutual-fund-distributor-details

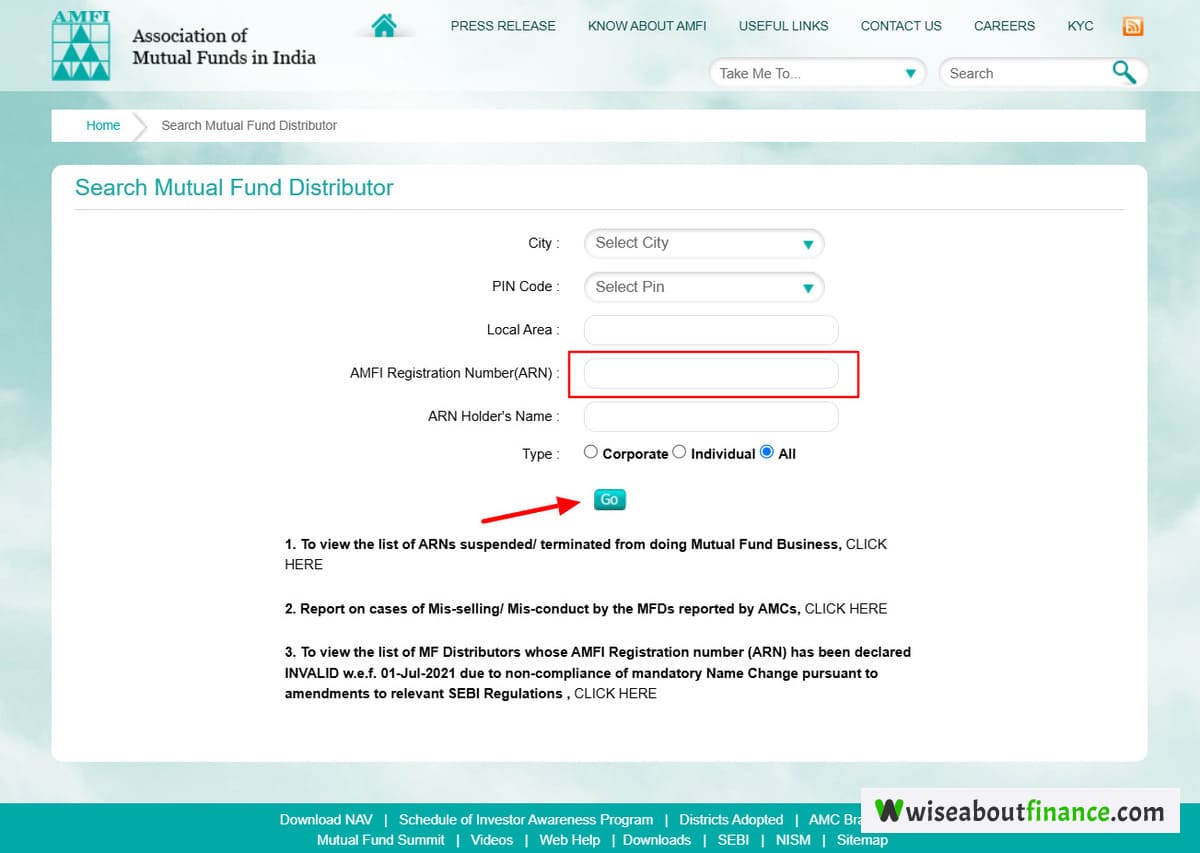

- Enter the ARN: On the “Search Mutual Fund Distributor” page, locate the input box specifically labeled “AMFI Registration Number (ARN).”

- Initiate Search: Carefully enter the ARN provided by your advisor into this box, as highlighted by the red rectangle in the screenshot below. Double-check for any typos.

- View Details: Click on the “Go“, as shown by the red arrow in the screenshot below. The website will then display the details associated with that ARN, including the distributor’s name and the validity status of their ARN.

Once you verify these details, you’ll have peace of mind knowing your advisor is properly trained, verified, and trustworthy. This simple check is a powerful step in securing your financial journey.

You can also check the details of the Distributor at an alternate link online. To do so, simply visit: Know Your Distributor (KYD) Status Inquiry

4. Real-Life Example

Let me share a quick story.

My friend was looking to invest but didn’t trust advisors because he had heard horror stories of people being sold bad products.

Then I told him to check the advisor’s ARN number online.

He did — and found out that the person had been in the field for 8 years and had passed all required exams.

That gave him the confidence to proceed — and today he’s happy with his growing portfolio.

5. Summary

- The “Mutual Funds Sahi Hai” campaign makes investing easier to understand with real-life stories and simple language.

- AMFI provides free resources like videos, brochures, and a user-friendly website (amfiindia.com) to help you learn at your own pace.

- Before selling mutual funds, advisors must pass exams like ARMFD and NISM certification, ensuring they give you good advice.

- You can always check an advisor’s ARN number online to confirm they’re qualified and trustworthy.

V. Understanding Your Mutual Fund Options: AMFI’s Classification System

1. Why We Need Categories for Mutual Funds in India

A. Making Sense of Different Types of Funds (e.g., Equity, Debt, Hybrid)

If you’ve ever looked at a list of mutual funds, you may have felt confused — there are so many names and types!

To make it easier for you to understand and compare them, AMFI has grouped mutual funds into simple categories.

These main categories include:

- Equity funds: These invest mostly in company shares or stocks. They carry more risk but also offer better long-term returns.

- Debt funds: These invest in safer options like government bonds and fixed deposits. They’re good for short-term goals.

- Hybrid funds: These mix both equity and debt. They balance your risk and return, making them great for medium-term goals.

This classification makes it much easier for you to pick the right kind of fund based on your needs.

B. How Classification Helps You Choose the Right Fund for Your Goals

Let’s say you’re saving for retirement — which is many years away. In that case, an equity fund might be a good choice because it gives better returns over the long term.

But if you’re saving up for something closer — like buying a house in 3 years — a hybrid fund might suit you better.

By grouping funds into these clear categories, AMFI helps you match your investment with your goal, without getting lost in confusing names and descriptions.

2. AMFI’s Simple Rules for Fund Categories

A. Standardizing Names and Definitions for Clarity

Earlier, two funds could have the same name — like “India Growth Fund” — but actually invest in completely different things.

One might be investing in risky tech stocks, while another might be focused on safe government bonds.

That made it really hard for investors like you to know what they were actually investing in.

Now, thanks to AMFI’s standardization rules, every mutual fund must clearly state:

- What type of fund it is

- What kind of assets it invests in

- What level of risk it carries

So when you see a fund called “XYZ Equity Fund,” you can be sure it mostly invests in stocks.

B. How This Helps You Compare Funds Easily (Apples to Apples)

Because of this standard naming and definition system, you can now compare similar funds easily.

For example, if you want to choose between two debt funds, you can look at how each one performs, what fees they charge, and how experienced their fund manager is — without worrying about misleading names or unclear information.

It’s like comparing two mobile phones from the same category — you know you’re looking at similar features and functions.

3. Matching Funds to Your Investment Goals

A. Picking Funds for Savings, Retirement, or Buying a House

Your financial goal plays a big role in deciding which type of fund to choose.

Here’s a simple guide:

- Short-term goals (1–3 years) — like saving for a vacation, Diwali shopping, or a down payment on a bike — go for debt funds.

- Medium-term goals (3–5 years) — such as saving for a car or home renovation — pick hybrid funds.

- Long-term goals (5+ years) — like your child’s education or retirement — choose equity funds, which grow faster over time.

This way, you don’t take unnecessary risks — and your money grows steadily toward your goal.

B. Simple Steps to Pick the Best Fit Based on AMFI Guidelines

Let me walk you through how I picked my first mutual fund using AMFI’s guidelines:

- Define your goal – I wanted to save for my younger brother’s college fees, which was 4 years away.

- Decide your time horizon – Since it was 4 years, I went for a balanced hybrid fund.

- Check AMFI’s fund categories – I looked at the hybrid fund group and picked one with a good track record.

- Look at past performance and expense ratio – I compared a few funds and chose one with consistent returns and low fees.

- Start with a small SIP – I began with just ₹1,000 per month via SIP and slowly increased it later.

That’s how easy it can be when you follow AMFI’s structure.

4. Summary

- There are many mutual funds, but AMFI groups them into clear types — equity, debt, and hybrid — so you can understand what they do.

- These categories help you choose the right fund based on your goal and time frame.

- AMFI sets rules so funds are named and described clearly — making it easier for you to compare them fairly.

- Whether you’re saving for a short-term goal like a gadget or a long-term goal like retirement, AMFI’s system helps you find the best fit.

- Just follow the steps: define your goal, decide your timeline, check the fund category, compare a few options, and start with a small SIP.

VI. Practical Steps: How AMFI Helps You Invest Smartly

1. Finding a Good Mutual Fund Distributor in India

A. How AMFI Helps You Find Trusted and Certified Advisors

If you’re new to mutual funds, you might need help choosing the right one.

That’s where mutual fund distributors come in — they’re like financial guides who help you pick the best funds based on your goals.

But how do you know if they’re trustworthy?

Here’s where AMFI helps you.

Only people who have passed certain exams (like ARMFD) are allowed to sell mutual funds in India. These certified advisors get a unique number called an ARN (AMFI Registration Number).

You can go to Search Mutual Fund Distributor on AMFI, enter “AMFI Registration Number (ARN)”, and check if the advisor is officially registered.

This makes sure that the person helping you knows what they’re doing — and isn’t just trying to earn commission without caring about your needs.

B. What to Look For in a Distributor

When choosing someone to guide your investments, here’s what to look for:

- Proper certification – Always verify their ARN number online.

- Experience – Someone with a few years of experience is usually better than a new person.

- Transparency in fees – They should clearly explain any charges or commissions involved.

- Willingness to explain things simply – If they can’t explain why a fund is good for you in plain language, it’s a red flag.

I remember when my cousin was starting out, he met a distributor who promised him high returns in just a few months. But when he checked the ARN, there was no record.

He walked away — and later found a certified advisor who explained everything step-by-step.

So always take a moment to verify and ask questions before trusting anyone with your money.

2. Understanding Your Rights as an Investor in India

A. What AMFI Wants You to Know About Your Investor Rights

As a mutual fund investor in India, you have some important rights.

These are not just rules — they’re protections designed to keep your money safe and give you peace of mind.

Here’s what you should know:

- You have the right to know where your money is being invested.

- You should get regular updates on how your investments are doing.

- If something goes wrong, you can file a complaint and expect a timely response.

- If you bought a fund offline, you can cancel within 7 days and get your money back.

These rights exist so you don’t feel trapped or confused once you invest.

B. How to Use Your Rights to Your Advantage and Stay Safe

Let me share a quick story.

A friend of mine once invested in a mutual fund through an agent but didn’t understand the details. After a month, she noticed the returns weren’t matching what was promised.

She asked the agent for a breakdown of where her money was going — and he couldn’t explain clearly.

So she filed a complaint with the fund house, and after a few days, she got a clear report.

The key takeaway? Always ask questions.

Also:

- Keep your KYC updated — this is like your identity proof for investing.

- Check your portfolio regularly to see how your funds are performing.

- Don’t be afraid to complain if something feels off.

Your money matters — and you deserve to know exactly what’s happening with it.

3. Using Online Platforms and Tools Safely

A. Getting Started with Online Platforms

More and more Indians are now investing through apps like:

These platforms make investing super easy — you can start with as little as ₹500 via SIP and track everything from your phone.

But since these are digital tools, you may wonder — are they safe?

Yes, they are — because they follow strict rules set by SEBI and AMFI.

Before using any app, make sure it’s regulated and has proper certifications.

Also, always use strong passwords and avoid sharing your login details with anyone.

B. How AMFI’s Guidelines Make These Platforms Safer for Your Investments

You might not realize it, but AMFI plays a role in making online investing safer too.

They work with SEBI to set standards for how these platforms operate — things like:

- How your data is protected

- How transactions are processed

- How complaints are handled

Because of these rules, when you invest through a trusted platforms like Zerodha, INDMoney, Groww and Kuvera, you can be confident your money and personal information are secure.

I remember when I first started investing, I was scared about online fraud. But after learning about the safety checks in place — and seeing how smooth and transparent the process was — I felt much more comfortable.

Now, I invest regularly through them and even recommend them to friends.

4. Summary

- Only certified distributors with valid ARN numbers can sell mutual funds in India. Always verify them before investing.

- When choosing a distributor, look for experience, transparency, and clarity in explaining things.

- As an investor, you have rights — like knowing where your money is invested and being able to cancel within 7 days if you bought offline.

- Use these rights wisely — ask questions, stay updated, and file complaints if needed.

- Popular platforms like Zerodha, INDMoney, Groww, Kuvera are safe and regulated, thanks to guidelines from AMFI and SEBI.

- Always protect your account details and stick to verified platforms.

VII. Common Pitfalls and How AMFI Helps You Avoid Them

1. Avoiding Misleading Information and Scams

A. Spotting Red Flags (Promises That Sound Too Good to Be True)

Let’s talk about something very important — how to stay safe when investing in mutual funds.

Sometimes, you might meet someone who says things like:

- “You’ll get double your money in just 6 months.”

- “This fund gives guaranteed returns.”

- “No need for paperwork — just give me the money.”

These are all red flags.

Here’s what to watch out for:

- Guaranteed returns: No investment is completely safe — even the best mutual funds carry some risk.

- High commissions or extra incentives: If someone is pushing too hard to sell a fund, they might be doing it for their own benefit, not yours.

- Unregistered advisors: Always check if the person helping you is certified.

- No proper documents or receipts: Real investments always have clear records.

If you hear any of these, stop and ask questions before moving ahead.

B. How AMFI Helps You Identify and Protect Yourself from Fraud

AMFI knows that many people feel confused or scared about being cheated — especially if they’re new to investing.

That’s why AMFI helps protect you by:

- Teaching you how to spot fraud through awareness campaigns like “Mutual Funds Sahi Hai.”

- Making sure all distributors are registered and have an ARN number, which you can verify on AMFI website.

- Encouraging you to invest only through official platforms like Zerodha, INDMoney, Groww, Kuvera, or directly with verified fund houses.

For example, my friend once met someone who promised him high returns in a “secret fund.” The person didn’t have any documentation or ARN.

Thankfully, my friend remembered seeing an AMFI ad warning against such offers. He walked away — and later found a real, certified advisor who helped him start investing safely.

So always remember: if it sounds too good to be true, it probably is.

2. Dealing with Complaints and Grievances Effectively

A. What to Do If You Have a Problem with a Fund or Advisor

Even with all the safety measures, sometimes things may go wrong — like:

- Your redemption request gets delayed

- You don’t receive confirmation of your investment

- An advisor gives confusing or misleading advice

If this happens, here’s what you should do:

- Talk directly to the fund house or distributor – Many issues get solved at this stage.

- Write down the problem clearly – Keep a record of dates, names, and what was said.

- If no solution is given within a week, go to SEBI’s SCORES portal or contact AMFI directly.

Both bodies take investor complaints seriously and will help you get a resolution.

B. How AMFI and SCORES Can Help You Get Justice

Let me share a quick story.

My uncle once invested in a mutual fund through an agent. After a few months, he noticed his returns were not matching what was promised.

He first contacted the fund house — but got no response.

Then, he went online and filed a complaint using SEBI’s SCORES platform.

Within a week, the fund house responded and fixed the issue.

Why did it work? Because both AMFI and SEBI support investors like you and make sure fund companies follow rules.

So if you ever face a problem:

- Don’t panic.

- Don’t stay silent.

- Use the tools available to you — like SCORES and AMFI’s grievance support — and get the help you deserve.

3. Not Understanding Fund Risks and Costs

A. Every Investment Has Some Risk – Understanding Different Levels

Many people think mutual funds are either fully safe or fully risky — but the truth is somewhere in between.

Every mutual fund has some level of risk. Here’s how AMFI helps you understand it:

- Low risk – Debt funds: These invest in government bonds and fixed-income securities. They’re good for short-term goals like saving for a wedding or Diwali shopping.

- Medium risk – Hybrid funds: These mix debt and equity. They’re great for medium-term goals like buying a car or home renovation.

- High risk – Equity funds: These invest mostly in stocks. They’re best for long-term goals like retirement or your child’s education.

Understanding your own risk level is key. Ask yourself: How much can I afford to lose?

B. How AMFI Encourages Transparency on Expense Ratios and Other Costs

Some people don’t realize that every mutual fund charges a small fee — called an Expense Ratio — for managing your money.

This is normal — but you should know exactly how much you’re paying.

AMFI makes sure that:

- Every fund clearly shows its expense ratio

- All fees are explained in simple terms

- There’s no hidden cost or surprise charge

For example, I once compared two similar funds and found one had a higher expense ratio than the other. Thanks to AMFI’s transparency rules, I could see the difference clearly — and picked the better option.

Always check the expense ratio before investing — because even small differences add up over time.

4. Summary

- Watch out for red flags like guaranteed returns, unregistered advisors, and no documentation.

- Use AMFI resources to verify advisors (check their ARN) and invest only through trusted platforms.

- If you face a problem with your fund or advisor, talk to them first — and if that doesn’t work, use SEBI’s SCORES or contact AMFI.

- Understand that every fund carries some risk — and pick one based on your goal and comfort level.

- Know what you’re paying — thanks to AMFI’s push for transparency, you can easily find out the expense ratio and other costs.

VIII. Important Tools and Resources from AMFI for Indian Investors

1. AMFI India Website: Your Go-To Information Hub

A. What You Can Find There

The AMFI website is a one-stop shop for everything related to mutual funds in India.

Here’s what you can do there:

- Check daily NAV (Net Asset Value) of all mutual funds

- Read detailed information about different funds

- Download investor guides and brochures in Hindi or English

- Watch short videos explaining how investing works

- Get updates on new rules or changes in the mutual fund industry

It’s like a library made just for people who want to learn more about mutual funds — and the best part? Everything is free and easy to understand.

B. How to Use the Website Effectively for Your Investment Journey

Let me show you how I used this site when I was just starting out.

First, I bookmarked amfiindia.com on my phone so I could visit anytime.

Then, I looked up terms like “how to start SIP”, “what is a debt fund”, and “best funds for beginners” using the search bar.

I found clear explanations, short videos, and even downloadable PDFs that I could read offline.

You don’t need to be an expert to use this site — just type in what you’re looking for, and it will guide you step by step.

So whether you’re saving for your child’s education, planning a wedding, or preparing for retirement, this site has something useful for you.

Let’s make this super simple.

Think of a mutual fund as a big cake that’s divided into many small pieces.

Each piece is called a Unit of the fund.

The price of each unit is called NAV (Net Asset Value).

Every day, the value of that unit changes based on how well the fund’s investments are doing — just like how the price of gold changes every day.

So if you invest ₹5,000 in a fund with a NAV of ₹50, you get 100 units.

If the NAV goes up to ₹60, your investment becomes ₹6,000.

That’s how NAV works — it shows how much each unit of your fund is worth on any given day.

Some people think a lower NAV means a better fund — but that’s not true.

What really matters is how fast the NAV grows over time.

For example:

- One fund might have a NAV of ₹10, and grow by 20% in a year.

- Another might have a NAV of ₹100, and also grow by 20%.

Both gave the same return — so the starting NAV doesn’t matter as much as how much it increases.

By checking NAV regularly, you can see how well your fund is performing — and compare it with others easily.

This helps you make smart decisions about where to invest.

3. Reading Fund Fact Sheets and Offer Documents

A. What Are They?

When you’re choosing a mutual fund, you should know:

- What kind of fund it is

- Where it invests your money

- Who manages it

- What fees it charges

All this info is available in two key documents:

- Fund Fact Sheet: This is like a quick summary — gives you the main points in a few pages.

- Offer Document: This is the full story — includes legal details, risks, past performance, and more.

These documents help you understand exactly what you’re investing in — so you don’t go in blind.

B. How AMFI Ensures These Documents Are Clear and Understandable for You

Earlier, these documents were written in complex language that only experts could understand.

But now, AMFI makes sure they are clear, simple, and easy to read.

They require all fund houses to follow a standard format — so no matter which fund you look at, the structure stays the same.

Also, the language is kept plain — often in both Hindi and English — so even if you’re new to investing, you won’t feel lost.

I remember when I first looked at a fund fact sheet, I was surprised how easy it was to understand. It clearly showed:

- The fund’s goal

- Risk level

- Expense ratio

- Past returns

- Top companies it invested in

That helped me pick the right fund for my goal without confusion.

4. Summary

- The AMFI website is your go-to place for all things mutual funds — from NAV updates to beginner guides.

- NAV tells you the price of one unit of a fund. Tracking its growth helps you see how well your investment is doing.

- Fund fact sheets give you a quick overview, while offer documents provide full details.

- Thanks to AMFI, all this information is now presented in a simple, standardized way — making it easier for you to choose wisely.

IX. The Future of Mutual Funds in India: AMFI’s Vision

1. More Growth and Reach Across India

A. Bringing More Indians, Especially in Tier 2 & 3 Cities, into Mutual Funds

Let me tell you something exciting — mutual funds are no longer just for people living in big cities like Mumbai or Delhi.

Thanks to AMFI, more and more people from smaller towns and cities — places like Jaipur, Lucknow, Indore, and even smaller districts — are now learning about mutual funds and starting to invest.

Why is this happening?

Because more people now have smartphones and internet access. And with that, they can easily learn about investing and start small — sometimes even with just ₹500 per month through SIPs.

For example, my cousin in Bhopal used to only invest in gold and fixed deposits. He thought mutual funds were too complicated and not for small-town investors.

But after watching a few videos on YouTube and using the “Mutual Funds Sahi Hai” campaign resources, he started investing regularly.

That’s exactly what AMFI wants — to make sure every Indian, no matter where they live, feels confident enough to invest wisely.

B. The Role of Digitalization in Expanding Investment Access

Digital tools like mobile apps, video tutorials, and online guides are making it easier than ever for new investors to learn and take action.

Platforms like Zerodha, INDMoney, Groww and Kuvera are helping people invest from anywhere, anytime — all you need is a phone and internet.

And guess what? AMFI supports this change.

They work with SEBI and digital platforms to make sure these tools are safe, simple, and follow the right rules.

So whether you’re saving up for your child’s education or planning for retirement, you can now do it from your home — without having to go to an office or meet an advisor in person.

2. Constant Improvement and Innovation for Investors

A. How AMFI Adapts to New Trends and Technologies

Technology is changing fast — and AMFI is keeping up.

They’re now looking at how tools like artificial intelligence (AI) and chatbots can help investors like you get better support and faster answers.

Imagine talking to a chatbot on a fund house app and getting instant help with:

- Choosing the right fund

- Understanding your investment performance

- Filing a complaint quickly

This kind of tech is already being tested — and AMFI is encouraging its use because it makes investing simpler and smarter.

They also support improvements in how funds are managed — like using data to give more personalized investment advice.

B. Benefits for You as an Investor

All these changes mean good news for you.

Here’s how:

- Better tools to track your investments: You’ll get clearer updates and real-time insights.

- Faster complaint resolution: If something goes wrong, you’ll be able to fix it quicker through digital systems.

- Easier access to education: From short videos to mobile-friendly guides, learning about mutual funds will become even simpler.

I remember when I first started investing, I had to call customer care every time I had a question. Now, I use an app that gives me instant updates and tips — and that’s thanks to AMFI’s push for modern, investor-friendly tools.

So as technology improves, your experience as an investor gets better too.

3. Making Investing Even Simpler and More Inclusive

A. Focus on User-Friendly Experiences for All Age Groups

Investing should not feel like solving a puzzle — especially if you’re new to it.

That’s why AMFI is pushing for:

- Better-designed apps that are easy to understand

- Voice-based tools for those who find reading hard

- Support in local languages so everyone feels comfortable

Whether you’re a young student just starting your first job or someone in their 60s planning for retirement — investing should be easy for everyone.

And AMFI is working hard to make that happen.

B. AMFI’s Continued Efforts in Investor Education and Financial Literacy

One of the biggest ways AMFI builds trust is by educating people.

They run special campaigns targeting women and youth — two groups that are becoming more and more active in investing.

For example, I recently saw a friend of mine — a young woman working in Pune — share a post from AMFI about how to start investing while still in college.

She said it gave her the confidence to begin with a small SIP.

That’s the kind of change AMFI is driving — helping more women and younger investors feel empowered and informed.

They also run workshops and online sessions in Hindi and other regional languages, so even more people can join the world of smart investing.

4. Summary

- AMFI is working to bring mutual fund awareness and access to every corner of India, including Tier 2 and Tier 3 cities.

- Digital tools like apps, videos, and online guides are making it easier than ever for anyone to start investing — no matter where they live.

- AMFI is embracing new technologies like AI and chatbots to give you better support and more transparency.

- They are also improving the way we learn about investing — with simple language, voice tools, and local language support.

- Special efforts are being made to include women and youth, helping them build financial confidence and grow their money safely.

X. Conclusion – Your Path to Confident Investing with AMFI’s Support

Investing in mutual funds can feel like a big step, but with AMFI working behind the scenes, you have a strong support system right here in India.

Remember, knowledge is your best friend when it comes to money. By understanding AMFI’s vital role, you’re not just learning about an organization—you’re empowering yourself to make smarter, safer financial decisions.

Take advantage of the resources AMFI provides. Start small. Learn continuously. Watch your investments grow with confidence—for a secure financial future.

XI. Frequently Asked Questions (FAQ) About AMFI and Mutual Funds in India

1. What exactly is AMFI?

AMFI stands for the Association of Mutual Funds in India. It's the official body that sets standards and educates investors for all mutual funds in India.

2. How does AMFI protect my money in mutual funds?

AMFI sets guidelines for how mutual funds operate, promotes fair practices among fund houses and distributors, and helps resolve investor complaints, acting as a safeguard for your investments.

3. Is "Mutual Funds Sahi Hai" an AMFI campaign?

Yes, "Mutual Funds Sahi Hai" is a very popular investor awareness campaign launched by AMFI to simplify mutual fund concepts and encourage more people to invest responsibly.

4. Can AMFI help me choose the best mutual fund?

AMFI does not recommend specific funds. Instead, it provides educational resources, standardized fund information, and guidelines to help you understand different fund types, so you can make informed decisions based on your own goals.

5. What is the AMFI Registered Mutual Fund Distributor (ARMFD) exam?

It's an exam for individuals who want to become mutual fund distributors (advisors) in India. Passing this exam, along with NISM certifications, ensures they have the necessary knowledge and ethical standards to guide investors.

6. Where can I complain if I have a problem with a mutual fund or distributor?

You should first contact the mutual fund house or distributor. If the issue isn't resolved, you can escalate it to SEBI through their SCORES platform. AMFI also works to ensure proper complaint resolution within the industry.

7. What's the difference between AMFI and SEBI?

SEBI is the primary regulator for the entire securities market in India, including mutual funds, acting as the policymaker. AMFI is an industry association for mutual fund companies that works under SEBI's overall guidance to implement industry standards, promote ethical conduct, and educate investors.

8. Do all mutual funds in India have to be part of AMFI?

Yes, all Asset Management Companies (AMCs) that offer mutual funds to the public in India are required to be members of AMFI.

9. What are "fund fact sheets" and "offer documents" and why are they important?

Fund fact sheets provide a quick summary of a mutual fund, while offer documents give detailed legal and operational information. AMFI ensures these documents are standardized, clear, and comprehensive, so you can understand what you're investing in.