Table of Contents

- I. Welcome to the World of Mutual Funds!

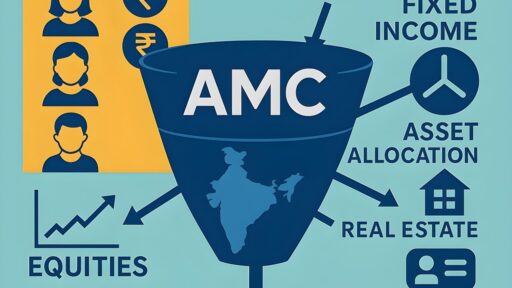

- II. Understanding Mutual Fund Units – Your Piece of the Pie

- III. Demystifying NAV (Net Asset Value) – The Fund’s Daily Report Card

- IV. Quick Reference Guide: Tables to Understand What Are Mutual Fund Units and NAV More Clearly

- V. The Journey of Your Mutual Fund Investment in India

- VI. Types of Mutual Funds (and How They Link to Units & NAV)

- VII. Safeguarding Your Investment: The Role of Regulators in India

- VIII. Common Mistakes Indian Beginners Make (and How to Avoid Them)

- IX. Practical Steps to Track Your Units and NAV in India

- X. Tools and Resources for Indian Investors

- XI. Conclusion – Your Journey to Smarter Investing in India

- XII. Frequently Asked Questions (FAQs) About Mutual Fund Units and NAV

- 1. What is NAV in mutual funds with a simple example?

- 2. How is NAV different from the market price of stocks?

- 3. Can the number of units I hold change without buying more?

- 4. Is it better to invest in funds with low NAV?

- 5. Does the NAV include fund management charges?

- 6. How does taxation affect my mutual fund units and NAV?

- 7. Where can I check the latest NAV of my mutual fund?

- 8. What is an NFO (New Fund Offer) and how does it relate to NAV?

- 9. Can I transfer my mutual fund units to someone else?

- 10. What happens if a fund splits or merges?

If you’ve ever thought about growing your money but didn’t know where to start, mutual funds might be the answer.

In this article, I’ll take you through the basics of what are Mutual Fund Units and NAV (Net Asset Value) — two key ideas that every Indian investor should understand before investing even a single rupee.

By the end of this guide, you’ll know:

- What mutual fund units are and why they matter

- How NAV works and why it’s important

- The difference between Units and NAV

- Common mistakes beginners make (and how to avoid them)

- And much more!

Let’s begin your journey into smarter investing in India.

I. Welcome to the World of Mutual Funds!

1. Investing Made Easy for Everyone

Let’s talk about how most of us in India save money.

We usually go for options like Fixed Deposits (FDs) or Public Provident Fund (PPF). These are safe and simple — and that’s great!

But here’s something many people don’t realize!

Over time, the price of things you buy (like groceries, school fees, petrol) keeps going up — this is called Inflation.

So even if your FD gives you 8% interest every year, after taking inflation of approximately 6% into account, your real profit might be only 2% or even less. That means your money isn’t really growing as much as it looks.

Now, what if there was a smarter way to grow your money — not just save it?

That’s where mutual funds come in.

You don’t need to be a finance expert or have ₹1 lakh to start. You can begin with just ₹500 or ₹1,000.

It’s like joining a big group of people who are all investing small amounts together.

And guess what? There are professionals who manage all the hard work for you.

A. Real Life Example from my life

I personally started with a lump sum investment when I began my investment journey. Over time, my investment grew to almost 3 times its original value — and I’m really grateful for that. To understand this, check out the screenshot of my fund in my portfolio below. The red arrow points to my invested amount, and the green arrow points to the current value of my invested amount:

There was one more mutual fund that I invested in with just Rs. 5,000 on an experimental basis. And the best part? This fund actually grew to more than three times its original invested value! You can see it below. The red arrow points to my invested amount, and the green arrow shows its current value:

This positive experience encouraged me to invest more, and I eventually moved most of my money from Fixed Deposits into mutual funds. It was a bold move, but one I’m very happy with.

Mutual funds give you the chance to grow your money faster — and you can start small.

2. What Exactly is a Mutual Fund?

A. Pooling Money: The Power of Many Investors

A mutual fund is like a group savings pot where money from many people is collected and invested in things like shares and bonds of companies, or other government securities.

Think of a mutual fund like a group savings pot for an investment business.

Let’s say you and a few friends decide to pool your money to start a small roadside tea stall. Each person contributes ₹1,000, making a total of ₹10,000. That money is used to buy ingredients, cups, and a small cart.

This is exactly how mutual funds work.

In a mutual fund, thousands of investors like you and me, pool their money into one large fund.

For example, if 100 people each invest ₹10,000, the fund grows to ₹10 lakh. This money is then invested in assets like company shares (e.g., Infosys or Reliance), government bonds, or other securities — depending on the fund’s goal.

Some funds target big companies, others focus on smaller ones, and some invest in safe government assets.

The best part? You don’t need to do the thinking or the buying and selling yourself, as the mutual fund manager takes care of this for you!

The basic idea is to grow your money together with others, guided by expert fund managers.

B. Professional Money Managers: Your Expert Guide to the Markets

Once your money goes into the mutual fund, it’s not left sitting idle.

As I stated just above, your money in the mutual fund is handled by professional fund managers — people who spend their whole day studying the market, tracking trends, and deciding when to buy or sell. They know which stocks or bonds are likely to go up and which ones may fall.

You don’t have to worry about checking stock prices every hour or trying to figure out which company to invest in. The fund manager does all that for you.

Think of it like having a money expert, manage your cash – they know just what to do to make it grow, so you don’t have to worry about it yourself.

Before you start investing in any mutual fund, there are two basic ideas you should understand: Units and NAV.

These are like the building blocks of your investment journey. Once you get them, everything else becomes easier to follow.

Let’s say you decide to invest ₹5,000 in a mutual fund. Depending on the current NAV (which I’ll explain in detail later in this article), you’ll get a certain number of units in return. These units show how much of the fund you own.

And the NAV tells you how much each unit is worth on that day.

Together, these two things help you track your investment and see how it’s doing.

A. Building Confidence Before You Invest a Rupee

When you understand how Units and NAV work, you feel more confident about investing.

You’re not just handing over your money blindly. You know how much you’re getting, how it’s tracked, and how to check its value anytime.

It’s like knowing how much fuel you’ve filled in your car and how far you can drive with it. You’re in control.

B. The Key to Knowing Your Investment’s Worth

Here’s why these two terms matter:

- Units tell you how much of the fund you own.

- NAV tells you how much each of those units is worth today.

For example, if the NAV is ₹20 and you invest ₹2,000, you’ll get 100 units.

If the NAV goes up to ₹25 after a few months, your 100 units will now be worth ₹2,500.

So, your investment grows — not because you got more units, but because each unit became more valuable.

Understanding this helps you make better decisions, track your progress, and stay calm during market ups and downs.

In short, Units + NAV = Clear picture of how your money is doing.

Now you’ve got a solid idea of what mutual funds are and why understanding Units and NAV is so important. Let’s move ahead with confidence!

If you still haven’t understood what Mutual Fund Units and NAV are, don’t worry. I will be explaining each of them separately, in detail below.

II. Understanding Mutual Fund Units – Your Piece of the Pie

1. What is a Mutual Fund Unit?

A. Imagine a Big Cake: Units are Your Slices of the Fund

In simple words:

A Mutual Fund Unit is a small part of a mutual fund that you own, based on the money you invest.

Let’s understand this concept with a simple example.

Think of a mutual fund like a big birthday cake that’s shared among many people. Each slice of that cake is called a Unit.

When you invest money in a mutual fund, you’re not buying the whole cake — you’re getting one or more slices (units) based on how much you invest.

It’s just like going to a party and being given a plate with your share of the cake. That piece belongs to you — no one else can eat it!

Likewise:

- A Mutual Fund Unit is your individual portion or share of that entire mutual fund.

- Each unit represents a tiny piece of all the stocks, bonds, or other assets that the fund owns.

- When you buy units, you’re essentially buying your very own “slice” of that big investment pie, and that slice belongs only to you.

- The more units you own, the larger your share of the fund’s total value.

Each unit represents a small part of the entire fund. The more money you invest, the more units you get.

If the fund does well (like the cake growing bigger), the value of your slice goes up — even though the number of slices (units) you own stays the same.

This helps you understand exactly how much of the fund you own and how much it’s worth.

2. How Do You Get Units?

A. Investing Your Money, Getting Units in Return

When you invest in a mutual fund, you don’t get back a certificate or cash — you get Units.

For example, let’s say you decide to invest ₹5,000 in a mutual fund where the NAV (Net Asset Value) is ₹25.

You’ll get:

₹5,000 ÷ ₹25 = 200 units

So now, you own 200 units of that fund.

The next time you check, if the NAV has gone up to ₹30, your 200 units will be worth ₹6,000.

Here is the math:

200 units (that you own) x ₹30 (new NAV) = ₹6000 (new value of your investment)

That’s how you grow your money — not by getting more units, but by each unit becoming more valuable.

B. The Relationship Between Your Investment Amount and Units Received

The more money you put in, the more units you get — but always based on the current NAV.

If you invest ₹1,000 when NAV is ₹10, you’ll get 100 units.

If you invest ₹1,000 when NAV is ₹20, you’ll get only 50 units.

But remember — whether you got 100 units or 50 units doesn’t matter as much as how much those units are worth later.

3. Why Units Matter for You (The Investor)

Units help you know exactly how much of the fund you own.

Say you have 500 units in a fund. Every time you check your investment, those 500 units are yours — unless you sell some or buy more.

This makes it easy to track how your investment is doing over time.

Here’s something important:

You don’t earn profits in extra units, but the value of your existing units increases.

For example:

- You bought 100 units at ₹20 → total investment = ₹2,000

- After a few months, NAV becomes ₹25 → value = ₹2,500

- So, your investment grew by ₹500, but your unit count stayed at 100

Same thing happens if the fund loses value — your units don’t disappear, but each one is worth less than before.

For example:

- You bought 100 units at ₹20 → total investment = ₹2,000

- After a few months, NAV becomes ₹15 → value = ₹1,500

- So, your investment went down by ₹500, but your unit count stayed at 100

A friend of mine once thought she had “lost” some units because her investment was showing lower returns. But when I explained how units work, she felt better knowing she still owned the same number — just at a lower value for now.

If you ever notice that the value of your units has gone down, don’t panic. It’s a natural part of growth when you invest in mutual funds. Just give it some time, and it will recover.

4. Can You Lose Units?

A. No, You Don’t “Lose” Units Unless You Sell Them

Many new investors think they’ve lost units when their investment value drops.

But here’s the truth:

You only lose units when you sell them.

Even if the market falls and your investment seems smaller, the number of units you own remains unchanged.

You may feel worried when the value dips, but remember — it’s just a temporary change in price, not in the number of units you own.

B. The Value of Your Units Changes, Not the Number

Let’s take an example from real life.

Imagine you bought gold coins. If gold prices fall tomorrow, do you suddenly have fewer coins? Of course not — you still have the same number of coins, just worth less at the moment.

Mutual fund units work the same way.

Your unit count stays the same — only the value (NAV) of the Mutual Fund Unit changes every day.

So, unless you sell, you haven’t actually lost anything permanently.

This might feel a bit confusing at first, but once you understand that units stay with you, and only their value changes, you’ll feel more confident about tracking and managing your investments.

In the next section, we’ll see what NAV is and why it’s so important — just like knowing the price of each slice of that big cake!

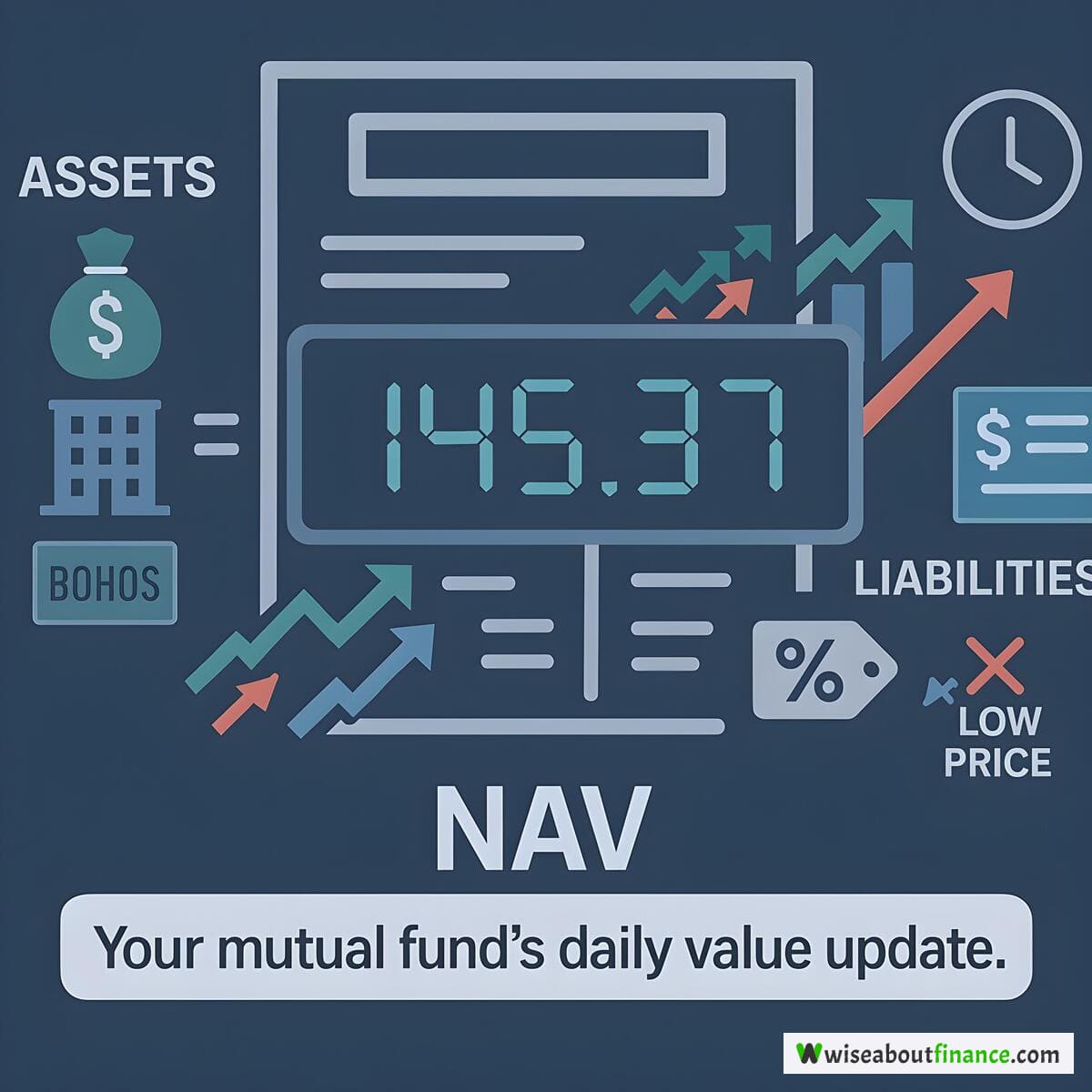

In simple words:

NAV is the value of one unit of your mutual fund on a given day.

Let’s understand this concept with a simple example.

Think of NAV like the price tag on one slice of a large pizza.

When you buy a whole pizza, each slice has a value – and that’s exactly what NAV is for a mutual fund. It tells you how much one unit (your “slice” of ownership) of the fund is worth on that specific day.

But unlike a stock price (which can jump up and down every second), NAV is updated only once a day, typically after the stock market closes.

So, if you decide to invest today, you won’t know the exact NAV until the end of the business day.

It’s a bit like ordering a custom cake online – you know the price will be finalized once it’s completely ready, not while the baker is mixing ingredients.

B. It’s the Fund’s True Worth Per Unit at Day’s End

At the end of every working day (Monday to Friday, excluding holidays), the mutual fund house carefully checks the total worth of all its investments – like shares, bonds, or government securities.

From this total value, they subtract any operating expenses or debts the fund has. Then, they divide that final amount by the total number of units currently in that fund.

That gives you the NAV per unit – which is basically the “price” of your single investment unit for that day.

A. Total Fund Assets Minus Liabilities, Divided by Total Units

Here’s the simple formula they use:

NAV = (Total Assets - Total Liabilities) / Total Number of Units

Let’s break it down with an easy, real-life example.

Imagine a small mutual fund that has smartly invested ₹10 lakh in various shares/stocks and bonds. However, it also has ₹50,000 in fees and other ongoing costs to pay.

So, for our example:

Assets = ₹10,00,000

Liabilities = ₹50,000

Total Units = 95,000

Putting these numbers into the formula:

NAV = (₹10,00,000 - ₹50,000) / 95,000

= ₹9,50,000 / 95,000

= ₹10 per unit

This means, each unit in this fund is valued at ₹10 today.

This calculation is done strictly every day, following clear rules set by SEBI (Securities and Exchange Board of India) – India’s financial watchdog that makes sure everything stays fair and transparent for investors like you.

B. Why It Changes Daily (But Only Once!) Based on Market Movements

Just like the price of vegetables or gold can change daily, the value of a fund’s investments goes up and down every day based on how the stock and bond markets perform.

If the shares and bonds the fund holds increase in value, the NAV will go up. If they fall, the NAV will fall too.

But here’s the key difference:

NAV changes only once a day – specifically, after the main market trading closes (usually around 3:30 PM IST).

So, whether you decide to invest at 9 AM or 2 PM, you’ll generally get the same NAV that is declared for that day – as long as your application reaches the fund before the daily cut-off time (which is usually 3 PM for most funds in India).

A. Knowing Your Investment’s Current Value Every Day

NAV is your daily report card, helping you track exactly how your money is growing.

Every time you log into your mutual fund account, you’ll typically see two key pieces of information:

- How many units of the fund you own

- What the current NAV per unit is

Simply multiply these two numbers, and you’ll know the exact worth of your investment right now.

For example:

- Units owned = 500

- NAV = ₹20

- Total investment value = 500 × ₹20 = ₹10,000

If, for instance, the NAV goes up to ₹22 next week, your investment will automatically be worth ₹11,000 – even if you haven’t added any new money.

This is exactly how your money grows when invested in mutual funds.

A common thought among many new investors is:

“Oh, this fund has a low NAV like ₹10 — it must be cheaper or better!”

This is a widespread misconception, and it’s not true.

Think of it this way: would you say a ₹5 ballpoint pen is inherently better than a ₹50 fountain pen just because it costs less?

No, right? What truly matters is the quality of the pen, how long it lasts, or how well it writes – not just its initial price.

The same logic applies to NAV.

i. Not Just a “Lower is Better” Game: Focus on Percentage Returns

Let’s look at an example to make this super clear:

- Fund A: Starts with an NAV of ₹10, and grows to ₹11 in one year (that’s a 10% growth).

- Fund B: Starts with an NAV of ₹100, and grows to ₹110 in one year (this is also a 10% growth).

As you can see, both funds gave you the exact same return in percentage terms – 10%. So, a lower NAV does not mean it’s a better or cheaper fund to buy.

What truly matters is how fast its value (NAV) grows in percentage terms over time.

I remember a friend who avoided investing in a consistently good fund just because its NAV was ₹100. Later, he realized that fund had been delivering steady 12% returns for years, outperforming many lower-NAV options. He missed out by focusing on the wrong thing.

Don’t make that same common mistake!

Just looking at the NAV number itself doesn’t tell you the whole story of a fund’s performance.

For example:

- Fund X has a current NAV of ₹20 and grew by 8% over the last year.

- Fund Y also has a current NAV of ₹20 but grew by 15% over the same year.

Even though both funds currently have the same NAV, Fund Y clearly performed much better in terms of growth.

So, always look beyond just the NAV number itself when trying to understand how well a fund is doing.

B. Understanding CAGR (Compounded Annual Growth Rate)

CAGR stands for Compounded Annual Growth Rate. It’s a key number that simplifies a fund’s performance by telling you:

“What was the average yearly return this fund gave over a specific period of time (like 3, 5, or 10 years)?”

Let’s say you invested in a fund 5 years ago. Over those five years, your investment might have grown by different percentages each year (some high, some low).

CAGR provides a smooth, average annual growth rate for that entire period. This makes it much easier to compare the long-term performance of different funds.

It’s like looking at your child’s school report – instead of just seeing individual test scores, you also get an overall average grade for the year to see their consistent progress.

C. Comparing Your Fund to Its Benchmark (e.g., Nifty 50, Sensex)

Every mutual fund in India is designed to be measured against a benchmark index, like the well-known Nifty 50 or Sensex.

These benchmarks are essentially big baskets of top-performing companies in the Indian stock market.

The idea is simple: if you invest in an Equity Mutual Fund, one of its main goals is to do better than a standard market index like the Nifty 50.

- If your fund gives higher returns than the Nifty 50 over time, that’s a good sign — it means the fund is doing well.

- But if it keeps giving lower returns than the Nifty 50, it may not be performing as well as it should.

This comparison helps you see whether your fund manager is actually doing a better job than the market, or if you’d have been just as well off with a cheaper index fund that simply follows the benchmark.

If you buy shares of a company like Reliance, Tata Motors, or Infosys, their prices keep changing every second during market hours (from 9:15 AM to 3:30 PM).

You can buy or sell at any time during that window, and the price you get depends on what it is right then.

But mutual funds work differently.

With mutual funds, you don’t get to know the exact NAV (price per unit) until the end of the day — after the markets close.

So whether you invest at 10 AM or 2 PM, as long as your money reaches before 3 PM, you’ll get the same NAV for the day.

Since NAV is updated only once a day, there’s no point in trying to guess when it might be low or high during the day.

Unlike stock traders who try to catch the best price minute by minute, mutual fund investing isn’t about timing.

Instead, the smart way is to focus on long-term growth and invest regularly — like using an SIP (Systematic Investment Plan).

This helps you grow your money steadily over time, without worrying about small daily changes in NAV.

Now you know what NAV really means, how it works in India, and why it’s not about the number — it’s about the growth.

In the next section, we’ll look at different tables to Understand Units and NAV Better.

To help you better understand and track mutual fund units and NAV , here are some easy-to-read tables summarizing key points, comparisons, and practical examples.

| Feature | Mutual Fund Units | NAV (Net Asset Value) |

|---|---|---|

| What it means | A small part of the mutual fund that you own | The price of one unit on a given day |

| How you get it | You receive units when you invest money | Determined by the fund based on market value |

| What it shows | How much of the fund you own | How much each unit is worth today |

| Does it change? | No (unless you buy/sell) | Yes, daily based on market performance |

| Example | ₹10,000 investment at ₹20 NAV = 500 units | If NAV becomes ₹25 tomorrow, your 500 units are now worth ₹12,500 |

| Can you lose it? | Only if you sell | Can go up or down with market conditions |

| Why it matters | Helps track your share in the fund | Tells you the current value of your investment |

| Analogy | Slices of a big cake (you own some slices) | Price tag on each slice (value changes daily) |

| Investment Amount | NAV | Number of Units You Get |

|---|---|---|

| ₹1,000 | ₹10 | 100 units |

| ₹2,000 | ₹20 | 100 units |

| ₹5,000 | ₹50 | 100 units |

| ₹10,000 | ₹100 | 100 units |

3. Sample Growth Over Time – Same Fund

| Month | NAV | Units Held | Total Value (Units × NAV) |

|---|---|---|---|

| Jan | ₹20 | 500 | ₹10,000 |

| Feb | ₹22 | 500 | ₹11,000 |

| Mar | ₹25 | 500 | ₹12,500 |

4. Sample Growth Over Time – Different Funds

| Fund Name | Starting NAV | After 1 Year (10% Growth) | Final Value |

|---|---|---|---|

| Fund A | ₹10 | ₹11 | 10% |

| Fund B | ₹100 | ₹110 | 10% |

In the next section, we’ll go through the full journey of investing in mutual funds in India — step by step!

V. The Journey of Your Mutual Fund Investment in India

1. Starting Your Investment: The Mandatory KYC Process

A. Know Your Customer (KYC): A Must-Do for Every Indian Investor

Before you can start investing in mutual funds, there’s one small but important step you need to complete — KYC.

KYC stands for Know Your Customer, and it’s a simple verification process that every investor must go through.

Think of KYC like signing up for a new mobile number — you need to show your ID so the company knows who you are.

It’s not just for mutual funds — you’ll also need KYC for opening a bank account or buying SIM cards.

This is done to keep things safe and legal, and it helps prevent fraud in financial systems.

B. Documents You’ll Need (PAN, Aadhaar, etc.) for Verification

To complete KYC, all you need is:

- PAN card (this is a must)

- Aadhaar card (for address and identity proof)

- A recent passport-sized photo

- Sometimes, a copy of your bank statement or cheque leaf

The good news? You don’t have to run from office to office to do this.

You can complete your KYC online, for free, using platforms like Zerodha, INDMoney, Groww and Kuvera.

Once you’ve done KYC once, you can invest in any mutual fund — no need to repeat it unless you’re updating your details.

I remember helping my cousin set up her first SIP. She was confused about why she needed to upload her PAN and Aadhaar again. But after we walked through the online KYC process together, it took less than 15 minutes and was super smooth.

2. How You Invest: Lump Sum vs. SIP

A. Lump Sum: Investing All Your Money at Once

In simple words:

A lump sum investment means investing a large amount of money all at once, instead of spreading it out over time.

Let’s understand this with a simple example:

Sometimes, you might get a big chunk of money — maybe from a bonus, a gift, or selling something like old gold or property. So for example, let’s say you got ₹10 lakh because you sold gold.

In such cases, you can choose to invest the whole amount of ₹10 lakh at once, in your favorite mutual fund. This is called a lump sum investment.

It works well if you’re confident about the market or have a specific goal with a fixed timeline.

But here’s the catch — if the market is high when you invest, you might end up buying fewer units for your money.

That’s where the next option becomes a safer bet for most people.

B. SIP (Systematic Investment Plan): Your Smart, Regular Way to Invest

In simple words:

A SIP (Systematic Investment Plan) allows you to invest small amounts of money consistently over time, avoiding the need to invest everything at once.

Let’s understand this with a simple example:

If you’re not sure when to invest or don’t want to take the risk of putting in a large amount at once, SIP (Systematic Investment Plan) is your best friend.

With SIP, you invest a small, fixed amount regularly — say ₹500 or ₹1,000 every month — directly from your bank account into your chosen mutual fund.

It’s like setting up an automatic savings habit — you don’t even have to think about it.

i. Rupee Cost Averaging: Buying More Units When Prices are Low

Here’s what makes SIP special:

- When the NAV (price per unit) is low, your fixed SIP amount buys more units.

- When the NAV (price per unit) is high, your fixed SIP amount buys fewer units.

Over time, this balances out the cost of your investment — which is called Rupee Cost Averaging.

Let me share a quick story.

My uncle used to wait for “the right time” to invest a lump sum. He kept missing opportunities because he was always waiting for a dip.

Then he switched to SIPs. Over 3 years, his investment grew steadily — and he didn’t have to worry about timing the market at all.

3. Getting Your Units: The Allotment Process and Cut-off Times

A. When Your Money Reaches the Fund: The Importance of the 3 PM Rule in India

Once you invest money in a mutual fund — whether through lump sum or SIP — the fund house needs some time to process it.

There’s a rule in India called the 3 PM cut-off time.

If your money reaches the fund house before 3 PM on a working day, you get that day’s NAV.

If it arrives after 3 PM, you get the next working day’s NAV.

So, for example, if you invest at 2:45 PM on Monday, you’ll get Monday’s NAV.

But if you invest at 3:15 PM, you’ll get Tuesday’s NAV instead.

This rule applies to most mutual funds and is especially important if you’re investing a large amount.

B. Confirmation and Statement: Your Official Proof of Unit Ownership

Once your transaction is processed, you’ll get a confirmation message or email showing how many units you received and at what NAV.

Also, every month or quarter, you’ll receive a Consolidated Account Statement (CAS). It shows all your mutual fund investments across different fund houses — like a report card for your money.

This helps you track your investments and see how they’re doing.

I still remember the first time I got my CAS. At first, it looked a bit confusing — but once I matched the numbers with my investment confirmation receipts that I received in my email, it became really easy to follow.

Now it’s time to talk about something that directly affects your returns — the type of plan you choose.

There are two types of plans: Direct Plan and Regular Plan.

Let me explain both with a simple example.

A. Direct Plans: Investing Directly with Fund Houses (Lower Expense Ratio)

Imagine you want to buy rice from a wholesale market.

If you go directly to the wholesaler instead of buying through a local shop, you’ll likely pay less — because there’s no middleman involved.

The same idea works for direct mutual fund plans.

When you invest in a direct plan, you invest directly with the fund house — not through an agent or broker.

Because there’s no commission paid to anyone, these plans have a lower expense ratio.

What is an expense ratio?

It’s the small fee that fund houses charge every year to manage your money. In direct plans, this fee is lower — which means more of your money stays invested and keeps growing.

You can invest in direct plans easily through platforms like:

I remember when I first started investing, I didn’t know about direct plans. Later, I switched from a regular plan to a direct plan — and saw that my returns were slightly better over time. That small difference added up to a meaningful amount after a few years!

So if you’re comfortable doing a bit of research and investing on your own, direct plans are usually the better choice.

B. Regular Plans: Investing Through a Broker/Distributor (Higher Expense Ratio)

Now let’s say you don’t have time to research funds or feel unsure about picking one yourself.

In that case, you might invest through an advisor, broker, or distributor.

That’s what a regular plan is.

Since the advisor gets a commission from the fund house, the expense ratio of the plan is a bit higher.

This small difference may not seem like much now — but over time, it can reduce your final returns.

For example:

| Type of Plan | Expense Ratio | Investment Value After 10 Years (Assuming 12% Growth) |

|---|---|---|

| Direct Plan | 0.20% | ₹3.5 lakh |

| Regular Plan | 0.75% | ₹3.2 lakh |

That’s a difference of ₹30,000 — just because of a small extra fee.

A friend of mine used to invest in regular plans through his agent without knowing about direct plans. When he found out, he was surprised — and quickly moved to direct plans for all future investments.

C. The Big Difference Between the Direct and Regular Plans

Here’s a quick summary:

| Feature | Direct Plan | Regular Plan |

|---|---|---|

| Who do you invest through? | Directly with the fund house | Through a broker, agent, or advisor |

| Expense ratio | Lower | Slightly higher |

| NAV | Slightly higher | Slightly lower |

| Returns | Slightly more over time | Slightly less over time |

| Best for | Self-aware investors who research | Investors who prefer guidance or support |

D. Which One Should You Choose?

If you’re someone who likes to do your own research and invest using apps like Zerodha, INDMoney, Groww and Kuvera, then direct plans are perfect for you.

But if you’re new and prefer some guidance or advice, a regular plan can still be a good way to start — as long as you know how it impacts your returns.

Either way, the most important thing is to start investing. Once you get more comfortable, you can always switch to direct plans later.

My personal suggestion is that you start with Direct Plans right away, so you don’t have to bother switching between Regular and Direct plans later.

Now you know the full journey of investing in mutual funds in India — from completing KYC to choosing between SIP and lump sum, understanding cut-off times, and picking the right plan type.

In the next part, we’ll explore the different types of mutual funds and how they link to units and NAV.

Stay with me — you’re doing great!

1. Different Flavors of Funds for Different Goals

Think of mutual funds like different types of ice cream — each one tastes different and is good for a different mood or occasion.

Similarly, there are different types of mutual funds that suit different goals, risk levels, and time periods.

Let’s look at the main ones:

A. Equity Funds: Investing in Indian Companies for Growth (Higher Risk)

Equity funds invest your money in shares of Indian companies listed on the stock market — like Reliance, Infosys, Tata Motors, etc.

These funds can give you higher returns, but they also come with more risk, because stock prices go up and down often.

They are best suited if you’re investing for the long term (say, 5 years or more), and you’re okay with some ups and downs.

For example, my friend Anil invested ₹2,000 every month in an equity fund through SIP. After 7 years, his investment grew by over 12% annually — which helped him save for his child’s education.

But remember: these equity funds can also lose value, especially in the short term. However, in the long run, they tend to outperform other types of mutual funds in the market.

B. Debt Funds: Lending Money to Governments/Companies (Lower Risk, Stable Returns)

Debt funds work differently.

Instead of buying company shares, the Debt funds lend money to governments, banks, or big companies in the form of bonds or fixed deposits.

Because of this, they are less risky and give stable returns — usually between 6–8% per year.

They’re great for people who want to grow their money slowly and safely, or for short-term goals like saving for a holiday, a new TV, or even your next Diwali shopping.

I personally use a debt fund to park 6 months of my emergency savings. It gives better returns than a regular savings account, and I can withdraw anytime without much worry.

C. Hybrid Funds: A Smart Mix of Both Equity and Debt

If you’re confused whether to pick equity or debt, hybrid funds are a middle path.

Hybrid funds are a mix of both equity and debt — part of your money goes in purchasing shares of companies (Equity), and part of your money goes in purchasing bonds or government securities (Debt).

This way, you get some growth from equity and some safety from debt.

Hybrid funds are perfect for investors who want a balanced approach — not too risky, not too slow.

A cousin of mine started investing in a hybrid fund when she was new to mutual funds. She didn’t want to take too much risk, but also wanted better returns than FDs. After two years, her money grew steadily without giving her sleepless nights.

2. Open-Ended vs. Close-Ended Funds

Now let’s talk about how you can buy and sell these funds — because not all mutual funds work the same way.

A. Open-Ended: Buy and Sell Anytime (Units Constantly Issued/Redeemed)

Most mutual funds you’ll see on platforms like Zerodha, INDMoney,

Groww and Kuvera are open-ended funds.

The good thing about them is: you can buy units any time, and you can also sell them back to the fund house whenever you want.

So if you invest ₹5,000 today, and decide to redeem it after 2 months, you can do that easily.

Your units are directly linked to the NAV, which is calculated daily. So when you buy or sell, the price depends on that day’s NAV.

This makes open-ended funds very flexible and beginner-friendly.

B. Close-Ended: Fixed Number of Units, Traded on Stock Exchanges

Close-ended funds are a bit different.

They are only available during a special period called an NFO (New Fund Offer) — kind of like a launch sale.

Once that period ends, no more units are issued. If you missed the NFO, you can only buy from someone else who already owns those units — just like buying shares on the stock market.

That means the price of close-ended fund units doesn’t always match the NAV. Sometimes they trade at a premium (more than NAV), sometimes at a discount (less than NAV).

These funds are less common among beginners because you can’t redeem them directly from the fund house — you have to wait until maturity or find a buyer/seller on the exchange.

3. Understanding NFOs (New Fund Offers)

When a new mutual fund is launched, it’s called an NFO (New Fund Offer).

During this time, the fund house offers units at a starting NAV of ₹10 — like a welcome price.

Many people think:

“Oh, ₹10 is cheap! Let me invest now before it becomes expensive.”

But here’s the truth: Just because the NAV is ₹10 doesn’t mean it’s a better deal.

Remember what we learned earlier:

It’s not the NAV number that matters, it’s how much it grows over time.

Let’s say two funds:

- Fund A starts at ₹10 (NFO)

- Fund B has been around for years and its NAV is ₹100

If both funds grow by 10%, they both give you the same return — ₹1 extra per unit.

So don’t choose a fund just because it’s new or has a low NAV. Look at the past performance, the fund manager, and whether it fits your goal.

A friend of mine once got excited about an NFO because the NAV was ₹10. But after a year, it barely gave 4% returns — while other funds gave 10%. He realized later that new doesn’t always mean better.

Always do a little research before jumping into a new fund.

You’ve now learned about the main types of mutual funds, how they link to units and NAV, and how to choose based on your goals and comfort level.

In the next part, we’ll talk about how your investment is protected in India — thanks to powerful regulators like SEBI and AMFI.

VII. Safeguarding Your Investment: The Role of Regulators in India

When you invest your hard-earned money in mutual funds, it’s natural to wonder — is my investment safe? Who makes sure that everything is fair and clear?

Good news! In India, there are strong systems and organizations in place to protect your investments and make sure the mutual fund industry works fairly for everyone.

Let me walk you through who these watchdogs are and how they help you as an investor.

1. SEBI (Securities and Exchange Board of India): The Apex Regulator

A. The Big Boss: Ensuring Fair Play and Transparency in Mutual Funds

Think of SEBI like the principal of a school.

SEBI makes the rules and ensures that all mutual fund companies (called fund houses) follow them. Their job is to keep things fair, clear, and safe for every investor — including you.

For example, SEBI decides how mutual funds should declare their NAV, when they must share performance reports, and how they can advertise their schemes.

Because of SEBI, you can trust that what you see on platforms like Zerodha, INDMoney, Groww and Kuvera is accurate and follows strict guidelines.

B. Protecting Indian Investors from Malpractices

SEBI also acts like a guard. If any fund house tries to do something wrong — like hiding losses or charging extra fees — SEBI steps in and takes action.

They have powers to fine companies, stop unfair practices, and even ban people from working in finance if they break the rules.

A few years ago, SEBI took strict action against a few fund houses that were not being transparent with investors. As a result, today’s mutual fund system is much more trustworthy than before.

So whenever you invest, remember — SEBI has your back!

2. AMFI (Association of Mutual Funds in India): Industry’s Own Watchdog

A. “Mutual Funds Sahi Hai” Campaign: Spreading Investor Awareness in India

While SEBI sets the rules, AMFI helps spread awareness and build trust among everyday investors like you.

You might have heard the slogan — “Mutual Funds Sahi Hai” — that’s AMFI’s idea!

Through TV ads, social media, and local events, they teach people how mutual funds work, why they’re better than just saving in a bank, and how to start investing safely.

I still remember seeing one of those ads during a cricket match. It made me curious enough to look into SIPs — and now I’ve been investing regularly for over two years.

B. Setting Standards and Protecting Investor Interests through Ethical Codes

AMFI also works behind the scenes to ensure that all fund houses behave ethically.

They promote best practices — like giving clear information about risks, not misleading investors with false promises, and treating all customers fairly.

Because of AMFI’s efforts, many fund houses now offer simple, easy-to-understand brochures and customer support in Hindi and regional languages too.

Now that you know your investment is protected by law, you might wonder — who actually keeps track of how many units I own and what their value is?

There are special companies called “RTAs” or “Registrar and Transfer Agents” that track the mutual fund units you own across different funds and their respective values.

A. RTAs (Registrar and Transfer Agents): CAMS and KFin Technologies Are Your Record Keepers

RTAs are like the office clerks of the mutual fund world. They maintain records of:

- How many units you own

- When you bought them

- What NAV you got

- Any redemptions (selling) you’ve done

The two biggest RTAs in India are CAMS and KFin Technologies,.

Every time you check your mutual fund holdings on Zerodha, INDMoney,

Groww and Kuvera, the data comes from these RTAs.

If you ever need to update your address or change your bank details, you’ll interact with the RTA associated with your fund.

B. Consolidated Account Statement (CAS): Your Single View of All Mutual Fund Investments

Imagine having mutual fund investments across 5 different fund houses — SBI Mutual Fund, ICICI Prudential, HDFC, etc.

Wouldn’t it be tough to track each one separately?

That’s where CAS (Consolidated Account Statement) comes in.

Once a month or quarter, you get a single report that shows all your mutual fund investments in one place, no matter which fund house or platform you used.

It’s like getting a monthly bank statement, but for all your mutual funds.

To get your CAS, all you need to do is link your PAN card with your investments — and everything gets automatically tracked for you.

My friend Ravi used to forget which fund he had invested in. But once he started getting his CAS every month, managing his investments became super simple.

You now know how your mutual fund investments are protected by powerful regulators like SEBI and AMFI, and how your ownership (units) and their value (NAV) are accurately tracked through systems like RTAs and CAS.

In the next part, we’ll talk about common mistakes beginners make — and how you can avoid them.

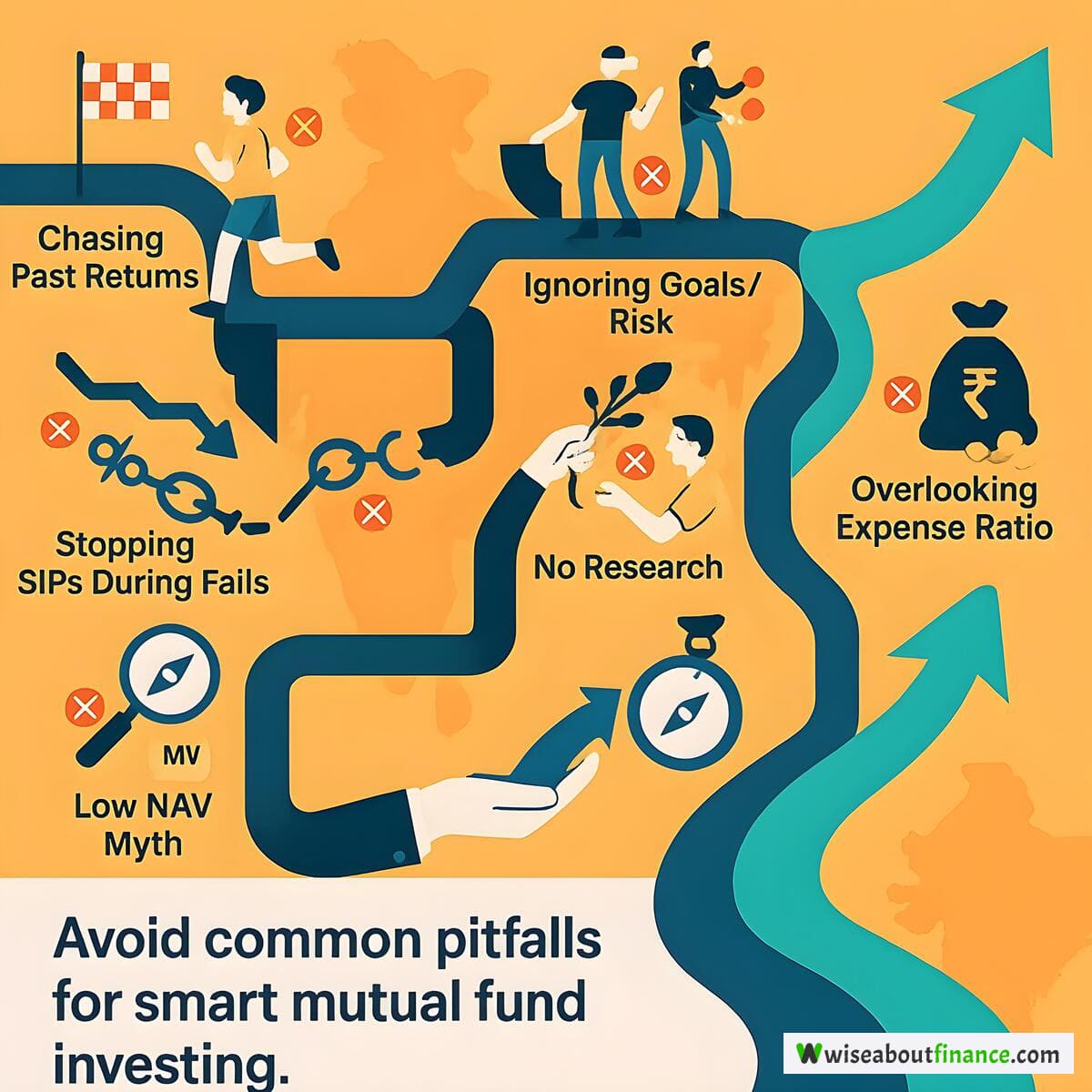

VIII. Common Mistakes Indian Beginners Make (and How to Avoid Them)

Now that you understand the basics of mutual fund units and NAV, it’s time to look at some common mistakes many new Indian investors make — and how you can avoid them.

Think of this as a friendly heads-up from someone who’s been there before.

Let’s walk through each one with simple, real-life examples.

1. Chasing Past Returns Blindly

A. “Last Year’s Winner Might Not Be Tomorrow’s Champion”

You might see a mutual fund that gave 30% returns last year and think:

“Wow, that’s amazing! I should invest in this fund.”

But here’s the truth: just because a fund did well last year doesn’t mean it will do the same this year.

Markets change, companies change, and so do fund managers.

Instead of chasing high past returns, look for funds that give steady, consistent growth over time.

B. Why Consistent Performance Matters More

Imagine two funds:

- Fund A gives 15% every year for 5 years.

- Fund B gives 40%, then -10%, then 30%, then -20%, then 30%.

Even though Fund B had higher highs, its performance is all over the place.

Fund A may not seem exciting, but it’s more predictable — and easier to plan around.

A friend of mine once invested in a fund that gave 40% returns one year. But the next year, it dropped by 15%. He panicked and sold everything at a loss.

If he had focused on consistency instead of chasing quick gains, he would have made better choices.

2. Ignoring Your Investment Goals and Risk Appetite

A. Are You Investing for a Child’s Education, Retirement, or a House?

Before investing, ask yourself:

What am I saving for?

- Are you saving for your child’s college education 10 years from now?

- Or maybe your retirement 25–30 years away?

- Or perhaps a new house in 5 years?

Your goal decides which type of fund you should choose.

For example:

- For short-term goals (like buying a car), debt funds are safer.

- For long-term goals (like retirement), equity funds can give better growth.

Define your goal first — then pick the right fund for it.

B. How Much Market Risk Are You Truly Comfortable With?

Another important question is:

How much market ups and downs can you handle without getting nervous?

Some people can sleep peacefully even if their investment falls by 10% — others start panicking and sell immediately.

Be honest with yourself about your risk appetite.

My friend would panic whenever his equity fund dropped by 8% during a market fall. However, after I explained how markets truly work, he remained invested — and remarkably, his money recovered and grew within 6 months.

Knowing your risk level helps you stay calm and stick to your plan.

3. Stopping SIPs During Market Falls

A. The Power of Buying Low: Don’t Panic and Stop Your Investments!

When the market drops, many people stop their SIPs out of fear.

But here’s what actually happens:

During market lows, your SIP buys more units for the same amount of money.

So if your NAV was ₹50 and you invested ₹1,000, you got 20 units.

If the NAV drops to ₹40, your ₹1,000 now buys 25 units!

That’s actually a good thing — you’re getting more value for your money.

Don’t stop your SIP just because things look bad for a while. Stay invested.

B. Rupee Cost Averaging Works Best During Volatility

This idea is called Rupee Cost Averaging.

It means that when prices are low, you buy more units; when prices are high, you buy fewer.

Over time, this balances out your average cost per unit — and helps you grow your money steadily.

My cousin used to stop her SIP whenever the market dipped. Then she learned about rupee cost averaging and decided to keep going. Over three years, her investment grew more than her friends who tried to time the market.

4. Not Doing Your Own Research

A. Don’t Just Copy Friends or Online Tips; Understand What You’re Buying

It’s easy to follow advice like:

“Hey, I’m investing in this fund — it’s doing great!”

Or read something like:

“Top 5 Funds to Invest Now!”

But remember — it’s your money. So always do your own research before investing.

Look at:

- The fund’s past performance

- Whether it suits your goal and risk level

- Its expense ratio

- How it compares to similar funds

A colleague once invested in a fund just because his friend recommended it. Later, he found out it was too risky for his goal — and lost sleep over it.

Always take advice with a pinch of salt — and do your homework.

5. Overlooking the Expense Ratio and Other Charges

A. Small Fees, Big Impact: How Annual Charges Eat into Your Returns

Every mutual fund charges a small fee to manage your money — called the Expense Ratio.

It might look small — say, 1% or 1.5% — but over time, it adds up.

For example, if you invest ₹1 lakh and earn 12% annual returns, after 20 years, you’d get about ₹9.6 lakh.

But if the fund charges 1.5%, your final amount drops to around ₹7.8 lakh — a difference of ₹1.8 lakh!

So always check the expense ratio, especially when choosing between direct plans and regular plans.

B. Understanding Exit Loads and Other Transaction Costs

Some funds charge extra if you withdraw your money too early — this is called an Exit Load.

For example, a fund may charge 1% if you redeem within one year.

These costs reduce your final returns, so always read the details before investing.

I once withdrew from a fund after 10 months and got charged an exit load. It taught me to be more careful about holding periods.

Many beginners think:

“This fund has a NAV of ₹10 — it’s cheaper than another fund with NAV ₹100.”

But this is completely wrong.

Think of it like this: would you say a ₹10 pen is better than a ₹100 pen just because it’s cheaper?

Of course not — what matters is how well it writes.

Similarly, a lower NAV doesn’t mean a better deal.

B. Focus on Percentage Growth, Not Just the Number

Let’s compare two funds:

- Fund X: NAV = ₹10 → grows by 10% → becomes ₹11

- Fund Y: NAV = ₹100 → grows by 10% → becomes ₹110

Both gave the same 10% return — so the actual NAV number doesn’t matter.

What matters is how fast it grows.

A friend once avoided a good fund because its NAV was ₹120. Later, he realized it had been giving steady 12% returns for years — and regretted missing out.

So always focus on percentage returns, not the NAV number.

You’ve now learned about the most common mistakes new Indian investors make — and how you can avoid them.

In the next part, we’ll talk about how to track your mutual fund units and NAV — including the best tools and platforms for Indian investors.

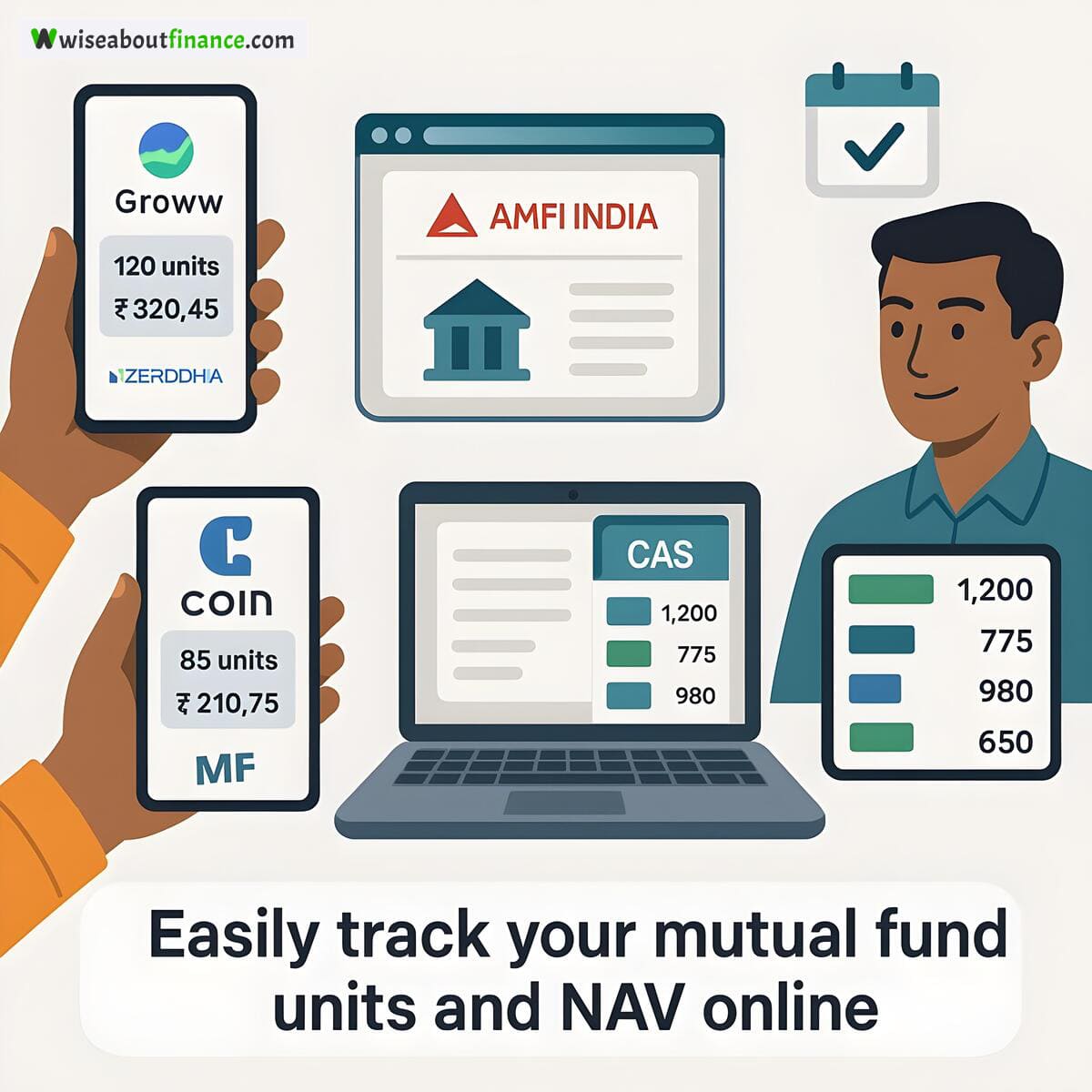

Now that you understand what mutual fund units and NAV are, the next step is knowing how to track them.

Good news — it’s easier than you think!

In this section, I’ll walk you through simple ways to check your mutual fund units and NAV using tools widely used by Indian investors.

1. How to Check Mutual Fund Units Online

Once you’ve invested in a mutual fund — whether through SIP or lump sum — you might want to know:

“How many units do I own?”

“What’s their value today?”

Here’s how to find out easily.

A. Using Popular Platforms

If you invested through apps like Zerodha, INDMoney,

Groww and Kuvera, checking your units is just a few taps away.

Just log into your account, go to the ‘Mutual Funds’ section, and you’ll see:

- The names of the funds you’ve invested in

- How many units you own

- The current NAV per unit

- Total value of your investment

These platforms are user-friendly, free to use, and great for beginners.

I remember when I first started investing, I used to receive reminders about when my next SIP was due.

So if you’re new, start with these apps — they make tracking feel effortless.

B. Using Official Platforms

If you’ve invested across multiple platforms or directly with fund houses, you might wonder:

“How do I see everything in one place?”

That’s where MF Central and RTA platforms like CAMS and KFin Technologies come in.

These are official systems that track all your mutual fund investments — no matter where you bought them from.

You can log in using your PAN card details, and get a Consolidated Account Statement (CAS) — which shows:

- All your mutual fund holdings

- Number of units in each fund

- Latest NAV

- Total portfolio value

It’s like getting a monthly bank statement — but for all your mutual funds.

I made investments through multiple apps. I got confused about my total holdings — until I checked my CAS on MF Central. Now every month, I receive the “CDSL Consolidated Account Statement (CAS) across Mutual Funds and Depositories” to my email and I feel fully in control.

Even if you’re not ready to sell, it’s good to know the current NAV of your funds.

Here are some reliable places to check:

The AMFI Official website is like the central database for mutual fund information in India.

On this site, you can:

- Look up daily NAVs for all funds

- Compare NAVs of different funds

- Download data in Excel format (if you’re detail-oriented)

It’s especially useful if you want to verify the NAV before investing in a new fund.

I often visit the AMFI site when researching new funds — it gives me confidence that the numbers I’m seeing are accurate and official.

B. Fund House Websites

Each fund house — like SBI Mutual Fund, HDFC Mutual Fund, or ICICI Prudential Mutual Fund — publishes its own NAVs daily on its website.

Just visit the fund house’s official site → look for a tab like “Products” or “NAV” → select your fund → and voilà! You’ll see the latest NAV.

This is handy if you’re invested in a specific fund and want to follow it closely.

C. Financial News Portals

Sites like Moneycontrol, ET Money, and Economic Times also publish updated NAVs every day.

They offer extra features like:

- Fund performance charts

- Comparisons with similar funds

- News and expert opinions

These portals are perfect if you enjoy reading about market trends or want to stay updated on your fund’s health.

I personally use Moneycontrol to keep an eye on how my funds are doing compared to others in the same category.

Now that you know how to check your units and NAV, let’s talk about how often you should do it.

A. Daily Check is Not Necessary for Long-Term Goals; Once a Week or Month is Sufficient

If you’re investing for the long term — say, 5 years or more — there’s no need to check your NAV every day.

Checking once a week or once a month is more than enough.

Remember, mutual funds — especially equity funds — go up and down regularly. That’s normal.

Don’t stress over small dips. Focus on the big picture.

When I first started, I used to check my funds daily. It made me anxious when the NAV dropped. Then I switched to checking once a month — and felt much calmer.

B. Avoid Panic from Daily Market Fluctuations

Markets react to news — elections, global events, inflation, etc. But reacting emotionally to short-term changes can hurt your returns.

Stick to your plan. Stay invested. Let rupee cost averaging and time work for you.

If you’re investing through SIPs, you’re already buying more units when prices are low — so short-term drops are actually helping you!

Now you know exactly how to track your mutual fund units and NAV using trusted platforms like Zerodha, INDMoney, Groww, Kuvera and more.

In the next part, we’ll explore useful tools and resources that can help you become a smarter, more confident investor.

X. Tools and Resources for Indian Investors

Now that you understand the basics of Mutual Fund Units and NAV, it’s time to take the next step — learning how to use tools and resources that make investing easier, safer, and more informed.

In this section, I’ll guide you through some of the best platforms, official sources, and simple calculators that every Indian investor should know about.

1. Best Free Apps and Websites for Tracking

Once you start investing, you’ll want to track your mutual funds regularly. Luckily, there are several easy-to-use apps and websites that help you do just that — for free!

A. User-Friendly Platforms

There are multiple user-friendly platforms that I personally use to manage my investments. Here is the list:

These platforms are perfect for beginners and experienced investors alike.

They let you:

- View all your mutual fund investments in one place

- Track how many units you own and their current NAV

- See the total value of your portfolio

- Set reminders for SIPs or new investments

- Compare different funds before investing

Let me share a quick story.

When I first started investing, I used Zerodha Coin. It was super easy to set up, and I could see exactly how many units I owned and what they were worth each day. Over time, I also tried Groww and Kuvera, and both gave me clear updates without any confusion.

All of these apps are free to use, and most offer educational content too — so even if you’re just starting out, you won’t feel lost.

If you’re looking to begin your journey with confidence, try one of these apps and start tracking your investments like a pro.

2. Official Government Resources for Learning

While third-party apps are great for tracking, sometimes you need official information from trusted government sources.

Here are three key places to go:

A. AMFI India for Data and Investor Education

The Association of Mutual Funds in India (AMFI India) is the main body that supports and regulates mutual funds in India.

Their website, amfiindia.com, offers:

- Daily updated NAV for all mutual funds

- Free guides and videos explaining investment basics

- SIP and lumpsum calculators

- Investor awareness campaigns like “Mutual Funds Sahi Hai“

I often visit AMFI when researching new funds — it gives me peace of mind knowing the data is accurate and official.

B. SEBI Website for Rules, Regulations, and Investor Alerts

The Securities and Exchange Board of India (SEBI) is the top regulator for everything related to securities and mutual funds.

On sebi.gov.in, you can:

- Learn about investor rights and protections

- Read alerts about frauds or misleading schemes

- Understand rules around KYC, SIPs, redemption, and more

SEBI ensures that fund houses follow strict guidelines — so you can invest with confidence.

C. SCORES Portal: Your Platform for Investor Complaints and Grievances

If ever you face an issue with your mutual fund provider, broker, or platform, you can file a complaint on the SCORES portal at scores.gov.in.

This is SEBI’s official complaints system, and it’s completely online. You can track your complaint and get timely updates.

A friend of mine once had trouble redeeming his units. He filed a complaint on SCORES — and within two weeks, the issue was resolved.

So, if something doesn’t seem right, don’t hesitate to raise your voice — the system is designed to protect you, the investor.

3. Simple Ways to Calculate Your Investment Value

Want to know how much your mutual fund is worth today? Or how much it might grow in the future?

Here are two easy ways to calculate:

This is the simplest calculation you’ll ever do.

Let’s say:

- You own 500 units

- The current NAV is ₹25

Then:

Total Value = 500 × ₹25 = ₹12,500

You can check your units and NAV anytime using apps like Zerodha, INDMoney, Groww and Kuvera or the fund house’s website.

This formula helps you instantly know the current value of your investment.

B. Using Online SIP and Lumpsum Calculators

Planning to start a Systematic Investment Plan (SIP) or invest a lump sum?

Most platforms like Zerodha, INDMoney, Groww and Kuvera have free calculators where you can enter:

- How much you plan to invest

- How long you’ll invest for

- Expected rate of return

And it shows you:

- How much your money will grow

- The power of compounding over time

For example, if you invest ₹2,000 every month for 10 years at 12% returns, your money will grow to over ₹4.5 lakh — even though you only invested ₹2.4 lakh!

I personally use these calculators to plan my monthly SIPs and set realistic goals — and it really helps me stay focused.

You now know about the best tools and resources to help you track, learn, and calculate your mutual fund investments in India.

In the final part, we’ll wrap everything up with a conclusion and answer some common questions to clear up any remaining doubts.

XI. Conclusion – Your Journey to Smarter Investing in India

You’ve come a long way — and now you have a clear understanding of how Mutual Fund Units and NAV (Net Asset Value) work.

Let’s wrap it up with a quick, friendly recap — and a gentle push to take the next step toward becoming a confident investor in India.

Think of a mutual fund like a big pizza.

Each slice is a unit, and the price of each slice on a given day is called the NAV.

- Units tell you how much of the fund you own.

- NAV tells you what each unit is worth today.

If you invest ₹2,000 when the NAV is ₹20, you get 100 units. If NAV rises to ₹25 later, your 100 units are now worth ₹2,500 — but the number of units stays the same unless you buy more or sell some.

This simple idea is the foundation of your investment journey.

B. These Basics Form the Foundation of Your Investment Journey

Once you understand Units and NAV, everything else — like tracking growth, comparing funds, or choosing between SIP and lump sum — becomes easier to follow.

I remember when I first started investing, I kept thinking:

“Why is my money value changing every day?”

After learning about NAV and units, it all made sense — and that gave me the confidence to keep going.

2. Trust the Process, Track the Right Metrics

A. Focus on Long-Term Goals, Discipline, and Consistent Investing (SIPs)

Investing isn’t about getting rich quickly — it’s about growing your money steadily over time.

That’s where SIPs (Systematic Investment Plans) come in. By investing small amounts regularly — say ₹500 or ₹1,000 every month — you build discipline and reduce the pressure of timing the market.

It’s like saving for Diwali gifts — if you start putting aside a little every month, you won’t feel the pinch at the end.

B. Don’t Get Swayed by Short-Term Market Noise

Markets go up and down — sometimes sharply. But reacting to every dip can hurt your returns.

Instead of panicking when the NAV drops, stay calm and stick to your plan.

Remember: A drop in NAV is just a temporary change, not a real loss, as long as you’re not selling. It’s merely a notional or virtual loss. Your loss becomes permanent only the moment you sell your units.

A friend of mine once stopped her SIP during a market fall. She missed out on great buying opportunities. Later, she restarted and now she’s happy she did.

3. Investing is Not Risk-Free, But It’s Worth It When Informed

A. Knowledge Empowers You to Make Better Decisions

There’s no such thing as risk-free investing — but knowledge helps you manage risks better.

As Indians, we’re often raised with a strong emphasis on safety and security. But the truth is, there’s no growth without taking “calculated” risks!

When you know how Units, NAV, and fund types work, you’ll be able to:

- Choose the right funds for your goals

- Avoid common mistakes

- Stay invested through ups and downs

And that makes all the difference.

B. Start Small, Stay Consistent, and Learn as You Grow

You don’t need lakhs to begin. Even ₹500 a month through SIP can grow into something meaningful over time.

The key is consistency — and the willingness to learn along the way.

I started with just ₹10,000 per month. Today, after a few years, that small amount has grown into a solid corpus!

4. Take the First Step Today

A. Set a Clear Financial Goal (Education, Retirement, House)

Before investing, ask yourself:

What am I saving for?

- Is it your child’s education?

- A home of your own?

- Or maybe a peaceful retirement?

Setting a goal helps you choose the right type of fund and keeps you motivated to stay invested.

B. Explore Direct Plans via MF Central or a Platform of Your Choice

If you want to save on fees, try direct plans — they offer higher returns because there’s no commission paid to agents.

You can invest directly through platforms/apps like Zerodha, INDMoney, Groww and Kuvera.

These tools make it easy for beginners to start and track their investments.

C. Embrace the Power of Disciplined Investing

Make investing a habit — like paying your monthly phone bill or saving for festivals.

Set up an SIP, track your units and NAV once a month, and let time and compounding do the heavy lifting.

5. Final Thoughts

Your journey to smarter investing starts with understanding the basics — and now you’ve got them covered.

Mutual funds aren’t magic — they’re a smart, accessible tool to grow your money, and now you know how to use them wisely.

So take that first step today. Set your goal. Pick your fund. Start small. Stay consistent.

And most importantly — believe in your ability to grow your money the smart way.

Happy investing! 🚀

NAV is the price of one unit. For example, if you invest ₹1,000 and the NAV is ₹20, you get 50 units.

Stock prices change throughout the day, but NAV is calculated once a day after the market closes.

3. Can the number of units I hold change without buying more?

No, your unit count stays the same unless you buy more or redeem (sell) units.

No. Whether NAV is ₹10 or ₹100 doesn't matter — what matters is how much it grows.

Yes, NAV already includes all expenses like management fees and operating costs.

Taxes apply when you sell units. Short-term and long-term capital gains tax rules vary by fund type.

You can check NAV on platforms like Groww, AMFI's website, or directly on the fund house's website.

An NFO is a new fund launched at a base NAV (often ₹10). But this doesn't mean it's a bargain.

9. Can I transfer my mutual fund units to someone else?

Yes, you can transfer units to family members through gift transfers, subject to documentation.

10. What happens if a fund splits or merges?

In case of a split or merger, your units may change in number, but the total value remains the same.