Table of Contents

- I. Introduction to Mutual Funds in India

- II. A Simple Analogy: How Mutual Funds Work

- 1. The “Cake in the Bakery”: A Relatable Illustration

- 1. Pooling of Money (Collective Investing)

- 2. Manager Manages Money (Expert Management)

- 3. Scale and Affordability

- 4. Units (Proportional Ownership)

- 5. Net Asset Value or NAV (Conceptual Valuation)

- 6. Cost Sharing (Implied)

- 7. Redemption (Realizing the Proportional Share of the Fund’s Output)

- 8. Investment Horizon (The Time it Took before Redemption)

- 2. Real-Life Example of a Mutual Fund investment in India

- III. Understanding the Basics of Mutual Funds

- IV. How Mutual Funds Work: Step by Step Guide

- V. Types of Mutual Funds in India

- VI. Benefits of Investing in Mutual Funds

- VII. Risks and Trade-offs in Mutual Funds

- VIII. Mutual Funds vs Other Investment Options

- IX. How to Choose the Right Mutual Fund

- X. How to Start Investing in Mutual Funds in India

- XI. Real-World Examples and Case Studies

- XII. Conclusion

- XIII. Frequently Asked Questions (FAQs)

- 1. Are mutual funds safe to invest in?

- 2. How do mutual funds work?

- 3. What is NAV in mutual funds?

- 4. What's the minimum I need to start investing in mutual funds?

- 5. What are the main types of mutual funds available in India?

- 6. What is SIP and why is it popular for beginners?

- 7. How are mutual funds taxed in India?

- 8. Can I withdraw my money from mutual funds whenever I need it?

- 9. What are the key benefits of investing in mutual funds?

- 10. How do I choose the right mutual fund for my needs in 2025?

If you have ever heard about “Mutual Funds” and wondering what exactly they are but never found a good resource to read and understand about them, then you have come to the right place!

As I have been a Mutual Fund investor for more than a decade, I am pretty sure that I would be able to explain about them from a practical standpoint.

I hope you find this article on “What are Mutual Funds and how do they work” to be simple, encouraging, and most importantly — useful.

So without further ado, let’s start!

I. Introduction to Mutual Funds in India

1. What is a Mutual Fund?

In simple words, a mutual fund simply collects money from many people a.k.a., investors (like you and me), and based on a particular objective, uses the collected money to buy different financial assets/securities, such as:

- Shares of companies

- Bonds of companies

- Gold (Physical or digital)

- Silver (Physical or digital)

- Shares of international companies

2. What is the goal of a Mutual Fund?

The goal of mutual funds is to help your money grow over time by investing it wisely — while you focus on your daily life.

Mutual Funds aim to give better returns than regular savings options (like a bank account), and protect your money from losing value due to inflation — all without needing you to track the market or make complex decisions yourself.

What is inflation, you ask?

Inflation is when the prices of things go up over time, so the same amount of money buys you less and less as time passes.

In other words, your money’s value goes down — which means it can’t buy as much as it used to. This is called a drop in “buying power”.

Let me explain with something we all love — samosas!

Today, imagine you walk into your favorite snack shop with Rs. 100 and buy 5 samosas at Rs. 20 each.

But after a year, you come back with the same Rs. 100 — only to find that the price of each samosa has gone up to Rs. 25. Now, with Rs. 100, you can only buy 4 samosas instead of 5.

That’s inflation — the price went up, so your Rs. 100 now buys you less than before.

This kind of price rise doesn’t just happen with samosas — it happens with most things like groceries, petrol, school fees, and even rent.

So, inflation is when prices go up for most things, and your money slowly starts buying you less than before.

To summarize:

The goal of a mutual fund is to:

- Collect money from many people.

- Invest it wisely in shares, bonds, gold, etc.

- Grow the invested money over time.

- Give returns back to investors based on how much they invested.

It’s like having your own personal financial helper who knows how to invest — so you don’t have to worry about it any more!

3. Why Mutual Funds matter for Indian Investors?

Let’s start with the basics.

A. What is investing?

Investing means using your money to buy something that has the ability to increase in value over time — so you end up with more money in the future, than what you started with.

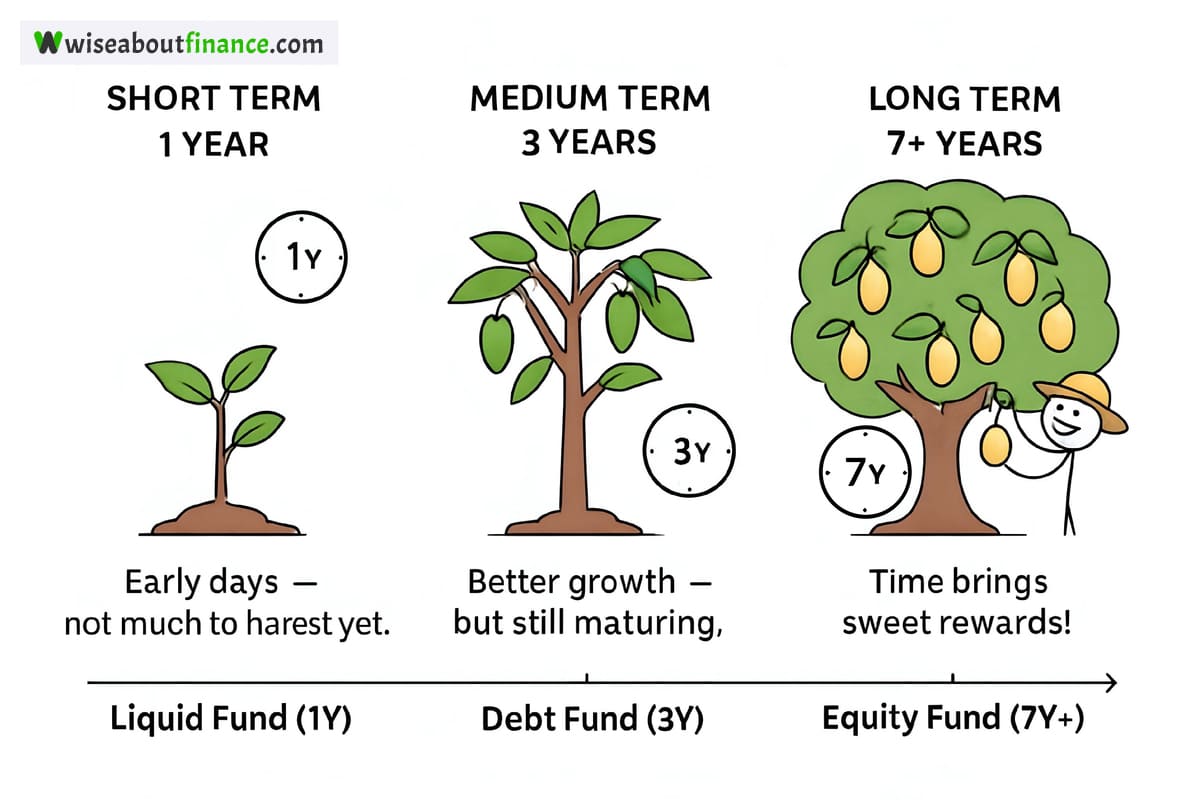

Think of it like planting a seed today so you can enjoy the fruit tomorrow (in future).

There are many ways to invest your money — like:

- Fixed Deposits (FD)

- Recurring Deposits (RD)

- Public Provident Fund (PPF)

- National Savings Certificate (NSC)

These are all safe and popular options in India, and you’ve probably heard about them from family or friends.

Each of these tools works differently and comes with its own pros and cons — which we’ll talk about later.

But here’s the thing: Mutual Funds are also one of those investment tools, and they’re becoming increasingly popular among everyday Indians.

B. So why do Mutual Funds matter in India?

Over the past decade, mutual funds have become a go-to option for many people because:

1. They’re easy to access

You don’t need lakhs to start. You can begin with as little as Rs. 500 using a mobile app. In some mutual funds, you can begin investing with as little as Rs. 100!

2. They offer better returns (over the long term)

Compared to traditional savings tools like FDs or PPF, mutual funds — especially equity funds — have the potential to grow your money faster.

3. They’re designed for everyone

Whether you’re someone who prefers playing it safe or you’re ready to take some risk for higher growth, there’s a mutual fund suited for you.

4. They help beat inflation

Unlike regular savings accounts or fixed deposits, good mutual funds aim to grow your money faster than the rising cost of living.

C. What You Need Most: Patience!

Unlike quick-return schemes or get-rich-fast ideas, mutual funds work best when you give them time.

Yes, markets will go up and down — sometimes sharply — but if you stay invested and keep your eyes on your goals, both the history and my experience say that your money can grow significantly!

Think of it like growing a tree — once you plant it, you water it regularly, protect it from damage, and wait patiently. In a few years, it gives you shade, fruit, and beauty.

Similarly, if you invest wisely and patiently in mutual funds, they can help you build wealth — whether it’s for your child’s education, buying a home, or enjoying a peaceful retirement.

4. Mutual Funds vs Traditional Saving Instruments (FD, RD, PPF)

Let’s be honest — we’ve all grown up hearing our parents say:

“Put your money in a Fixed Deposit. It’s safe!”

Yes, I agree!

But wait! There’s more to consider.

While traditional saving instruments like Fixed Deposits (FD), Recurring Deposits (RD), National Savings Certificate (NSC), Public Provident Fund (PPF), etc., are relatively safe and offer guaranteed returns, they often fail to beat inflation over the long term — because their returns are usually lower than what mutual funds can deliver if you stay invested for many years.

Mutual funds, especially equity-based ones, have the potential to generate returns that outpace inflation over the long run.

Mutual funds do come with some risk — unlike FDs or PPFs — but they also offer higher growth potential, tax-saving options, and better liquidity in many cases.

For example, while a Fixed Deposit might give you around 5–7% annual returns, investing the same amount in a good equity mutual fund could average 10–14% returns annually if held for 5 years or more. Of course, there’s more risk involved — but we’ll get into that later.

5. Why Beginners Should Consider Mutual Funds Today

Today is a great time to start investing in mutual funds! 👌

Wondering, why? I’ve got the answer for you.

We are currently living in a time when inflation is rising, and traditional savings options like Fixed Deposits or Savings Accounts are not giving us returns high enough to keep up with inflation. That means if you are only saving money without growing it, it’s real value is actually going down over time.

In simple words, if you’re not growing your money, you are slowly losing purchasing power. With the same amount of money, you will be able to buy less in the future than you can today. And that’s definitely something we want to avoid.

Mutual funds give you the chance to beat inflation, grow your money steadily, and plan for important life goals — whether it’s buying a home, funding your child’s education, retiring comfortably, or any other financial goal you have in mind.

Thanks to digital platforms, mobile apps, and easy online processes like KYC and SIPs (Systematic Investment Plans), getting started with mutual funds has never been easier.

You can easily begin with as little as Rs. 100 through a SIP and build a habit of disciplined investing.

I personally started with a lump sum investment when I began my investment journey. Over time, my investment grew to almost 3 times its original value — and I’m really grateful for that. To understand this, check out the screenshot of my fund in my portfolio below. The red arrow points to my invested amount, and the green arrow points to the current value of my invested amount:

There was one more mutual fund that I invested in with just Rs. 5,000 on an experimental basis. And the best part? This fund actually grew to more than three times its original invested value! You can see it below. The red arrow points to my invested amount, and the green arrow shows its current value:

This positive experience encouraged me to invest more, and I eventually moved most of my money from Fixed Deposits into mutual funds. It was a bold move, but one I’m very happy with.

Of course, I’ve also seen ups and downs along the way. But here’s what I’ve learned: with patience, time, and proper planning — investing wisely and redeeming at the right time — you can avoid long-term losses.

6. What This Guide Will Help You Understand and Decide

By the end of this article, you’ll:

- Know exactly what a mutual fund is.

- Understand how mutual funds work step-by-step.

- Types of mutual funds in India

- Risks and benefits

- Comparison with other investment options

- Real-life examples

- Learn how to choose the right fund for your needs.

- Feel confident enough to start investing today!

So let’s dive in!

II. A Simple Analogy: How Mutual Funds Work

1. The “Cake in the Bakery”: A Relatable Illustration

To understand the concept of Mutual Funds and how they work at their core, let’s consider a simple example. Make sure to refer to the image below each section for a visual explanation.

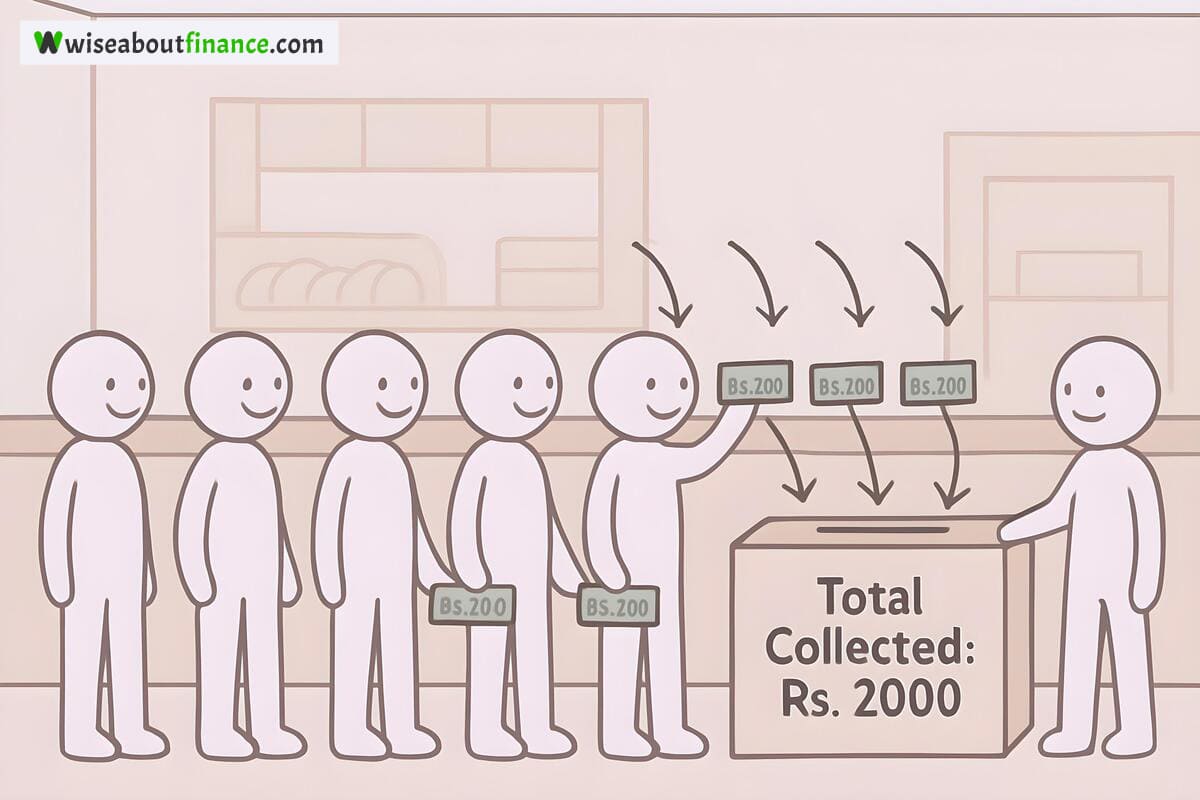

1. Imagine that there are 10 friends in an office who wish to go out for a snack to a new bakery that specializes in baking fresh cakes in 10 minutes.

2. They reach the bakery, look through the menu, and decide they want to order a chocolate cake that weighs 1 kg. This cake costs Rs. 2000.

3. All of them are hungry but none can afford to buy the whole cake on their own or eat it alone. So, each friend decides to contribute an equal share to purchase the cake. Each of the 10 friends gives Rs. 200 from their own pocket, making a total of Rs. 2000. Together, they place the order.

4. The baker receives the full payment of Rs. 2000.

5. The baker then bakes the cake in 10 minutes.

6. Once the cake is ready, the group asks the baker to serve their respective portions to eat. The baker cuts the 1 kg cake into 10 equal parts — each weighing 100 grams.

7. The baker then serves one slice to all the 10 friends.

8. Then, all 10 friends enjoy their own slice of the chocolate cake.

The concept of mutual funds is exactly like this example. To help you understand better, we will now replace some elements of the story with real-life equivalents:

So now from the above example:

- Let’s call the 10 friends as “Investors”.

- Let’s call the chocolate cake as a “Fund”.

- Let’s call the 1 kg weight of the chocolate cake as the “Total Assets / Portfolio Size of the Fund”.

- Let’s call the baker as the “Fund Manager”.

- Let’s call the Rs. 200 each friend contributed as the “Individual Investment Amount”.

- Let’s call each individual slice of cake as “Units representing the investor’s share of the fund’s output”.

- Let’s call the act of each friend enjoying their slice as “Redemption (Realizing the Proportional Share of the Fund’s Output)”.

- Let’s call the 10 minutes it took to bake the cake as the “Investment Horizon of the Fund”.

Now, let’s draw some simple analogies from this example.

1. Pooling of Money (Collective Investing)

Just like the 10 friends shared money to buy a common item (a chocolate cake), similarly, multiple investors pool (share) their money to invest in a common financial instrument called a “Fund”.

Since everyone invests the same amount on the same day, and shares in the returns equally based on what they invested, it is called a “Mutual Fund”.

In simpler words, many people come together, each investing a small amount, and collectively invest in a fund. That’s why it’s called a mutual fund.

2. Manager Manages Money (Expert Management)

Just like the baker was an expert in baking the cake and gave it his full attention to make sure it turned out well, a fund manager manages the pooled money in a mutual fund.

He knows how the market works, tracks daily changes, and makes smart investment decisions so that the fund grows over time and meets the investors’ goals.

Most mutual funds have at least one fund manager, though some may have more than one.

3. Scale and Affordability

Just like each friend contributed a small amount — Rs. 200 — instead of paying Rs. 2000 to buy the entire cake, retail investors can start investing in mutual funds with small amounts like Rs. 100.

You don’t need to invest lakhs or crores to begin. You simply invest a small amount, and the fund manager takes care of everything for you.

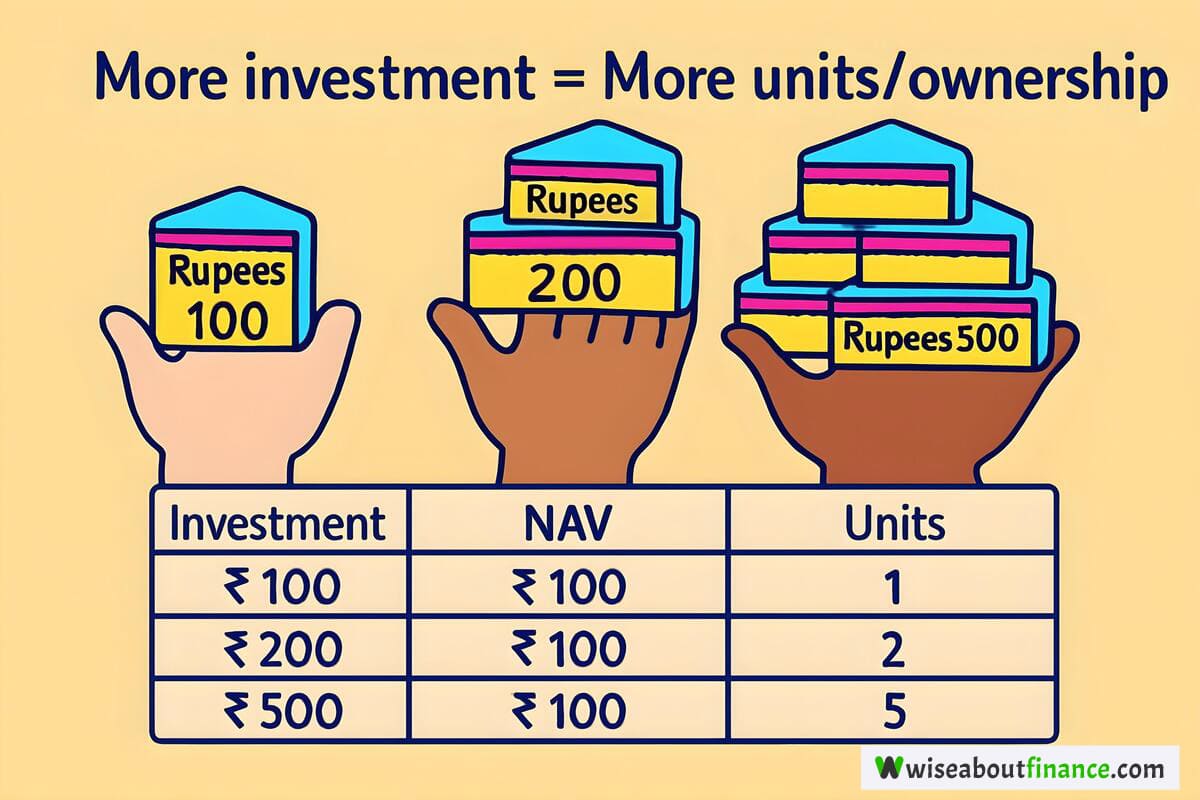

4. Units (Proportional Ownership)

Just like each friend got one slice of the cake after contributing Rs. 200, when you invest in a mutual fund, you get something called “Units” credited to your account.

In this example, one slice equals one unit. If someone had contributed twice as much, they would have received two slices — or two units.

Similarly, the number of units you get depends on how much you invest and the current Net Asset Value (NAV) of the fund.

From the above example, the total value of the cake was Rs. 2000. When it was cut into 10 equal pieces, each piece was worth Rs. 200.

Likewise, if we take the total value of all investments in a mutual fund and divide it by the total number of units issued to all investors, we get the value of one unit.

This is known as the Net Asset Value (NAV). It tells you how much each unit of your mutual fund is worth on a given day.

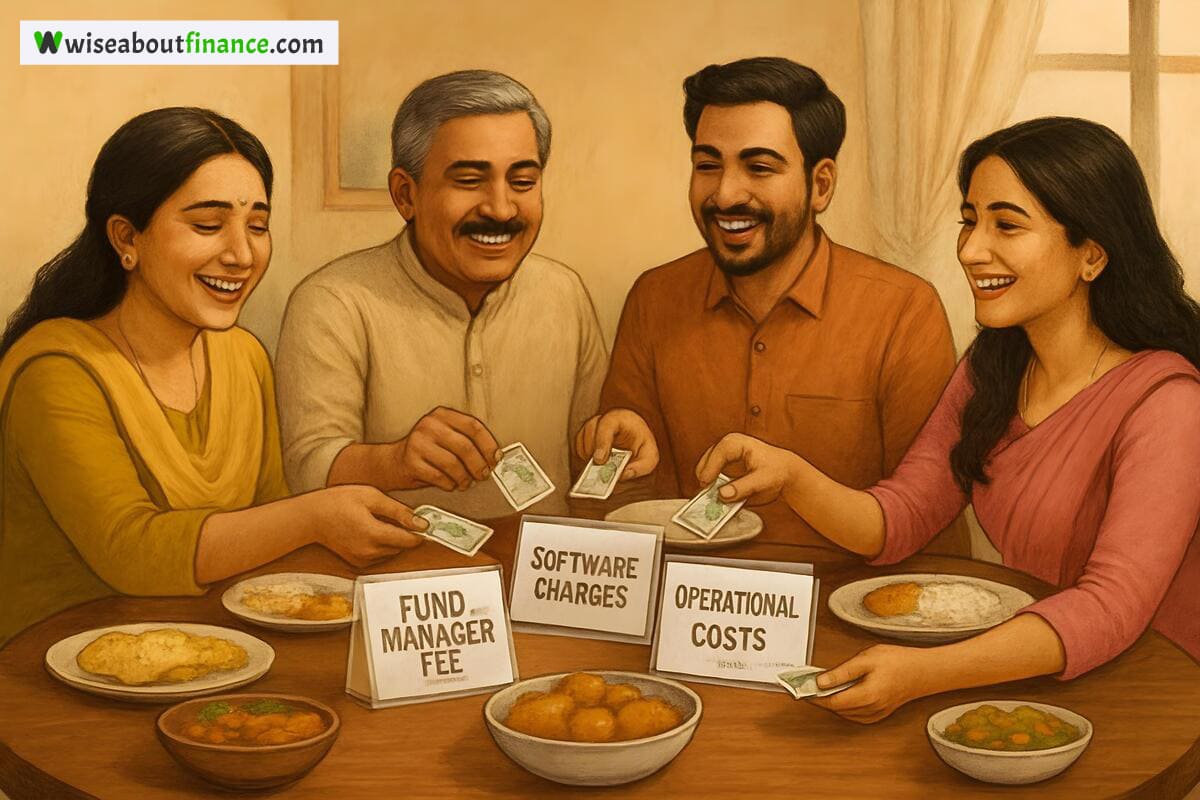

6. Cost Sharing (Implied)

Just like the cost of the cake was shared among all 10 friends, there are certain costs involved in running a mutual fund.

These include fees paid to the fund manager, software expenses, and other operational charges. These costs are shared by all investors and are deducted from the fund’s overall value.

While these costs aren’t visible directly, they affect the fund’s performance and are reflected in the NAV.

Just like each friend enjoyed a slice of the cake after investing Rs. 200, you can redeem your mutual fund units when you want to realize the growth in your investment.

You can sell all or part of your units back to the fund and receive the current value based on the NAV. Just like withdrawing money from a bank, you can choose how much you want to redeem — whether it’s one unit or all of them.

8. Investment Horizon (The Time it Took before Redemption)

Just like it took 10 minutes for the baker to prepare the cake, mutual funds also require time to grow.

Some funds are meant for short-term goals, while others are best suited for long-term growth. Your investment horizon is the time you stay invested before redeeming your units.

It could be just a few days, few months, 1 year, 10 years or even 30–50 years, depending on your goal.

2. Real-Life Example of a Mutual Fund investment in India

Here’s a screenshot of my real-life Mutual Fund investment. The screenshot has numbered labels, and below it, you’ll find an explanation for each numbered item, helping you understand what these terms mean.

Here’s an explanation what each of the numbers represent:

1. Fund Name: Bandhan Innovation Fund

- What this means: This is the specific “basket” of investments I’ve chosen. “Bandhan” is the company managing the fund, and “Innovation Fund” tells us that this particular basket focuses on investing in companies that are new, groundbreaking, and constantly coming up with new ideas or technologies.

- For you: I picked a fund that’s trying to grow by backing innovative businesses.

- What this means: NAV is like the price tag of one tiny piece (unit) of my investment basket. My “Average NAV” is the average price I paid for each of the units I own.

- For me: On average, I bought each unit of the “Bandhan Innovation Fund” at ₹10.00. This is my personal buying price on the day that I invested in this mutual fund.

- What this means: This is the current price of one unit of my fund, updated daily based on how well the companies in its basket are doing.

- For me: Right now, each unit I own is worth ₹12.4140. This is higher than my average buying price of ₹10.00, which is a good sign!

4. Invested: ₹1,000.95

- What this means: This is the total amount of money I’ve actually put into this fund from my own pocket.

- For me: I’ve invested ₹1,001 in this “Bandhan Innovation Fund.” This is the principal amount I started with. ₹0.05 was deducted towards taxes on the day I invested, hence the invested amount shows up as ₹1,000.95.

5. Current: ₹1,242.58

- What this means: This is how much my entire investment is worth today, based on the “Current NAV.”

- For me: My initial ₹1,000.95 investment is now worth ₹1,242.58. This shows my money has grown!

6. P&L: ₹241.62 (24.14%)

- What this means: “P&L” stands for Profit & Loss. This tells me exactly how much money I’ve gained or lost since I invested. The percentage shows this gain/loss relative to my initial investment.

- For me: I’ve made a profit of ₹241.62, which is a fantastic 24.14% return on my original investment! This is a good indicator that my fund choice has been profitable so far.

7. Day Chg.: ₹6.71 (0.54%)

- What this means: This tells me how much my investment’s value changed just in the last working day (or since the last update).

- For me: My investment went up by ₹6.71, or 0.54%, just today. This is the fund’s daily performance, showing a positive movement.

8. Units: 100.095

- What this means: When I invested in this Mutual Fund, my money bought “units.” This number tells me exactly how many units of this specific fund I own.

- For me: I own 100.095 units of the “Bandhan Innovation Fund.” My “Current” value of ₹1,242.58 comes from multiplying these 100.095 units by the “Curr. NAV” of ₹12.4140.

9. Date: 29th Apr 2024

- What this means: This is the date on which I bought the units.

- For me: This shows that my initial investment in this fund officially began on April 29th, 2024. All the performance numbers you see (like P&L and XIRR) are calculated from this exact starting point.

10. Days: 396

- What this means: This is roughly how many days my money has been invested in this specific fund, usually counted from my very first investment date.

- For me: My investment has been in the fund for about 396 days, which is a little over a year. This helps give context to my returns.

11. Pledged Units: 0

- What this means: Sometimes, people use their Mutual Fund units as security to take a loan. If I do that, those units are “pledged” and can’t be sold until the loan is repaid.

- For me: “0 Pledged Units” means I haven’t used any of my units as collateral for a loan, so all my units are freely available if I decide to sell them.

12. XIRR: 21.44

- What this means: XIRR is a very smart way to calculate my actual yearly return on my investment, especially if I’ve put money in at different times. It takes into account when I invested and how much, giving me a truly personalized, annualized percentage.

- For me: My XIRR of 21.44 means that, on average, my investment has grown by an impressive 21.44% per year since I first invested. This is a very strong return for a little over a year’s investment! This is the most accurate way to see my real annual growth.

How this helps you understand Mutual Funds in real-time:

So the above screenshot shows the basics of how my Mutual Fund investment is performing right now, giving us insight into its current status:

- I put in money (Invested).

- That money bought me “units” (like shares of the fund’s basket).

- The value of these units (NAV) changes daily based on the performance of the underlying stocks/bonds the fund invests in.

- My total investment value (Current) goes up or down with the NAV.

- I can track my real-time profit/loss (P&L and Day Chg.) and, most importantly, my annualized return (XIRR) to see if my money is growing effectively.

My investment in “Bandhan Innovation Fund” is clearly showing positive growth, with a healthy profit and a strong annualized return over the past year. This is a practical example of how my money works for me in a Mutual Fund!

III. Understanding the Basics of Mutual Funds

1. Definition and Structure of a Mutual Fund

- A mutual fund is a professionally managed investment scheme that collects money from investors who share a common investment objective.

- The fund then invests the collected money in different financial instruments such as shares, bonds, and commodities (like gold, silver, etc.).

- Based on the investment amount, each investor’s account is credited with the appropriate number of units.

- Investors are free to redeem the units as they prefer or as allowed by the mutual fund.

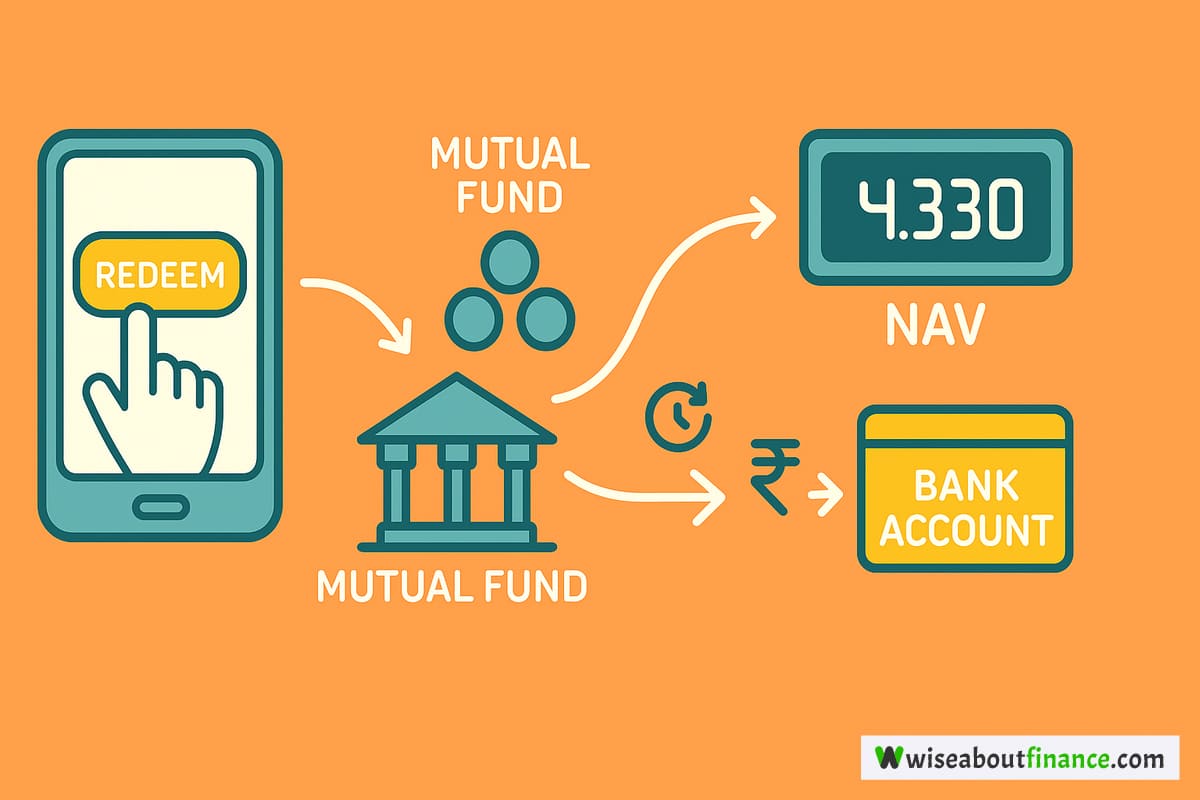

- Upon successful redemption, the investor’s bank account will be credited with the redeemed amount, typically within a few minutes to a few days, depending on the type of mutual fund redeemed.

Let’s try to understand this concept with a simple illustration, as shown below:

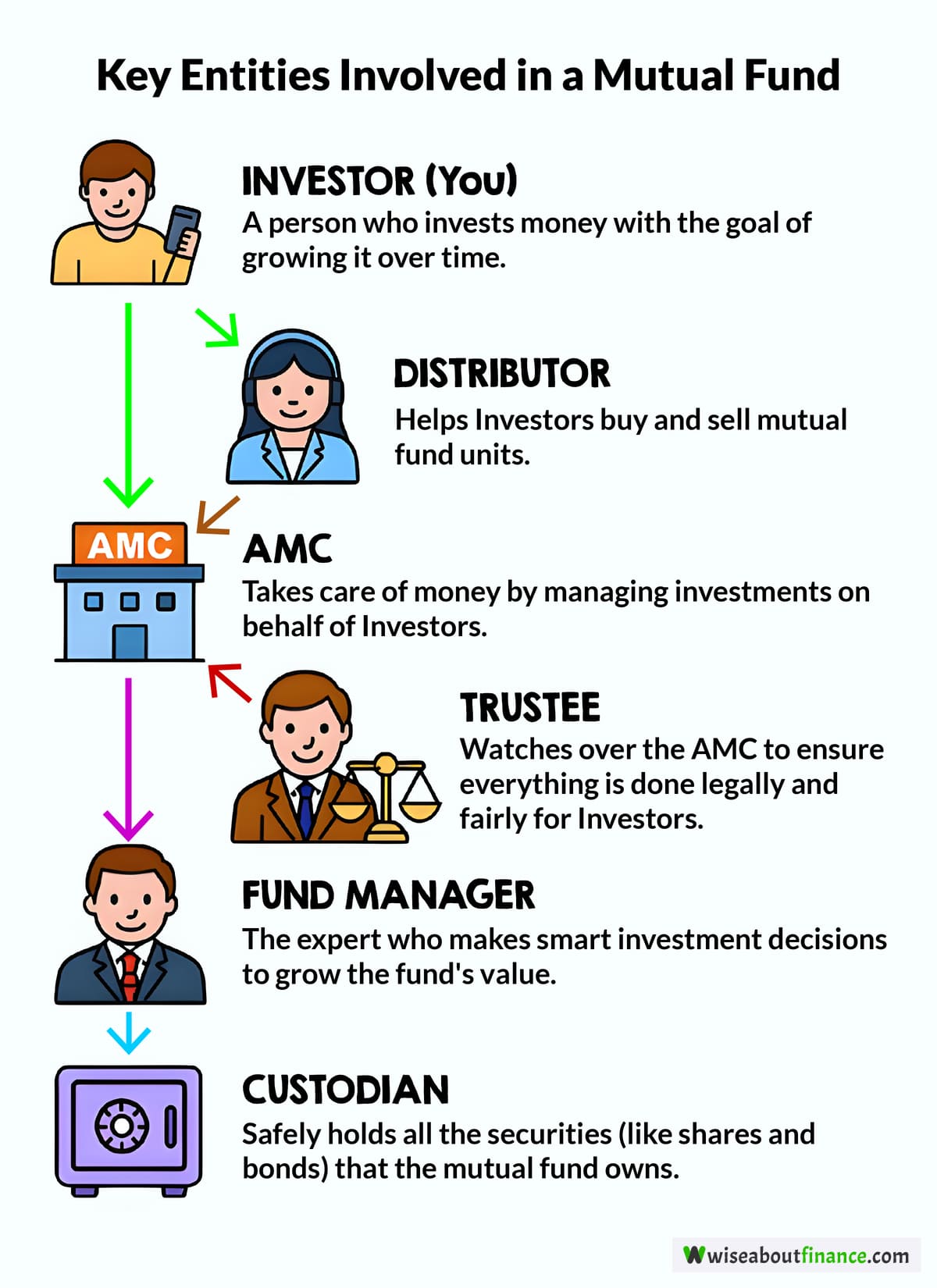

2. Key Entities Involved in a Mutual Fund

Let’s meet the key players in the setup and maintenance of a mutual fund:

A. Asset Management Companies (AMCs)

Every mutual fund is owned by one or the other Company. In other words, there are many companies in the market that launch their own mutual funds with the aim of meeting certain specific objectives. These companies are collectively known as Asset Management Companies or AMCs.

These AMCs have teams of managers and other experts, who decide which securities (such as shares, bonds, etc.) to buy and sell, based on the investment objectives or market conditions. And in order to do so, these AMCs have to abide by standard rules and regulations set by the Securities and Exchange Board of India (SEBI).

Some examples of AMCs are:

- HDFC AMC

- ICICI Prudential AMC

- SBI Mutual Fund

B. Fund Managers

These people are the actual in-charge within the AMCs, who undertake the responsibility of making investment decisions for the funds they are responsible for.

Based on the investment objectives or market conditions, the fund managers buy and sell the underlying securities (such as shares, bonds, etc.) of the mutual funds.

An experienced fund manager can make a significant positive difference in the performance of a fund.

C. Custodians and Trustees

These are independent entities that act as watchdogs, to everything runs smoothly and legally in the Mutual Funds industry.

Trustees oversee the AMC to ensure that they are following the rules and working in the best interests of the investors. As of May 2025, there are 39 AMC Trustees. You can see the entire list here:

Custodians hold the securities of the mutual funds safely. As of May 2025, there are 19 Custodians. You can see the entire list here:

List of Registered Custodian of Securities

D. Investors and Distributors

People or entities who invest in the mutual fund schemes, are called as Investors. Examples of investors are: Individuals like you, me, our families, our relatives, our friends etc.

We can either invest in mutual funds either directly through the AMC or via Distributors.

Distributors are like brokers or mediators that stay in between the AMCs and us individuals investors.

Some examples of distributors are:

- Banks

- Brokers

- Apps who help us buy/sell funds (e.g., Zerodha Coin, INDMoney)

3. How a Mutual Fund Pools and Allocates Money

Did you ever wonder how your money actually gets invested when you put it in a mutual fund? It’s pretty straightforward, but definitely not instant. Let’s break it down into simple steps so it’s super clear:

- You Decide to Invest: First off, you (and me), like many other investors, decide to put your hard-earned money into a mutual fund that matches your goal — whether it’s for your child’s education, buying a house, or retirement. You’re aiming to grow your money and hit those financial goals, right?

- You Make the Payment: So, you make the payment to buy units of your chosen mutual fund. Easy-peasy!

- It Doesn’t Get Invested Instantly: Now, here’s the thing – that money doesn’t immediately go into buying shares or bonds of companies the very second you pay. It waits for a bit.

- Daily Money Gathering (The “Pooling”): What happens is, at the end of each business day, after the share markets close, the Asset Management Company (AMC) — basically the company running the mutual fund — collects all the money from all the individual investors who invested in that same mutual fund on that day. They literally put it all into one big pot, or a “fund”.

- The Fund Manager Steps In: Once this big pot of money is ready and meets what the fund needs, the fund manager gets to work. This person is the expert who knows the market inside out.

- Smart Allocation for Returns: Based on what that particular mutual fund aims to do (its “objective”), the fund manager uses this collected money to buy various things. This could be shares of companies, government bonds, gold, or whatever else fits the fund’s strategy. Their main goal? To invest it smartly so that your money, along with everyone else’s, grows over time and generates good returns!

It’s pretty cool how they manage to take everyone’s small contributions and turn them into a powerful investing tool, isn’t it? This systematic approach helps ensure everything is handled efficiently and professionally.

The above concept is illustrated in the image below:

For example:

- If you invest in an equity fund, your money will mostly go into buying shares of different companies as mentioned by the mutual fund.

- If you invest in a debt fund, the money will be used to buy safer instruments like government bonds or company debentures.

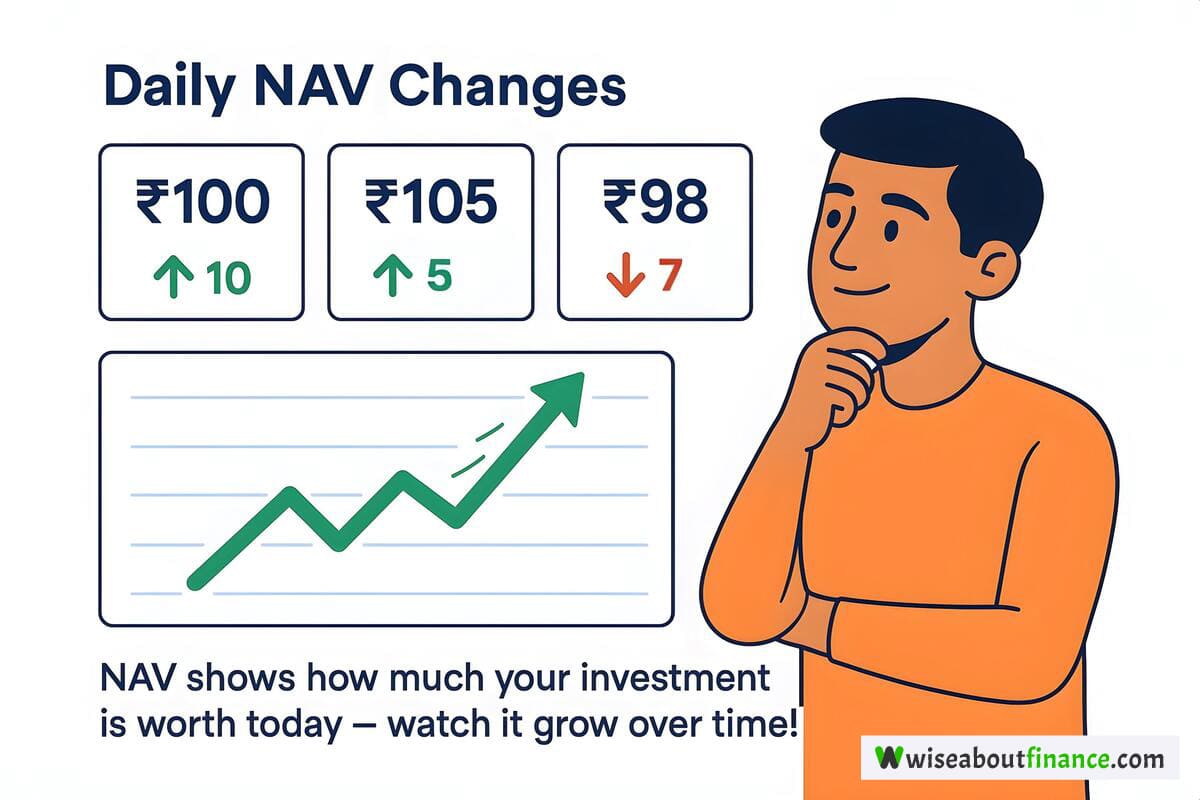

Net Asset Value or the NAV is the price per unit of a mutual fund. It’s value changes every day, based on the performance of the underlying assets.

The above concept is illustrated in the image below:

For example, let’s say you invest Rs. 10,000 in a fund with an NAV of Rs. 20. You’ll get 500 units. If next week the NAV goes to Rs. 22, your investment is now worth Rs. 11,000!

Understanding NAV helps you track your investment’s growth and compare funds. The formula to calculate NAV is as follows:

NAV = (Total Value of Assets − Total Liabilities)/Number of Outstanding Units

Notes:

- The NAV is calculated and updated daily (usually at the end of the trading day). It’s crucial because it tells you the current market value of your investment in the fund.

- When you buy units, you buy them at the prevailing NAV.

- When you sell (redeem) the units, you receive the value based on the NAV at that time (of sale).

IV. How Mutual Funds Work: Step by Step Guide

Let’s break down the process of how the mutual funds actually operate:

1. Pooling of Capital from Investors

Investors like us invest our money into a mutual fund of our choice. The amount invested by each investor can be different; hence, all these different amounts received for the same mutual fund are collected in a common pool.

2. Allocation into Market Instruments

Based on the fund’s investment objective and strategy, the mutual fund manager, who is entrusted with the responsibility of the fund, then takes the common pool of money and uses it to buy various securities.

For example:

- If the mutual fund that received the funds is a purely equity fund, then the fund manager would purchase only shares of different companies.

- If the mutual fund that received the funds is a purely debt fund, then the fund manager would purchase only the bonds of different companies.

- If the mutual fund that received the funds is a hybrid fund, then the fund manager would purchase both the shares and bonds of different companies.

All the above purchases are done according to the investment goals and ratios as disclosed by the mutual fund in their scheme documents.

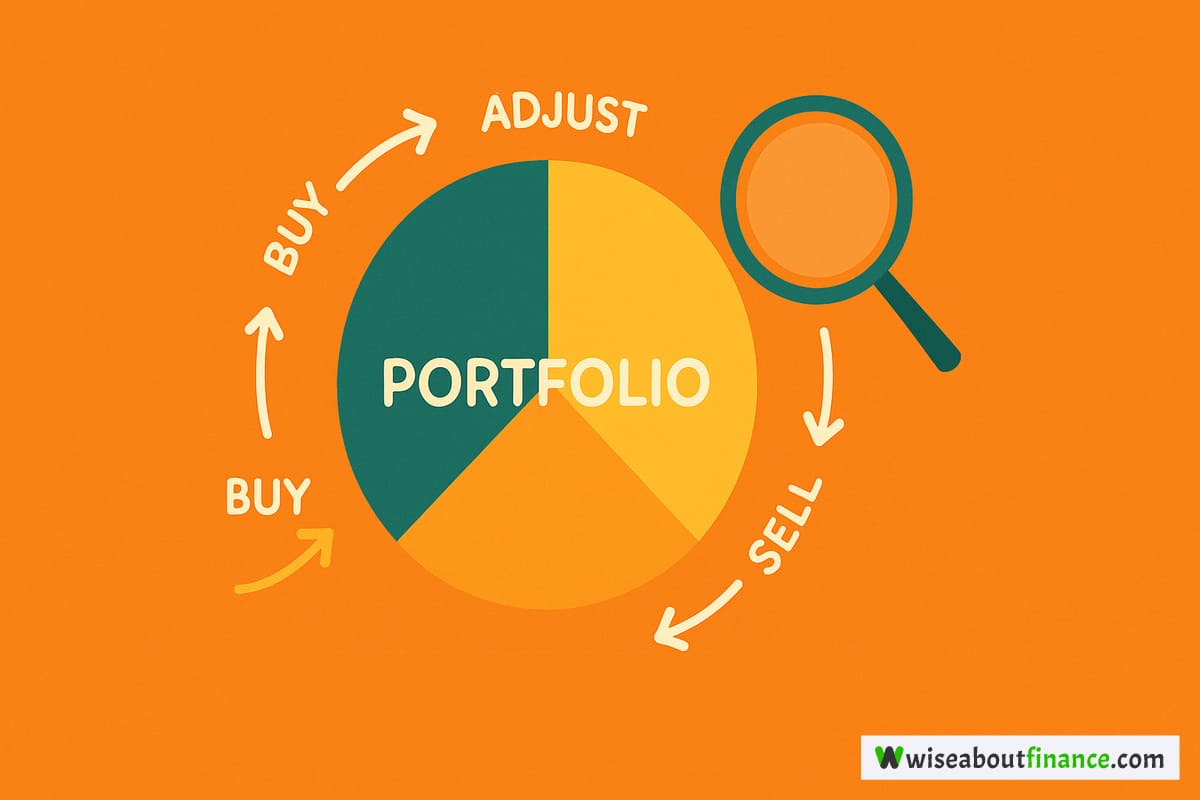

3. Ongoing Management and Rebalancing

For actively managed mutual funds, the mutual fund manager doesn’t just invest and forget. They actively manage the portfolio, which involves continuous research, analysis, and making decisions about when to buy, sell, or hold different investments. They also rebalance the portfolio periodically to maintain the desired asset allocation.

For example, if equity has grown significantly and now forms a larger portion of a balanced fund than intended, the manager might sell some equity and invest in debt to bring it back in line. All of this is done according to the objectives of the mutual fund.

On a daily basis, as the stock market fluctuates, the value of the underlying investments also changes. This also leads to a change in the Net Asset Value (NAV) of the mutual fund.

This change in NAV is calculated at the end of each trading day and reflects the current market value of each unit of the fund.

5. Redemption Process and Payouts

When an investor wants to withdraw their money, they request a redemption of their units held in the mutual fund. After necessary scrutiny, the applicable units of the mutual fund are sold as per the order, and then the investor is paid based on the prevailing NAV.

The payout is usually credited directly to the investor’s bank account, typically within a few minutes to a few business days, depending on the type of mutual fund whose units were redeemed.

V. Types of Mutual Funds in India

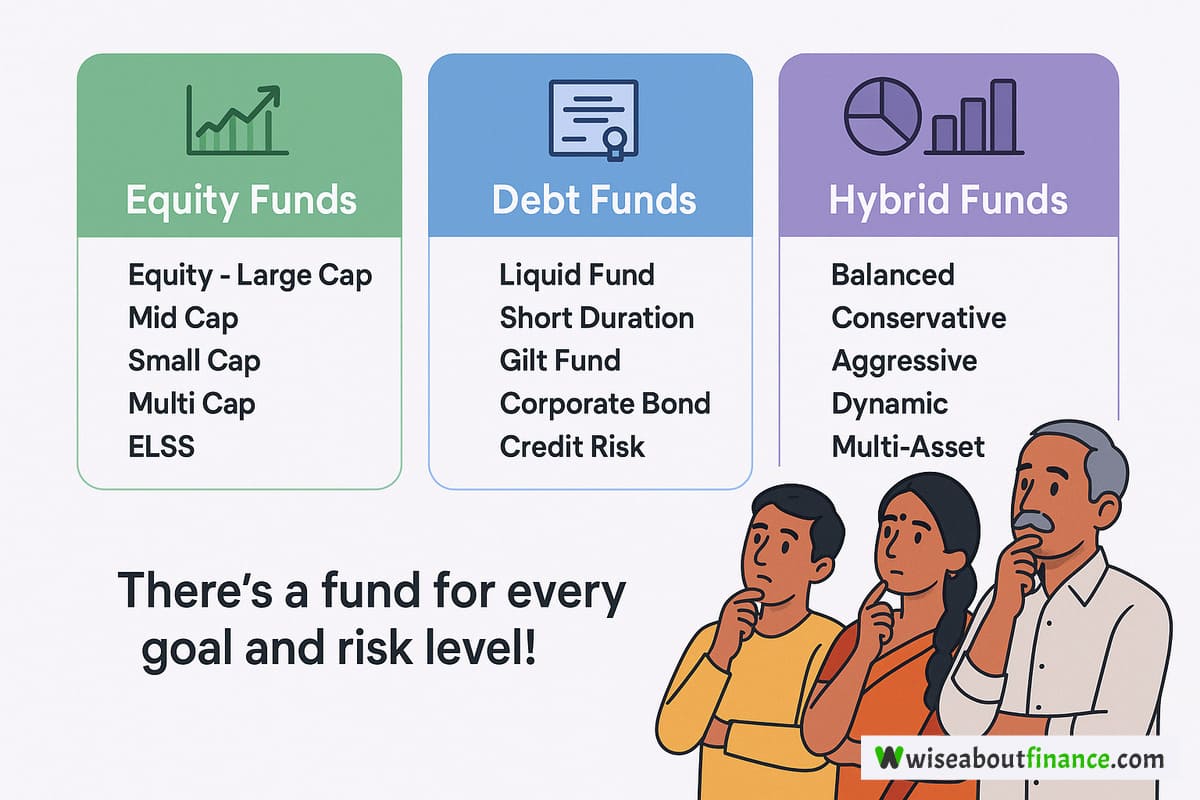

There are different types of Mutual Funds in India, that are suitable for different needs and risk appetites. The following is the list, categorized based on asset class, structure, investment goals, risk, and other relevant criteria:

1. Based on Asset Class

A. Equity Mutual Funds

These invest primarily in stocks/equities. Suitable for long-term wealth creation. Types include:

- Large Cap Fund

- Mid Cap Fund

- Small Cap Fund

- Multi Cap Fund

- Flexi Cap Fund

- Sectoral/Thematic Fund

- ELSS (Equity Linked Saving Scheme) – comes with tax benefits

- Focused Fund (maximum 30 stocks)

- Contra Fund

- Value Fund

B. Debt Mutual Funds

These invest in fixed-income instruments like government securities, corporate bonds, and treasury bills. Types include (as per SEBI classification):

- Overnight Fund

- Liquid Fund

- Ultra Short Duration Fund

- Low Duration Fund

- Money Market Fund

- Short Duration Fund

- Medium Duration Fund

- Medium to Long Duration Fund

- Long Duration Fund

- Dynamic Bond Fund

- Corporate Bond Fund

- Credit Risk Fund

- Banking and PSU Fund

- Gilt Fund

- Gilt Fund with 10-Year Constant Duration

- Floater Fund

C. Hybrid Mutual Funds

These combine equity and debt in different ratios to balance risk and return. Types include:

- Conservative Hybrid Fund (mostly debt)

- Balanced Hybrid Fund (equity and debt in equal proportion)

- Aggressive Hybrid Fund (mostly equity)

- Dynamic Asset Allocation/Balanced Advantage Fund

- Multi Asset Allocation Fund (invests in 3+ asset classes)

- Arbitrage Fund

- Equity Savings Fund

D. Other Asset Classes

- Gold Mutual Funds – Invest in gold ETFs or bullion

- International or Global Funds – Invest in overseas equities or funds

- Real Estate Funds (REITs) – Indirect exposure to real estate through listed trusts

2. Based on Structure

A. Open-Ended Funds

- No lock-in period

- Buy/sell anytime at prevailing NAV

- Most common type in India

B. Close-Ended Funds

- Fixed maturity period

- Subscription only during NFO (New Fund Offer)

- Traded on stock exchanges

C. Interval Funds

- Combine features of open and close-ended funds

- Purchase/redemption allowed only at specific intervals

3. Based on Investment Goals / Objectives

A. Growth Funds

- Focus on capital appreciation

- Best for long-term goals

B. Income Funds

- Focus on generating regular income via interest/dividends

- Suitable for conservative investors

C. Tax-Saving Funds (ELSS)

- Eligible for tax deduction under Section 80C

- 3-year lock-in period

- Equity-based

D. Liquid and Short-Term Funds

- Invest in very short-term debt instruments like T-Bills, Commercial Papers, etc.

- Ideal for parking surplus money and emergency funds

- Highly liquid and low risk

E. Capital Protection Funds

- Primarily invest in debt and a small portion in equity

- Aim to protect the principal investment

F. Fixed Maturity Plans (FMPs)

- Closed-ended debt funds

- Invest in fixed-income instruments for a specific term

4. Based on Risk Profile

- Low Risk: Liquid Funds, Overnight Funds, Gilt Funds

- Moderate Risk: Hybrid Funds, Large Cap Equity Funds

- High Risk: Small Cap Funds, Sectoral/Thematic Funds, Mid Cap Funds

5. Based on Mode of Investment

A. Direct Mutual Funds

- Bought directly from AMC (Asset Management Company)

- Lower expense ratio

- Higher returns (no commission)

B. Regular Mutual Funds

- Bought through intermediaries (agents, brokers, apps)

- Higher expense ratio (due to commission)

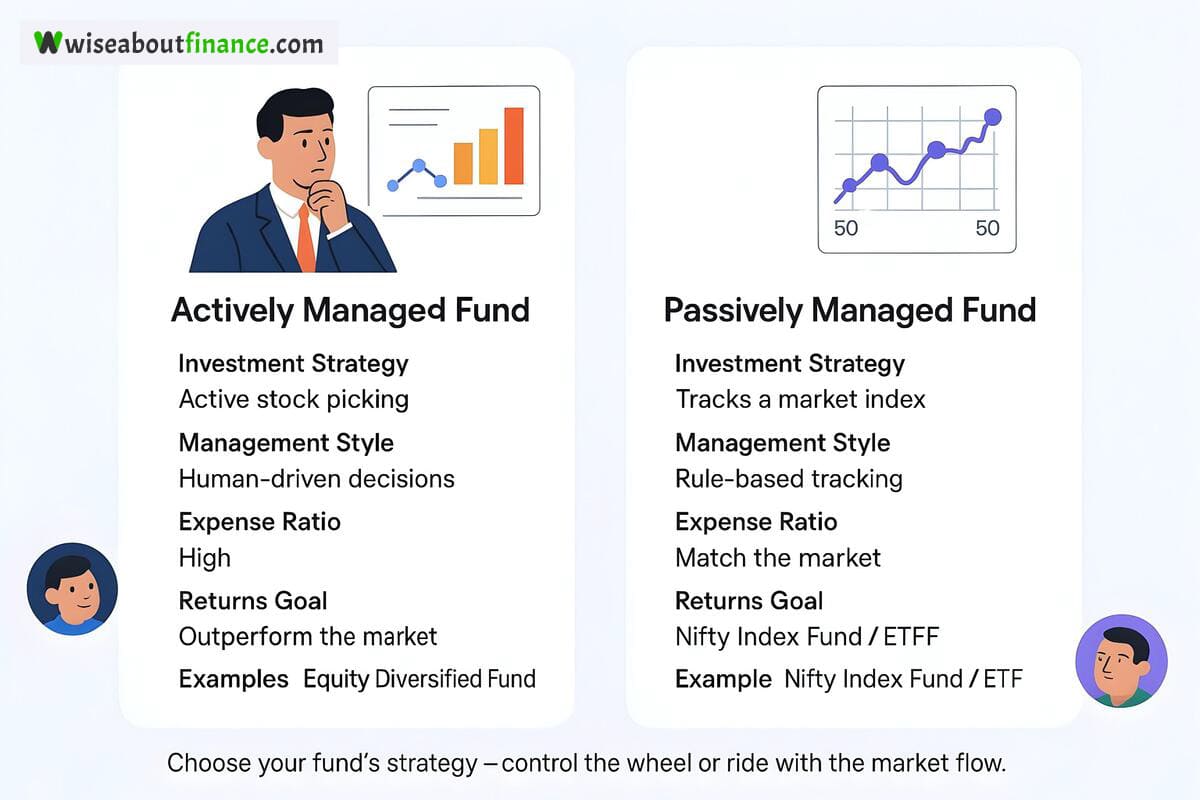

6. Based on Investment Style

A. Actively Managed Funds

- Fund manager selects stocks/assets actively to outperform the market

B. Passively Managed Funds

- Track a market index (e.g., Nifty 50, Sensex)

- Includes Index Funds and Exchange Traded Funds (ETFs)

7. Based on Duration

- Short-Term Funds: Liquid Funds, Ultra Short-Term Funds, Low Duration Funds

- Medium-Term Funds: Short Duration, Medium Duration Funds

- Long-Term Funds: Equity Funds, Long Duration Debt Funds, ELSS

VI. Benefits of Investing in Mutual Funds

Let’s try to understand what makes investing in mutual funds a very popular option:

1. Diversification and Risk Reduction

The real beauty of mutual funds in the fact that when you invest in a mutual fund, your money is not used to buy the securities (shares, bonds, etc.) of a single company.

Rather, your money is used to buy the securities (shares, bonds, etc.) of multiple companies, as indicated by the mutual fund.

In this way, your money gets diversified across a variety of securities of various companies. This diversification helps reduce risk.

For example:

- Let’s assume that you have invested in a mutual fund that holds shares of 10 different companies.

- In an unfortunate event that 3 of the companies in the mutual fund holding do not perform well, due to which, their share price decreases, there is a possibility that the rest 7 can perform well, due to which, their respective share prices increase and the overall value of your holding goes up.

- The opposite is also true, wherein, in an event of a major market downturn, the value of the shares of majority companies can go down with the values of only a few companies following the uptrend. Hence to workaround this issue, it is suggested to either leave your investment in the mutual fund for a longer time or invest in a less volatile mutual funds.

These are some of the sure-shot ways in which you could ensure that your money is protected and also grows ultimately earning you a handsome reward in the long run.

2. Professional Fund Management

As every mutual fund has at least one manager (or more) to manage the fund, you can enjoy peace of mind knowing that you can count on the knowledge and the professional experience of the fund manager to manage your investment without your involvement on a day-to-day basis.

You don’t need to study balance sheets or read charts and buy/sell securities of the mutual fund, as the fund manager does this for you.

The mutual fund manager’s day to day operations involve researching and analyzing investment opportunities to ensure that the mutual fund meets your financial objectives.

As the manager has a team of experts working for him and is equipped with latest technologies and devices, this enables the manager and his team to take plan strategically and take calls on purchase and sale of the underlying securities of the mutual fund that you are invested in, based on economic up-trends and downturns, thereby ensuring the mutual fund makes a profit and so do you.

Also, the mutual fund manager receives a commission for managing your fund on an everyday basis and this commission is deducted from the NAV of the mutual fund everyday. Hence, the manger gets the incentive to protect your financial interests as he himself makes a profit of the same. This is a win-win situation for both us, the retail investors and the mutual fund AMC.

3. Liquidity and Flexibility

Liquidity means the ability to sell off your mutual fund units that you are holding and get back your money, to your bank account.

For example:

- Let’s say you invest Rs. 1 Lakh in a mutual fund.

- After 1 month, you find out that you need Rs. 1 Lakh for youre expenses.

- You try to redeem your mutual fund by selling off the units that were allotted to you in your account.

- You notice that in a span of 1 month, the value of your units have gone up by Rs. 5,000.

- So the net worth of your initial investment of Rs. 1,00,000, is now Rs. 1,05,000.

- So if you sell of all your mutual fund units, you will now get back Rs. 1,05,000 in your back account in the next 2-3 business days.

This ability to sell off your investments and get back your money in the shortest time possible, to cover your financial requirements, is called “Liquidity”.

Flexibility refers to the choice of investing in different types of funds based on your changing financial goals and risk appetite. You are free to invest in a single mutual fund or multiple mutual funds, depending upon your financial goals.

4. Cost Efficiency via Low Entry Barriers

As mentioned earlier, to start investing in mutual funds, you have a very low entry barrier. This means that you do not need to start investing with Lakhs or Crore of rupees. Rather, you can start investing in many mutual funds with a relatively small amount, such as Rs. 100 (or as indicated by the mutual fund scheme).

This flexibility to start investing with a nominal amount thus makes it accessible for almost everyone to begin their investment journey.

The costs of managing the fund are shared among all investors by the AMC managing the mutual fund. This makes it more cost-efficient than to build a similarly diversified portfolio on your own.

5. SIP (Systematic Investment Plan) Advantages for Beginners

Systematic Investment Plan, is also very popular known an SIP (yes-eye-pea).

I highly recommend all beginners to start their mutual fund investment journey using SIP, without having to invest a huge amount upfront.

Investing in a mutual fund via SIP involves making fixed monthly payments towards the purchase of units of your desired mutual fund. You may make these purchases either weekly, bi-weekly, monthly, quarterly or as allowed by the mutual fund scheme.

Investing via SIP has several advantages, as indicated below:

- Rupee Cost Averaging: By investing regularly, if the market is down on the day of your purchase, then you end up receiving more units. If the market is in up trend on the day of your purchase, then you end up receiving less units. Over time, this averages out your purchase cost.

- Disciplined Investing: SIPs encourage a habit of regular saving and investing.

- No Need to Time the Market: You don’t have to worry about trying to predict the best time to invest. You simply keep investing the same amount every month in a mutual fund of your choice and let the magic of growth happen over a period of time.

Remember this:

Disciplined Investing every month + Consistency of Mutual Fund unit purchase = Huge growth in the net worth of your investments over time.

VII. Risks and Trade-offs in Mutual Funds

While I love mutual funds for the benefits they offer, it would not be fair if we don’t talk about the potential risks and trade-offs. They are as below:

1. Market Risk and Volatility

As you have already understood by now, when we invest our money in a mutual fund, the mutual fund manager purchases securities such as shares and bonds of different companies, and also other financial instruments such as gold, silver, shares of international companies, etc. as underlined in the mutual fund scheme.

To understand the concept of market risk and volatility, think of it like this:

- Imagine you’re at the local market buying vegetables.

- One day, tomatoes are selling for Rs. 20 per kg.

- The next week, there’s heavy rain and the supply drops, so prices shoot up to Rs. 40 per kg.

- A few days later, the rains stop and tomatoes flood the market again — so the price falls back down.

This kind of price change happens with shares of companies and commodities like gold or oil, just like with tomatoes — but instead of weather, things like news, company performance, or how people feel about the economy can affect their prices.

Now, if you invest in something like an equity mutual fund, your money is used to buy shares of different companies. The value of your investment (called NAV) depends on how much those shares are worth on a given day.

So when the prices of those shares go up or down because of what’s happening in the market, the NAV of your fund also goes up or down. That’s just how these kinds of investments work — they move with the market!

To summarize:

Prices of things like company shares and gold naturally go up and down every day. These changes affect how much your mutual fund units are worth. So, if you’re investing in market-linked funds, expect some ups and downs — it’s completely normal!

2. Fund Manager Dependence

Think of a mutual fund like a cricket team. You’ve got the players (which are like the stocks or bonds the fund invests in), and then there’s the captain or coach who decides which players to pick and when to play them.

In the world of mutual funds, that captain is called the fund manager.

Now, just like how a good captain can lead the team to victory with smart decisions, a skilled fund manager can help your money grow by choosing the right stocks or bonds at the right time.

But here’s the catch — if the captain isn’t making good calls — like picking the wrong player for the situation — the team might lose. Similarly, if the fund manager makes bad investment choices, it can hurt the performance of the fund, and your returns might suffer.

So, when you invest in a mutual fund, a big part of your success depends on how good the fund manager is at their job.

To summarize:

That’s what the meaning of “Fund Manager Dependence” is — your money is being managed by a person whose decisions directly affect how well your investment does.

3. Expense Ratio Impact on Returns

Imagine you’re ordering food from your favorite restaurant using a food delivery app like Swiggy or Zomato.

You pick a meal worth Rs. 200. But when you go to pay, you notice:

- Rs. 180 for the food

- Rs. 20 extra for delivery charges, GST, and platform fees

So even though you paid Rs. 200, only Rs. 180 went toward the actual food — the rest went into fees.

Now think of a mutual fund like that meal.

The money you invest is like your Rs. 200.

The returns your fund earns are like the value of the food you get.

But before you get those returns, a small fee called the expense ratio is taken out — just like those delivery charges.

Now let’s try to understand the above with a real-life example below:

Let’s say you invest Rs. 1 lakh in a mutual fund that gives an average annual return of 12%.

- If the fund has an expense ratio of 0.20%, then Rs. 200 per year goes toward managing the fund.

- Your actual return will be around 11.8% instead of 12%.

Over time, this difference adds up — especially if you’re investing for 10–15 years.

Here’s how it looks over 10 years:

| Fund | Expense Ratio | Annual Return | Final Amount (on Rs. 1 lakh) |

| Fund A | 0.20% | 11.8% | Rs. 3,07,640 |

| Fund B | 1.50% | 10.5% | Rs. 2,75,650 |

That’s a difference of over Rs. 32,000 just because of a higher expense ratio!

To summarize:

Think of the expense ratio like a small commission your mutual fund takes to manage your money. Even though it looks tiny each year, over time, it can make a noticeable difference in how much money you actually end up with.

So always check the expense ratio before investing — lower is usually better!

4. Exit Load and Lock-in Periods

Imagine you go to your favorite mobile phone store and buy a new smartphone on an EMI plan. But there’s a catch — the salesperson tells you:

“You can’t return this phone for at least 3 years. If you try to return it before that, we’ll charge you a small fee.”

Sounds familiar? Well, something similar happens with certain types of mutual funds — especially ELSS (Equity Linked Savings Scheme) funds.

Now let’s try to understand the above with a real-life example of an ELSS Fund below:

Let’s say you invest Rs. 50,000 in an ELSS fund because it gives tax benefits under Section 80C.

Here’s what you need to know:

- Lock-in Period: You cannot withdraw or redeem your money for 3 years. It’s like a fixed deposit, but for mutual funds.

- Exit Load: After 3 years, you’re free to take your money out. But if you exit before the lock-in is over, you may either not be allowed to redeem at all (in most cases), or if allowed, a small fee (like 0.5% – 1%) is charged.

To summarize:

- Lock-in Period: Some funds (like ELSS) don’t let you take your money out for a set time (usually 3 years).

- Exit Load: A small fee you pay if you withdraw your money before a certain period.

These are like rules put in place to help you stay invested longer — which often leads to better returns!

5. Tax Implications (STCG, LTCG, Dividend Tax)

Let’s say you work in an office and earn a monthly salary. At the end of the year, you also get a bonus and maybe some extra income from interest on fixed deposits.

Now imagine your mutual fund investment works like that:

- Your profit from selling units is like your bonus.

- Any dividends you receive are like interest income.

- And just like your salary or bonus, this profit is also taxable — depending on how long you held the investment and what type of fund it was.

To summarize:

Think of your mutual fund profits like different kinds of income:

- Selling quickly? Pay higher tax (like short-term gains).

- Holding longer? Pay lower tax (like long-term gains).

- Got dividends? That’s like extra income — taxed based on your income slab.

VIII. Mutual Funds vs Other Investment Options

1. Mutual Funds vs Fixed Deposits

Fixed deposits are offered (generally) by banks and offer fixed returns. You know how much money you’ll get back at the end of the term. They are safe but give lower returns.

Mutual funds, on the other hand, invest your money in stocks, bonds, or gold. The returns depend on market performance. Over time, they can give better returns than FDs, especially equity mutual funds.

Think of it this way:

- A Fixed Deposit is like eating the same dal-chawal every day — safe, predictable, but not very exciting.

- A Mutual Fund is like trying a thali — more variety, potentially tastier, and more satisfying in the long run — though sometimes the taste might not be exactly what you expect.

Who should choose what?

- Go for FD if you want safety and don’t want any surprises.

- Choose mutual funds if you’re okay with some ups and downs for better growth over time.

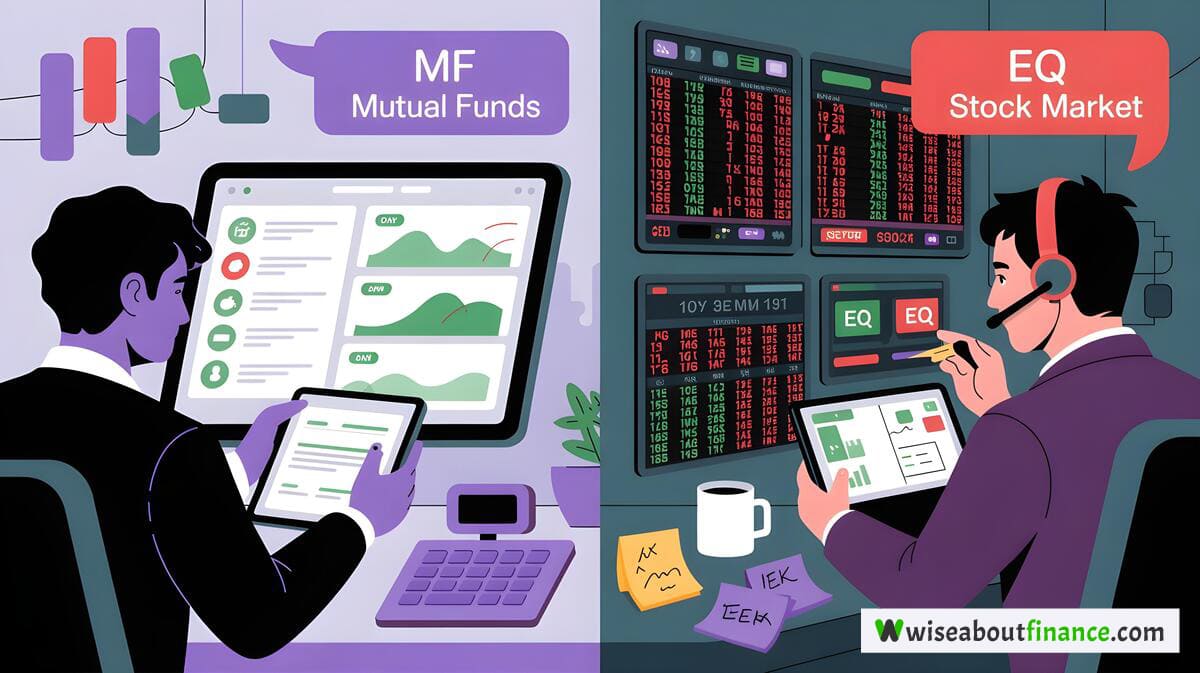

2. Mutual Funds vs Stock Market (Direct Equity)

Investing directly in the stock market means buying shares of companies yourself. It gives you full control, but also requires knowledge, time, and effort.

Mutual funds do all that for you. A fund manager picks the stocks and manages them so you don’t have to worry about it.

Here’s a real-life example:

- Managing your own stock portfolio is like driving your own car — you need to know the rules, maintain the vehicle, and keep your eyes on the road.

- Investing in mutual funds is like taking a shared cab driven by an experienced driver — you sit back, relax, and still reach your destination.

Who should choose what?

- Pick direct stocks if you enjoy tracking markets and have the time to learn.

- Go for mutual funds if you want to grow your money without getting into the daily market noise.

3. Mutual Funds vs ULIPs and Insurance Products

ULIPs (Unit Linked Insurance Plans) are a mix of insurance and investment. When you invest in a ULIP, part of your money goes toward life insurance and the rest is invested in the market.

Mutual funds are purely for investment — there’s no insurance component attached.

Think of it like this:

- Buying a ULIP is like buying a combo meal — you get both food and a drink whether you wanted the drink or not.

- Buying a mutual fund is like ordering only what you need — you decide separately if you want to buy insurance or not.

Who should choose what?

- ULIPs may suit people who want insurance along with investing (but often cost more).

- Mutual funds are better if you just want to invest and prefer to buy insurance separately — which is usually cheaper and more flexible.

4. Mutual Funds vs Real Estate Investment

Real Estate is nothing but land/property and any permanent structures attached to it. Buying property is one of the most common ways Indians invest their money. But real estate needs a lot of capital, paperwork, and maintenance.

Mutual funds require much less money and zero maintenance. You can start investing with as little as Rs. 100 from your phone.

Here’s a simple comparison:

- Owning property is like running your own shop — you have to deal with tenants, repairs, and paperwork.

- Investing in mutual funds is like owning a small piece of many shops through a company — you benefit from their success without lifting a finger.

Who should choose what?

- Real estate suits those with big savings and an interest in physical assets.

- Mutual funds are perfect for people who want to grow their money easily and hassle-free.

IX. How to Choose the Right Mutual Fund

Choosing a mutual fund is like choosing what to eat for dinner — you need to know what you’re hungry for, how much time you have, and what kind of food suits your taste.

Let’s break it down step by step:

1. Define Your Financial Goals and Risk Appetite

Before investing, ask yourself:

- What are you saving for? A new phone? A vacation? Retirement?

- How long can you wait to reach that goal?

- Are you okay with some ups and downs in value, or do you prefer safety?

Example:

If you’re saving for a bike you want in 2 years, you’ll pick something safe like a debt fund.

If you’re saving for your child’s education in 15 years, you can take more risk with an equity fund.

2. Evaluate Fund Performance (3Y, 5Y CAGR, Benchmark)

Look at how well the fund has performed over the last 3 or 5 years. This is called CAGR (Compound Annual Growth Rate) — basically, the average yearly return.

Also, check if the fund beats its benchmark — like whether your friend runs faster than the average runner in school.

Example:

If a fund gives 12% average return over 5 years and the market (like Nifty 50) only gave 10%, that fund did better than average — just like scoring higher than the class average.

3. Check Fund Rating and Fund Manager’s Track Record

Some platforms rate funds like movies — ★★★☆☆. Higher ratings mean better performance and stability.

Also, look at who’s managing the fund — just like checking the chef’s experience before eating at a restaurant.

Example:

Would you go to a restaurant where the chef keeps changing every month? Probably not. You’d prefer someone experienced and consistent.

4. Understand the Expense Ratio and Exit Load

Every fund charges a small fee to manage your money — this is called the expense ratio. Lower is better.

Also, some funds charge a small fee if you withdraw early — called an exit load.

Example:

It’s like ordering food online and seeing extra charges for delivery and GST. Even though the food is good, those fees reduce how much you actually get.

5. Align Fund Type with Investment Horizon

Your investment horizon means how long you plan to keep your money invested.

Choose the type of fund based on this:

- Short-term goals (up to 1 year): Liquid Funds

- Medium-term goals (1–3 years): Debt Funds or Balanced Funds

- Long-term goals (5+ years): Equity Funds

Example:

You wouldn’t use a pressure cooker to make biryani — it’s the wrong tool for the job. Similarly, don’t invest in a risky equity fund for a goal that’s just a few months away.

To summarize:

Think of choosing a mutual fund like planning a meal:

- Know what you’re hungry for (your goal)

- Pick the right dish (fund type)

- Check the chef’s skills (fund manager)

- Look at the price and hidden costs (expense ratio & exit load)

- Make sure it cooks in the right time (investment horizon)

When all these match, you end up with a satisfying meal — and a growing investment!

X. How to Start Investing in Mutual Funds in India

Starting to invest in mutual funds is easier than you think — like ordering food online or booking a movie ticket. Let’s walk through the steps using simple analogies everyone can understand.

1. KYC Process and PAN Requirement

Before you can invest, you need to complete your KYC (Know Your Customer). It’s like submitting your ID when opening a bank account or getting a SIM card.

You also need a PAN card, which acts like your financial identity.

Example:

Think of KYC like showing your ID at a cinema hall before entering. Once verified, you’re allowed inside and can enjoy the show (i.e., start investing).

2. Choosing a Platform (AMC, App, Broker, Direct)

You can invest directly through an AMC (like HDFC Mutual Fund or SBI Mutual Fund), or use third-party platforms such as:

- Mobile apps

- Brokers

- Banks

Which one should you choose?

It’s like choosing where to buy groceries:

- Buy directly from the farmer (AMC direct plans) — cheaper, no middleman.

- Or go to a supermarket (third-party app) — more choices, convenience, and sometimes offers.

3. Lump Sum vs SIP – Which One Suits You?

There are two main ways to invest:

- Lump Sum: Invest a big amount all at once.

- SIP (Systematic Investment Plan): Invest small amounts regularly (e.g., Rs. 100 every month).

Example:

- Lump sum is like buying all your monthly groceries in one go.

- SIP is like buying groceries weekly — smaller, manageable, and avoids overspending.

Which one should you choose?

- Choose SIP if you get a regular salary and want to invest slowly but steadily.

- Choose lump sum if you have a large bonus or savings ready to go.

4. Setting Up Auto-Debit for SIPs

Once you choose SIP, you can set up an automatic payment — just like setting up a monthly mobile recharge plan.

Your bank will automatically deduct the SIP amount on the date you choose and invest it in your selected fund.

Example:

It’s like paying your electricity bill automatically — you don’t have to remember it every time, and your investment keeps going without a break.

5. Tracking, Reviewing, and Rebalancing Your Portfolio

After investing, it’s important to check how your investments are doing — just like checking your health during a routine check-up.

If one fund isn’t performing well, or your goals have changed, you may need to rebalance — meaning shift some money around.

Example:

Imagine you planted different types of vegetables in your garden. If tomatoes aren’t growing well but chillies are thriving, you might plant more chillies next season.

Similarly, if equity funds are doing well but debt funds are not, you might adjust your portfolio accordingly.

To summarize:

Starting to invest in mutual funds is like planning your meals:

- First, prove who you are (KYC)

- Decide where to shop (platform)

- Choose whether to spend all at once or little by little (lump sum vs SIP)

- Set reminders so you don’t forget (auto-debit)

- And check your progress now and then to stay on track (review & rebalance)

With these simple steps, anyone can begin their journey into investing — even if you’ve never bought a stock in your life!

XI. Real-World Examples and Case Studies

Let’s look at how real people use mutual funds to meet their goals — using simple, everyday situations that you can relate to.

1. Beginner Investor Building Wealth with SIPs Over 10 Years

Imagine your friend Ravi is just like you — he started working a few years ago and decided to invest Rs. 2,000 every month in a good equity mutual fund through SIP.

He didn’t stop for 10 years and kept investing regularly — even during market ups and downs.

Result after 10 years:

At an average return of about 12% per year, his total investment of Rs. 2.4 lakh grew to around Rs. 4.7 lakh!

What’s the takeaway?

You don’t need to be rich or an expert to grow your money. Just start early, stay consistent, and let compounding work its magic — like watering a plant daily until it grows into a tree.

2. Short-Term Investor Using Liquid Funds for Emergency Needs

Your cousin Priya got a job and saved Rs. 1 lakh from her first salary. She wanted to keep it safe but also have access to it if she needed it urgently.

She invested in a liquid fund, which is like a digital savings jar — it gives better returns than a regular savings account and lets you take your money out anytime.

After 6 months:

Her Rs. 1 lakh grew to around Rs. 1.03 lakh — not a lot, but better than keeping it idle in the bank.

What’s the takeaway?

If you’re saving for something short-term — like a medical emergency or a sudden trip — liquid funds are a better choice than leaving money unused in your savings account.

3. Comparing ELSS vs PPF for Tax Saving

Your uncle Rajesh wants to save tax under Section 80C. He has two options:

- ELSS (Equity Linked Savings Scheme): A type of mutual fund that gives tax benefits and locks your money for 3 years.

- PPF (Public Provident Fund): A government-backed savings scheme with a lock-in of 15 years.

Here’s how they compare:

| Feature | ELSS | PPF |

| Lock-in Period | 3 years | 15 years |

| Returns | Around 10–12% | Around 7–8% |

| Risk | Moderate | Very Low |

| Flexibility | Can switch funds | Not flexible |

What did Uncle Rajesh choose?

Since he wanted better returns and didn’t want to lock his money for 15 years, he picked ELSS.

What’s the takeaway?

Both help you save tax, but ELSS gives better returns and shorter lock-in, making it more suitable for many people today.

4. Investor Mistakes: Chasing Returns vs Goal-Based Investing

Your neighbor Anil heard that a certain stock or fund gave 30% returns last year, so he jumped in without thinking about his own goals.

But this year, the same fund only gave 5% returns. He panicked and sold — missing out on long-term growth.

Meanwhile, his friend Suman had a clear plan:

- For her child’s education (10 years away), she chose a good equity fund.

- For her retirement (25 years away), she picked a balanced fund.

- For emergencies, she used a liquid fund.

She didn’t get distracted by what others were doing — she stayed focused on her goals.

What’s the takeaway?

Don’t chase hot returns like everyone else. Instead, invest based on your goals and time horizon — that’s how you build lasting wealth.

To summarize:

Think of investing like planning your monthly budget:

- Use SIPs to grow your money slowly over time.

- Keep emergency money in liquid funds.

- Save tax smartly with ELSS instead of locking money for too long.

- And most importantly — don’t follow the crowd blindly, make choices based on your own goals.

When you invest with a plan, your money starts working for you — just like your salary does every month.

XII. Conclusion

So, to wrap it all up in simple terms — mutual funds are a smart and easy way for everyday people like you and me to grow our money over time.

Instead of trying to pick stocks or worry about when to buy or sell, we can let expert fund managers do the hard work for us. They take our money (along with others), invest it in things like company shares, bonds, or even gold, and aim to make our money grow.

Mutual funds are great because:

- You can start with as little as Rs. 100.

- They help your money beat inflation — meaning your savings don’t lose value over time.

- They spread the risk by investing in many different things.

- You can choose funds based on your goals — whether it’s buying a house, saving for retirement, or planning your child’s education.

- With tools like SIPs (small regular investments), it’s easy to build a habit of investing without feeling the pinch.

Of course, there are risks — especially if you pick market-linked funds that go up and down. But if you stay patient, invest wisely, and give your money time to grow, mutual funds can be a powerful tool in building wealth.

So, whether you’re just starting out or already know a bit about investing, mutual funds are a friendly, flexible option that can help you reach your financial goals — one small step at a time.

XIII. Frequently Asked Questions (FAQs)

1. Are mutual funds safe to invest in?

Safety depends on the type of fund and its underlying investments. Lower-risk options exist, but all carry some market risk.

2. How do mutual funds work?

They pool money from investors, professionally managed, and invested in diverse assets like stocks and bonds.

Net Asset Value. It's the per-unit market value of the fund's investments, updated daily.

4. What's the minimum I need to start investing in mutual funds?

Often Rs. 100 for SIP (Systematic Investment Plan); lump sums can vary.

5. What are the main types of mutual funds available in India?

Equity (stocks/shares), Debt (bonds), Hybrid (mix of both), and solution-oriented (e.g., retirement, children's funds).

6. What is SIP and why is it popular for beginners?

Systematic Investment Plan. It allows regular, small investments, averaging out costs and reducing the need to time the market.

7. How are mutual funds taxed in India?

Tax depends on the fund type (equity/debt) and holding period (STCG/LTCG). Dividend income is also taxable. *Consult a tax advisor for specific details.

8. Can I withdraw my money from mutual funds whenever I need it?

Generally yes, for open-ended funds. Some might have an exit load if withdrawn early.

9. What are the key benefits of investing in mutual funds?

Diversification, professional management, liquidity, and accessibility even with small amounts.

10. How do I choose the right mutual fund for my needs in 2025?

Consider your financial goals, risk tolerance, investment timeframe, and the fund's performance and expense ratio.