Table of Contents

- I. Welcome to the World of Mutual Funds! – A Simple Start for Every Indian

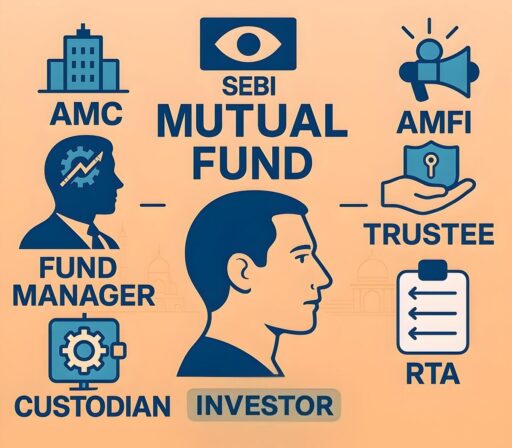

- II. The Main Players: Who’s in Charge of Your Mutual Fund Behind the Scenes?

- 1. The Big Boss: Asset Management Company (AMC) – The Organizer

- 2. The Investment Whiz: The Fund Manager – Your Investment Captain!

- 3. The Watchdog: The Trustee – Your First Layer of Protection

- 4. The Safekeeper: The Custodian – Protecting Your Assets Physically

- 5. The Record Keepers: Registrar and Transfer Agents (RTAs) – Making Your Life Easy

- III. The Guardians of the Indian Mutual Fund Industry: Keeping You Safe

- IV. How Your Money Moves: The Journey of Your Investment in India

- V. Key Things to Look for When Choosing a Mutual Fund and its Manager

- VI. Common Mistakes Indian Beginners Make (and How to Avoid Them!)

- VII. Tools and Resources for Indian Mutual Fund Investors: Your Support System

- VIII. Practical Tips for Beginners: Choosing the Right Fund Managers or AMCs

- IX. What’s the Future of Mutual Fund Management in India? – Trends to Watch

- X. Conclusion – Trust the System, Stay Alert, and Empower Your Financial Future

- XI. Frequently Asked Questions (FAQs) – Your Common Doubts Answered!

- 1. Who is the actual person managing my mutual fund investment?

- 2. Can I meet or contact the fund manager directly?

- 3. Are fund managers allowed to invest my money in risky shares?

- 4. What if my fund manager leaves the AMC?

- 5. Do fund managers guarantee returns?

- 6. What's the difference between an AMC and a bank offering mutual funds?

- 7. Is it safer to go with government-backed AMCs like SBI Mutual Fund?

- 8. How many fund managers typically work on one mutual fund?

- 9. How do I complain if I think my money is being mishandled?

- 10. Where can I learn more about who is managing my mutual fund?

Mutual funds are a popular investment option for many Indians today. But have you ever wondered who manages mutual fund investments in India and how your money is being looked after by professionals?

In this article, we’ll break it down step by step and help you understand the different people and institutions involved in managing your money.

You’ll learn who’s behind the scenes, how they work together, why their roles matter, and how you can make informed choices as an investor.

Whether you’re new to investing or just curious about where your money goes, this guide will give you clarity and confidence.

Let’s dive in!

I. Welcome to the World of Mutual Funds! – A Simple Start for Every Indian

1. What Are Mutual Funds, Really? – A Group Savings Jar

Think of it like this:

You and a few friends want to buy something expensive — maybe a big TV or a Diwali gift for everyone. You all chip in some money together so you can afford something bigger than what you could buy alone.

That’s exactly how mutual funds work.

A. Pooling Your Money for Bigger Power and Better Returns

When you invest in a mutual fund, your money is added to a big pool with money from other people like you and me — office employees, teachers, shopkeepers, etc.

This large amount of money gives professional managers the power to invest in things like:

- shares of big companies (like Reliance or Infosys),

- government bonds,

- gold,

- or even real estate-related assets.

These are things that most of us wouldn’t be able to buy individually because they cost too much or need expert knowledge.

Key takeaway: By joining a mutual fund, you and other investors pool your money together, allowing even small savings to grow and achieve bigger financial goals.

B. Why Investing Together Makes Sense for Beginners

Let’s say you’ve just started working and don’t know much about stock markets. Picking the right shares can feel confusing and risky.

But with a mutual fund, you don’t have to worry about that. Experts called Fund Managers take care of everything — they decide which stocks or bonds to buy or sell.

You only need to:

- Decide how much you want to invest.

- Choose a fund based on your goals — like saving for a house, your marriage, your child’s education, or retirement.

- Pick a risk level you’re comfortable with (low, medium, or high).

Key takeaway: You don’t need to be an expert. Just choose a good mutual fund and let professionals manage your money.

For example, my friend Anil had ₹5,000 saved up but didn’t know where to invest. He was scared of losing money. So he chose a debt mutual fund — low risk, steady returns. Over 2 years, his money grew safely without any stress. That’s the power of mutual funds for beginners!

C. The “Mutual Funds Sahi Hai” Story – Building Trust and Awareness in India

A long time ago, most Indians didn’t trust mutual funds. They preferred fixed deposits or gold. But in the early 2000s, the Association of Mutual Funds in India (AMFI) launched a big campaign called “Mutual Funds Sahi Hai“.

This campaign used simple ads and videos to explain:

- what mutual funds are,

- why they’re safe,

- and how anyone can start investing — even with as little as ₹500.

Today, millions of Indians — including people from small towns and villages — invest in mutual funds regularly.

Key takeaway: Thanks to “Mutual Funds Sahi Hai”, more and more Indians now understand and trust mutual funds as a smart way to grow their money.

2. Who Manages Mutual Fund Investments in India – And Why It Matters to YOU!

Now that you know what mutual funds are, here’s the next important question: who’s actually handling your money?

A. It’s Your Hard-Earned Money!

This isn’t just some extra cash lying around. It’s the money you earn from your job, business, or savings — maybe even money set aside for your child’s future or your dream home.

Would you hand over your life savings to someone without knowing who they are?

Of course not!

So, it’s important to know who’s managing your mutual fund and whether they’re experienced and trustworthy.

Key takeaway: Knowing who manages your money helps you sleep better at night and feel confident about your investment.

B. Understanding How Your Investments Grow (or Don’t)

The person managing your fund decides where to invest your money — in which companies, how much risk to take, and when to buy or sell.

If they make smart decisions, your money grows.

If they make bad choices, your money might not grow as expected — or worse, lose value.

So, it’s not just about choosing any mutual fund. It’s about choosing one managed by a good, experienced team.

Key takeaway: The fund manager’s skills and decisions directly affect how well your money grows over time.

C. Avoiding Surprises, Staying Safe

Imagine someone else using your money without telling you — that would be scary, right?

Because mutual funds are regulated by SEBI (India’s financial watchdog), there are rules in place to protect your money.

Still, it’s wise to know:

- who is managing your fund,

- how long they’ve been doing it,

- and if they have a good track record.

This way, you can avoid surprises and feel safer about where your money is going.

Key takeaway: Being informed helps you stay alert, avoid frauds, and protect your hard-earned savings.

So far, we’ve covered what mutual funds are and why it matters who’s managing them. In the next section, we’ll meet the people behind the scenes — like the AMC, fund manager, and other key players.

Keep reading — it gets even more interesting!

II. The Main Players: Who’s in Charge of Your Mutual Fund Behind the Scenes?

Now that you know why it matters, let’s meet the team behind your mutual fund.

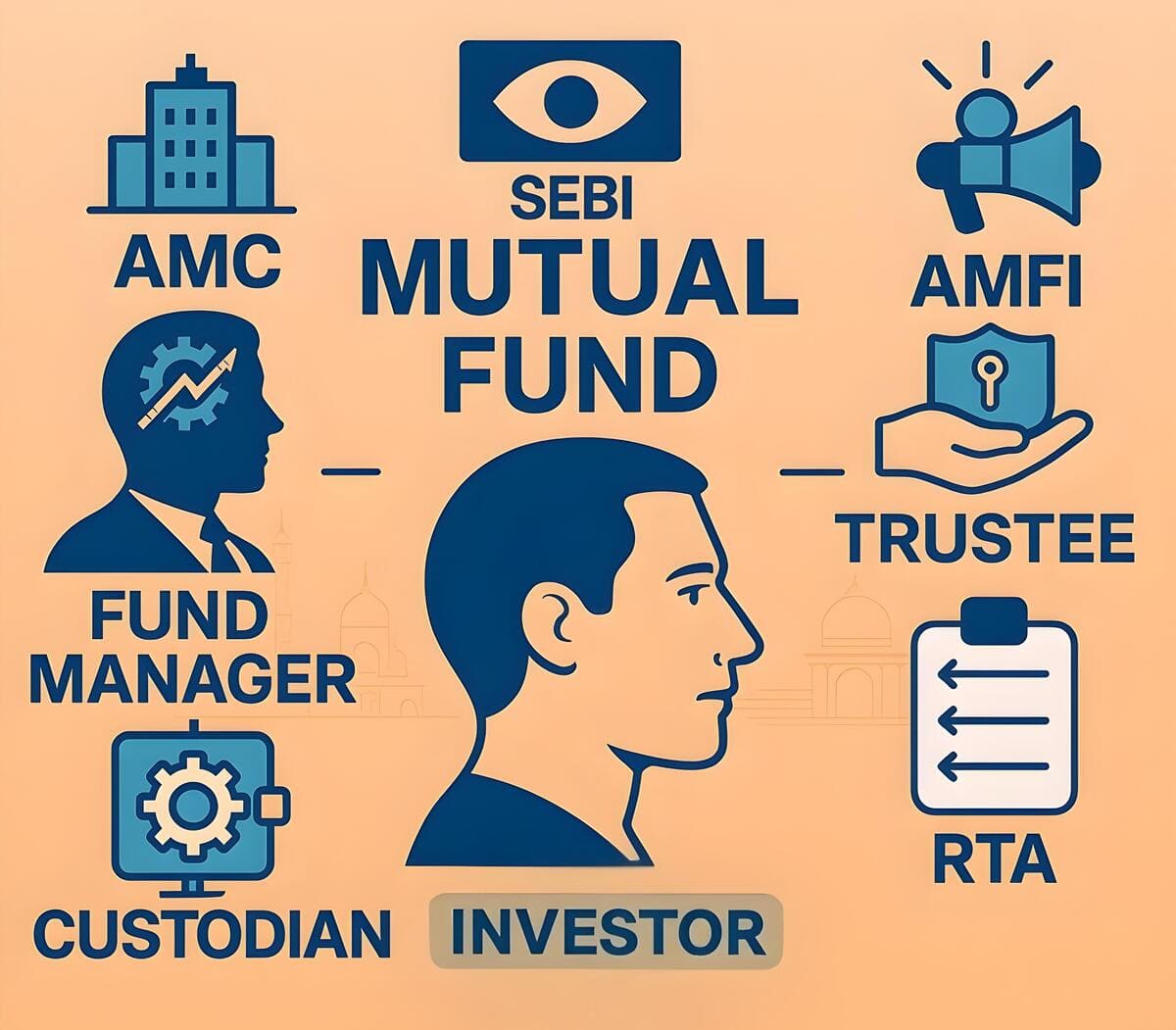

1. The Big Boss: Asset Management Company (AMC) – The Organizer

Let’s say you want to start a small business with friends — like a local kirana store or a food stall. But you don’t have all the money or experience. So you team up with someone who knows how to run such businesses and they help set everything up — from buying stock to hiring staff.

That’s what an Asset Management Company (AMC) does for mutual funds.

A. What an AMC Does

An AMC is like the main organizer of your mutual fund. They:

- Create the mutual fund scheme,

- Hire experts (like fund managers),

- Decide which types of funds to offer (like equity funds, debt funds, etc.),

- And make sure everything runs smoothly and fairly.

They are responsible for managing your money along with other investors, just like how a shop owner manages a business for everyone involved.

Key takeaway: An AMC sets up and runs your mutual fund, making sure it follows rules and works well for you.

B. Different AMCs You See in India

There are many AMCs in India, but some big names you might see are:

- SBI Mutual Fund

- HDFC Mutual Fund

- ICICI Prudential Mutual Fund

- Axis Mutual Fund

Each of these companies offers different kinds of mutual funds — like low-risk funds for people who want safety, or high-return funds for those who can take more risk.

For example:

If you’re saving for your child’s education in 10 years, you might pick a balanced fund offered by HDFC Mutual Fund. If you’re saving for retirement over 25 years, you might go for an equity fund from SBI Mutual Fund.

These AMCs create schemes based on your goals and how much risk you’re comfortable with.

C. How AMCs Make Money

An AMC doesn’t work for free — they charge a small fee called the Expense Ratio. This covers their costs for managing your money.

But don’t worry — this fee is very small (usually less than 2% per year), and it’s clearly shown in the fund details before you invest.

Also, AMCs must follow strict rules set by SEBI, India’s financial regulator, so they can’t just take extra money or misuse your savings.

Key takeaway: AMCs charge a small fee (called Expense Ratio) and operate under SEBI rules to ensure fairness and transparency.

2. The Investment Whiz: The Fund Manager – Your Investment Captain!

Imagine you’re playing cricket and your team needs a good captain to decide who bats first, who bowls when, and how to win the match. That’s exactly what a fund manager is — the captain of your investment game.

A. Who Is a Fund Manager?

A fund manager is a professional expert who decides where to invest your mutual fund money — whether in shares of big companies, government bonds, or gold.

You can say that a Fund Manager is like the decision-maker of your fund.

B. What Does a Fund Manager Do All Day?

Fund managers spend their time:

- Watching the stock market closely,

- Studying reports about companies,

- Deciding when to buy or sell stocks,

- And making sure your money is safe even if markets fall.

It’s a bit like being a chef — they mix different ingredients (stocks, bonds, etc.) to create a recipe that gives you good returns.

Key takeaway: Fund managers study markets, choose investments, and manage risks to grow your money.

C. Why a Good Fund Manager Matters

Just like how a good cricket captain can turn around a losing match, a skilled fund manager can give better returns.

Their experience and past performance matter a lot.

For example:

- If a fund manager has been working for 10+ years and delivered consistent returns, that’s a good sign.

- If they only had one lucky year but did poorly otherwise, it may not be reliable.

So always check the track record of the fund manager before investing.

Key takeaway: Always check the fund manager’s experience and consistency before investing.

3. The Watchdog: The Trustee – Your First Layer of Protection

Now imagine your friend starts managing your small business. You trust them, but you also want someone to keep an eye on things — just to be safe.

That’s where trustees come in.

A. What’s a Trustee’s Job?

Trustees are like independent guardians of your money. They make sure the AMC (the main company running the fund) plays fair and doesn’t misuse your savings.

They are usually big institutions or groups of experienced professionals.

B. Why Trustees Matter

Trustees regularly review what the AMC is doing. If something seems wrong, they report it to SEBI — India’s financial watchdog.

This means there’s always someone checking that your money is used properly.

Key takeaway: Trustees act as protectors of your money, ensuring the AMC follows all rules.

C. How Trustees Ensure Your Money Is Used Properly

Trustees ensure that:

- The fund operates according to its stated goals,

- The AMC follows SEBI regulations,

- And your money is invested safely and transparently.

In short, trustees help prevent fraud and mismanagement.

Key takeaway: Trustees ensure that your mutual fund works the way it says it will and stays within legal limits.

4. The Safekeeper: The Custodian – Protecting Your Assets Physically

Think of your valuables — like gold, property papers, or cash. You probably keep them in a bank locker or safe place. Similarly, your mutual fund investments need a secure place too.

That’s where the Custodian comes in.

A. What a Custodian Does

A Custodian is like a security guard for your investments. They hold and protect your assets — like shares and bonds — so no one can steal or misuse them.

Even though most investments are digital now, Custodians still play a key role in keeping your investments safe.

Key takeaway: Custodians safeguard your mutual fund assets and prevent fraud or mismanagement.

B. Why You Need a Custodian

Without a Custodian, there could be chances of theft or errors in records. They keep track of every transaction — like when your fund buys or sells shares — so everything is clear and correct.

C. Role of Custodians in India

All Custodians in India are registered with SEBI and must follow strict rules. Some top Custodians include:

- Deutsche Bank

- HDFC Bank

- Citibank

They work behind the scenes to make sure your mutual fund investments stay safe and secure.

Key takeaway: Custodians are SEBI-registered and play a crucial role in protecting your mutual fund investments.

5. The Record Keepers: Registrar and Transfer Agents (RTAs) – Making Your Life Easy

Have you ever kept track of your household expenses in a notebook or app? Like noting down how much you spent on groceries, school fees, or petrol?

Well, Registrar and Transfer Agents (RTAs) do something similar for your mutual fund investments.

A. CAMS and KFintech: The Two Big Names

Most Indian mutual fund investors interact with either CAMS or KFin Technologies, the two largest RTAs in the country.

They are like the office clerks of the mutual fund world — they handle all the paperwork and records so you don’t have to.

B. What RTAs Do

RTAs are responsible for:

- Keeping records of how many units you own,

- Processing your investments and redemptions (when you take money out),

- Sending you regular statements,

- Helping with KYC updates and other formalities.

They ensure everything is recorded correctly and updated in real time.

C. How RTAs Make Things Easier

Thanks to RTAs, you can:

- View your investments online,

- Update your address or mobile number easily,

- Redeem your mutual fund units with just a few clicks.

Many platforms like Zerodha, INDMoney, Groww and Kuvera connect directly with RTAs, so you can track and manage your investments without any hassle.

Key takeaway: RTAs simplify your life by handling all the records, transactions, and updates related to your mutual fund investments.

You’ve now met the full team behind your mutual fund — from the big boss (AMC) to the fund manager, trustee, Custodian, and record keeper (RTA). Each plays a unique role in making sure your money is managed safely and professionally.

In the next section, we’ll learn how SEBI and AMFI act as the ultimate protectors of your mutual fund investments in India.

Keep reading — it’s getting even more interesting!

III. The Guardians of the Indian Mutual Fund Industry: Keeping You Safe

Now that you’ve met the main players behind your mutual fund — like the AMC, fund manager, and Custodian — it’s time to meet the two big organizations that protect your money and make sure everything is fair and safe.

These are like the police and the teachers of the mutual fund world — they keep things in order and help you understand how to invest safely. They are SEBI and AMFI

1. SEBI: The Super Regulator – India’s Financial Watchdog

Think of SEBI (Securities and Exchange Board of India) as the traffic police of the financial market. Just like how traffic police make sure everyone follows the rules on the road, SEBI makes sure all mutual funds follow the rules so your money stays safe.

A. What Is SEBI?

SEBI is a government body responsible for regulating:

- stock markets,

- mutual funds,

- brokers,

- and other investment-related activities.

They make sure no one cheats or plays unfair games with your savings.

Key takeaway: SEBI is the main regulator of mutual funds in India and works to protect investors like you.

B. How SEBI Protects Indian Investors

SEBI does several important things to keep your money safe:

For example:

- Approves new fund schemes: Before any AMC can launch a new mutual fund, SEBI checks if it’s fair and makes sense.

- Sets limits on fees: They decide how much an AMC can charge as a fee (called expense ratio), so you’re not overcharged.

- Requires regular updates: Funds must share their performance and holdings regularly so you always know where your money is going.

This way, you never feel left in the dark about your investments.

C. Key Rules Set by SEBI

Here are some important rules SEBI has put in place:

- Caps on expense ratios: AMCs cannot charge more than a certain percentage (usually around 2.5%) as management fees.

- Mandatory risk disclosure (Risk-o-meter): Every fund must show how risky it is using a simple scale from 1 to 5 — just like how medicine bottles have warning labels.

- Portfolio diversification guidelines: Funds must spread your money across different stocks and sectors so your investment isn’t too risky.

Key takeaway: Thanks to SEBI, mutual funds in India are among the safest and most transparent investment options.

2. AMFI: The Industry Voice and Educator – Spreading Awareness

Now imagine someone teaching kids how to cross the road safely — not just once, but every year. That’s what AMFI (Association of Mutual Funds in India) does, but for investing.

A. What Is AMFI?

AMFI is a group made up of all registered Asset Management Companies (AMCs) — like SBI Mutual Fund, HDFC Mutual Fund, etc.

Their job is to:

- promote mutual funds,

- educate people like you,

- and ensure ethical practices in the industry.

Key takeaway: AMFI helps build trust in mutual funds by spreading awareness and setting high standards.

B. “Mutual Funds Sahi Hai” Campaign

Before 2008, many Indians didn’t know much about mutual funds. Most people preferred fixed deposits or gold.

So, AMFI launched a big campaign called “Mutual Funds Sahi Hai“. It used simple ads, videos, and posters to explain:

- what mutual funds are,

- why they’re safe,

- and how even small investors can benefit.

Today, millions of Indians — including those in small towns and villages — are investing in mutual funds thanks to this campaign.

Key takeaway: The “Mutual Funds Sahi Hai” campaign helped millions of Indians understand and trust mutual funds.

C. How AMFI Helps You

AMFI supports you in many ways:

- Sets ethical standards: All AMCs in AMFI agree to follow good business practices and treat investors fairly.

- Promotes financial literacy: They run programs and publish content to teach people how to invest wisely.

- Launches investor-friendly initiatives: Like Chhoti SIP, which encourages small, regular investments, and MITRA, which focuses on women investors.

For example:

My friend Kiran was scared to invest because he didn’t understand how mutual funds worked. Then he saw a short video from the “Mutual Funds Sahi Hai” campaign that explained everything in simple Hindi. He started investing ₹500 every month through a SIP — and now he’s earning better returns than her FD!

That’s the kind of difference AMFI makes.

You’ve now learned how SEBI and AMFI work together to protect your money and make investing easier and safer for you.

In the next section, we’ll walk through the journey of your investment — from your bank account to the mutual fund and back again.

Keep reading — it’s going to be super useful!

IV. How Your Money Moves: The Journey of Your Investment in India

Now that you know who manages your mutual fund, let’s follow your money — from the moment it leaves your bank account to when it grows and comes back to you.

Think of this like sending a parcel through courier service — we’ll track where it goes, how it gets there, and what happens once it reaches its destination.

1. From Your Bank Account to the Fund – Easy Ways to Invest

There are three main ways you can send your money into a mutual fund:

A. Investing Through SIPs

A Systematic Investment Plan (SIP) lets you invest small amounts regularly — even ₹100 or ₹250 a month. It’s perfect for salaried professionals.

For example:

- My friend Ravi earns ₹30,000 a month.

- He sets aside ₹1,000 every month through SIP in an equity fund.

- Over 10 years, his small monthly investment has grown into a big sum without any stress.

Why SIP works well:

- No need to time the market

- Builds discipline

- Works with rupee cost averaging (you buy more units when prices are low)

Key takeaway: SIP is like saving a little every month for Diwali or school fees — small steps that add up over time.

B. Lumpsum Investments

If you have a large sum, say from a bonus or inheritance, you can invest it all at once.

This is called a lumpsum investment.

For example:

- You get a Diwali bonus of ₹50,000.

- Instead of keeping it idle in your savings account, you invest the full amount in one go.

When lumpsum makes sense:

- When you have a large sum sitting unused

- When you’re confident about long-term growth

- For specific goals like buying a car or home

But remember — timing matters. If the market is high, your investment might dip before rising again.

Key takeaway: A lumpsum investment allows you to invest a large amount at once, such as from a bonus or inheritance. It works well for specific goals and long-term growth, but be mindful of market timing and risk.

C. Online Platforms

Thanks to technology, investing is now super easy.

Apps like Zerodha, INDMoney, Groww and Kuvera make investing simple and fast.

What they help you do:

- Compare different funds side by side

- See who the fund manager is

- Choose between direct plans (lower fees) and regular plans (with advisor fees)

- Track your investments anytime

For example:

My cousin started investing using Groww during the lockdown. She found a good fund, checked the expense ratio, read the fund manager’s profile, and started a ₹500 SIP. Now she checks her returns every month!

Key takeaway: Use trusted online platforms to invest easily, compare funds, and save on fees with direct plans.

2. Inside the Mutual Fund: Where Your Money Actually Goes

Once your money reaches the mutual fund, here’s what happens behind the scenes.

A. Building a Portfolio

Fund managers don’t put all your money in just one company or asset. They spread it across different types — like shares and/or bonds of companies, gold, etc.

This is called Diversification, and it helps reduce risk.

Key takeaway: Diversification means not putting all your money into one investment — so if one fund or asset doesn’t do well, others may balance it out.

For example:

Let’s say you have ₹10,000 to invest.

If you don’t diversify:

- You put all ₹10,000 in shares of one company, like a tech company.

- If that company does badly (like during a market crash), your whole ₹10,000 could drop fast.

But if you do diversify:

- You split your money like this:

- ₹4,000 in shares (like a mix of big companies such as Reliance and Infosys),

- ₹3,000 in bonds (safe debt investments that give steady returns),

- ₹3,000 in gold ETFs (which track the price of gold).

Now, even if the stock market falls one month, your bonds and gold might stay stable or even go up — helping to balance the loss.

In simple words, to reduce the risk of market fluctuations and uncertainties, don’t put all your money into one type of investment. It’s advisable to mix shares, bonds, and gold so your money stays safer and grows better over time.

B. Buying and Selling Decisions

Your fund manager keeps an eye on the market daily.

They decide:

- Which shares to buy or sell

- When to shift some money to safer assets like bonds

- How to manage risks based on market conditions

It’s like how a chef tastes food while cooking and adjusts the spices — the fund manager tweaks your portfolio as needed.

NAV stands for Net Asset Value. Think of it as the price tag of your mutual fund unit.

Every day, the value of the fund changes depending on how the assets inside it perform.

Let’s say:

- Today, the NAV of your fund is ₹20.

- Tomorrow, the stocks in the fund rise in value — so the NAV becomes ₹20.50.

- That means your investment grew by ₹0.50 per unit.

You can see the updated NAV daily on the AMC website or your investment app.

Key takeaway: NAV shows how much each unit of your mutual fund is worth on any given day.

3. Getting Your Money Back: The Redemption Process

Eventually, you may want to take your money out — maybe to pay for your child’s college fees, buy a house, or retire comfortably.

Here’s how you get your money back.

A. Selling Your Units

You can redeem your mutual fund units anytime (except for ELSS funds, which have a lock-in period).

Just log into your app or website, select the fund, and choose how many units you want to sell.

Within a few days, the money will be in your bank account.

B. How Long It Takes

Redemption usually takes 1–3 business days, depending on the type of fund:

| Type of Fund | Time to Get Money |

|---|---|

| Equity Funds | 2–3 business days |

| Debt Funds | 1 business day |

| Liquid Funds | Same day or next day |

So if you redeem on Monday, you could get the money as early as Tuesday.

C. Important Things to Remember

Before redeeming, keep these points in mind:

- Check your consolidated statement via MF Central

This is your “mutual fund locker” where you can see all your investments across AMCs in one place. - Be aware of exit loads (if applicable)

Some funds charge a small fee (like 0.5%–1%) if you withdraw within a certain period — usually 1 year. - Understand tax implications

Depending on how long you held the fund and the type of fund, you may have to pay capital gains tax.

Key takeaway: Always check for exit loads and taxes before redeeming your mutual fund units.

By now, you’ve followed your money’s full journey — from your bank account into the fund, how it grows, and how you can get it back.

In the next section, we’ll look at what to check when choosing a mutual fund and fund manager — and how to avoid common mistakes that many Indian beginners make.

Keep reading — it’s going to help you make smarter decisions!

V. Key Things to Look for When Choosing a Mutual Fund and its Manager

Now that you know who manages your mutual fund, it’s time to learn how to pick the right one.

This section will guide you through what to look for when choosing a mutual fund and its fund manager — so you can invest with confidence and clarity.

1. Understanding Your Own Needs: Goals and Risk Appetite

Before you choose any mutual fund, start by asking yourself:

- What are my goals?

- How much risk am I willing to take?

A. What Are Your Financial Dreams?

Ask yourself:

- Do you want to buy a house?

- Save for your child’s education or marriage?

- Plan for retirement?

Write down your goals clearly. This helps you decide which type of fund to go for.

Key takeaway: Defining your financial goals helps you pick the right mutual fund that matches your life plans.

B. How Much Risk Can You Handle?

Not everyone is comfortable with big market swings. Some people prefer steady growth, while others are okay with short-term ups and downs if it means better long-term returns.

Here’s how to think about it:

- Low risk (steady but slower growth): Like FDs or PPFs.

- Medium risk (some ups and downs): Like hybrid funds.

- High risk (more volatility, but higher return potential): Like equity funds.

If you’re close to your goal (say, 2–3 years away), low-risk funds are safer. If you have time (like 10+ years), high-risk funds might work better.

Key takeaway: Match your risk appetite with the fund type. Don’t stretch beyond what makes you uncomfortable.

C. Matching Goals and Risk with the Right Fund Type

Once you’ve decided your goal and risk level, match them with the right kind of fund:

| Goal | Time Horizon | Suggested Fund Type |

|---|---|---|

| Short-term (1–3 years) | Emergency fund, buying a car | Debt Funds |

| Medium-term (3–7 years) | Child education, home down payment | Hybrid Funds |

| Long-term (7+ years) | Retirement, wealth building | Equity Funds |

For example:

My aunt wanted to save for her daughter’s college fees in 6 years. She chose a hybrid fund, which gave decent returns without too much risk.

Key takeaway: Pick a fund type based on your goal and time frame — not just because someone else recommended it.

2. Decoding Fund and Fund Manager Performance

Just because a fund did well last year doesn’t mean it will do well this year. Here’s how to dig deeper.

A. Past Performance Isn’t Everything

Don’t get impressed by one good year. Instead, check how the fund has done over 3–5 years.

Look for consistent performance, not just a lucky streak.

Key takeaway: Focus on consistency, not just past highs.

B. Benchmark Comparisons

Every fund has a benchmark index — like Nifty 50 or Sensex.

Check whether the fund beat its benchmark over time.

For example:

- If a large-cap fund gives 12% returns and the Nifty gives 10%, that’s good.

- But if the fund gives 9% and the Nifty gives 11%, it underperformed.

You can find this info easily on platforms like Zerodha, INDMoney, Groww and Kuvera.

Key takeaway: Always compare a fund’s returns with its benchmark index to see if it’s truly doing well.

C. Compare Within Category

Not all funds are the same. So, don’t compare apples with oranges.

Compare similar funds — like two mid-cap funds or two debt funds.

Tools like Morningstar, Value Research and AMFI let you compare funds side-by-side.

For example:

I helped my uncle compare two debt funds before investing. One had slightly lower returns but was more stable. He picked that one, and now he sleeps better at night.

Key takeaway: Use comparison tools to find the best-performing fund in its category.

D. Research the Fund Manager

The fund manager is the captain of your investment team.

Check:

- How many years they’ve been managing the fund

- Whether they’ve handled market downturns well

- If they communicate regularly via factsheets or investor letters

You can find this info on the AMC’s official website or in monthly fund factsheets.

Key takeaway: A fund manager with a consistent track record adds value to your investment.

Yes, mutual funds charge you a small fee to manage your money. But even small differences matter over time.

A. What Is an Expense Ratio?

The Expense Ratio is the annual fee charged by the AMC to manage your money.

It covers:

- Fund manager salaries

- Custodian fees

- RTA charges

- Marketing costs

It may look small (like 1%), but over 10 years, it can add up.

Key takeaway: The expense ratio is the annual cost you pay for professional management of your mutual fund.

B. Lower Is Better

A fund with a 0.8% expense ratio is better than one with 1.5% — especially if both give similar returns.

Over time, the difference in fees can leave thousands in your pocket.

Let’s say:

- You invest ₹1 lakh in two funds.

- Fund A charges 1.5% expense ratio.

- Fund B charges 0.8% expense ratio.

- Both grow at 12% annually.

After 10 years:

- Fund A gives you around ₹2.8 lakhs

- Fund B gives you around ₹3.1 lakhs

That’s a clear difference — just from lower fees!

Key takeaway: Even small savings in expense ratios can make a big difference over time.

C. Direct vs. Regular Plans

There are two types of mutual fund plans:

- Direct Plans: No commission paid to agents. Lower expense ratio. Better for DIY investors.

- Regular Plans: Include agent commissions. Slightly higher expense ratio.

If you invest online through apps like Zerodha, INDMoney, Groww and Kuvera, always go for Direct plans. You’ll earn more because less money goes into fees.

Key takeaway: For online investors, direct plans offer better returns due to lower fees.

By now, you’ve learned how to:

- Understand your goals and risk appetite,

- Choose the right type of fund,

- Evaluate fund performance and fund managers,

- And compare costs to maximize your returns.

In the next section, we’ll cover common mistakes Indian beginners make and how to avoid them — so you can invest smarter and stay on track!

VI. Common Mistakes Indian Beginners Make (and How to Avoid Them!)

Even the smartest among us can make mistakes when starting something new — and investing in mutual funds is no different.

Here are six common mistakes many Indian beginners make, along with simple ways to avoid them.

1. Chasing “Hot” Funds (FOMO Investing)

It’s easy to get excited when everyone is talking about a fund that gave 30% returns last year. But just because it’s popular doesn’t mean it’s right for you.

For example:

My cousin saw an ad saying, “Top-performing fund of the year!” So he invested all his savings in it without checking anything else.

A few months later, the fund dropped because it was too risky. He panicked and sold at a loss.

Key takeaway: Don’t invest just because others are doing it. Understand the fund’s goals and risk level before jumping in.

Here’s how to avoid this mistake:

- Ask yourself: Does this fund match my goal and risk appetite?

- Look at its performance over 3–5 years, not just one good year.

- Compare it with similar funds using tools like Value Research or Morningstar.

2. Stopping SIPs When Markets Are Down

When markets fall, it’s natural to feel scared. Some people stop their SIPs thinking they’ll restart later.

But here’s the truth: market dips are actually a good time to buy more units at lower prices.

Here’s how rupee cost averaging helps:

Let’s say you invest ₹1,000 every month in a fund:

| Month | NAV | Units You Get |

|---|---|---|

| Jan | ₹20 | 50 units |

| Feb | ₹18 | 55.5 units |

| Mar | ₹15 | 66.6 units |

You end up buying more when prices are low — which works in your favor over time.

Key takeaway: Continuing your SIP during market downturns can help reduce average cost and increase long-term gains.

What to do instead:

- Stay calm and stick to your plan.

- Trust the process — consistency beats timing.

3. Not Diversifying Enough

Putting all your money into one type of fund or sector is like betting everything on a single cricket match — it can go wrong.

Diversification means spreading your money across:

- Different types of funds (equity, debt, hybrid),

- Different sectors (like banking, tech, pharma),

- And even different fund managers.

For example:

My friend invested only in IT sector funds because he worked in tech. When the tech market dipped, his entire portfolio suffered.

He later diversified into healthcare and consumer goods funds — and things balanced out.

Key takeaway: Diversification reduces risk by not relying on one investment alone.

Steps to diversify:

- Invest in multiple fund categories (e.g., large-cap + mid-cap + debt).

- Choose funds managed by different AMCs.

- Include both growth and dividend options if applicable.

4. Forgetting to Review Investments

Once you start investing, it’s tempting to forget about it and focus on daily life.

But your life changes — your income grows, your goals shift, and so should your investments.

Important to know:

If you don’t review your investments regularly, you might be:

- Holding too much risk as you age,

- Missing better-performing funds,

- Or investing in funds that no longer match your goals.

Key takeaway: Your mutual fund portfolio shouldn’t be a “set it and forget it” thing — check it every 6–12 months.

Here’s what to do:

- Use apps like Zerodha, INDMoney, Groww or Kuvera to track your investments easily.

- Update your goals and risk profile once a year.

- Shift some money from equity to debt if you’re nearing your goal.

5. Ignoring Fund Documents

Many investors skip reading the Scheme Information Document (SID) or Key Information Memorandum (KIM) — big mistake!

These documents tell you:

- Where the fund invests,

- The risks involved,

- Who the fund manager is,

- And how much it costs to invest.

Real-life situation:

I once helped my uncle understand why his fund wasn’t performing well. We checked the SID and found out it was mostly invested in small-cap stocks — which are high risk. He had expected a safe return and was shocked.

Now he reads the KIM before investing.

Key takeaway: Always read the fund’s key documents to know exactly where your money is going.

Quick steps:

- Find the KIM or SID on the AMC’s website.

- Read about the fund’s objective and risk level.

- Check the expense ratio and exit load details.

6. Believing “My Advisor Decides Everything”

Some people think their advisor picks all the investments inside the fund — but that’s not true.

Advisors suggest which funds to invest in — but once you choose a fund, the fund manager decides what to buy or sell inside it.

Let’s break it down:

- Advisor: Helps you pick the right fund based on your goals.

- Fund Manager: Decides which stocks or bonds to invest in within that fund.

So even if two people take the same advisor’s advice and invest in the same fund — they still have the same fund manager working for them.

Key takeaway: Advisors guide you to the right fund, but the fund manager controls how your money is invested.

What to do:

- Ask your advisor who manages the fund.

- Check the fund manager’s experience and strategy.

- Know that you’re not fully dependent on your advisor once the money is in the fund.

These six mistakes are very common among new investors — but now that you know them, you can avoid them!

In the next section, we’ll look at useful tools and resources that will make your mutual fund journey easier and smarter.

Keep reading — you’re doing great!

VII. Tools and Resources for Indian Mutual Fund Investors: Your Support System

Now that you know who manages your mutual fund and how to choose the right one, it’s time to talk about the tools and resources that make investing easier, safer, and more informed.

Think of these as your support system — like having a GPS while driving or a calculator while doing maths. These tools help you invest smartly and stay on top of your money game.

1. Online Investment Platforms

Thanks to technology, investing in mutual funds is now super simple — even from your mobile phone.

For example:

Apps like Zerodha, INDMoney, Groww and Kuvera let you:

- Compare different mutual funds side by side

- See who the fund manager is and how long they’ve been managing the fund

- View expense ratios and performance over time

- Invest easily with just a few taps

Key takeaway: Online platforms give you full control and transparency over your investments — all in one place.

Let me share a quick story:

My friend Ravi wanted to start investing but didn’t know where to begin. I suggested he try any of the listed apps in the example above, to pick a fund of his choice. He found a good equity fund, checked the fund manager’s profile, read the risk details, and started a ₹500 SIP. Now he checks his returns every month!

2. MF Central

Imagine if all your mutual fund investments were scattered across different AMCs — SBI Mutual Fund here, HDFC Mutual Fund there — and you had no way to see them together.

That’s where MF Central comes in.

Key point:

MF Central is like your “mutual fund locker” — a single online platform where you can see all your investments across all AMCs.

Here’s what you can do on MF Central:

- View your complete investment portfolio

- Consolidate multiple folios (if you have invested under the same PAN before)

- Update KYC details

- Track unclaimed investments

Key takeaway: MF Central gives you a clear, consolidated view of all your mutual fund holdings — making it easy to track and manage your wealth.

This helped my uncle find an old investment he forgot about — and it had grown quite nicely over the years!

3. Government and Regulator Platforms

If something goes wrong with your mutual fund, or if you want to learn more about rules and investor rights, these official platforms are your go-to guides.

Here’s what they offer:

SEBI SCORES

If you face any issues with your mutual fund company or advisor, you can file a complaint on SEBI SCORES.

It’s SEBI’s official portal for:

- Reporting fraud

- Filing complaints

- Tracking their resolution

Key takeaway: If you feel cheated or misled, SEBI SCORES helps you raise your voice and get justice.

AMFI Website

The Association of Mutual Funds in India (AMFI) has a website packed with useful info, including:

- A list of all registered AMCs

- Investor education material

- Distributor search (to verify if your advisor is authorized)

- Reports and updates on mutual fund trends

Also, check out:

- Mutual Funds Sahi Hai campaign videos — great for beginners

- Initiatives like Chhoti SIP, MITRA, and Tarun Yojana that promote small and regular investing

Key takeaway: The AMFI website is a one-stop shop for everything related to mutual funds in India.

4. Learning Resources

To become a confident investor, keep learning — and the best part is, you don’t need to go to a class or buy expensive books.

Here are some excellent free resources:

A. “Mutual Funds Sahi Hai” Website & Videos

This government-backed campaign uses simple Hindi and English videos to explain:

- What mutual funds are

- How they work

- Why they’re better than FDs and gold in the long run

Perfect for people who prefer watching rather than reading.

B. YouTube Channels with NISM-certified Experts

Some popular channels include:

- Pranjal Kamra

- Yogesh Mehta

They break down complex topics into short, easy-to-understand videos — often using real-life examples from Indian households.

C. Books Written Specifically for Indian Investors

You don’t need to read thick finance textbooks. Try beginner-friendly books like:

- What Smart Indians Do With Their Money by Monika Halan

- Financially Happy by Preeti Zende

- Let’s Talk Money by Monika Halan

These books guide you step-by-step through personal finance basics — including mutual funds.

Key takeaway: Use free and affordable learning resources to build confidence and avoid costly mistakes.

With all these tools and resources at your fingertips, investing in mutual funds in India has never been easier or safer.

In the next section, we’ll look at how to pick the right fund manager or AMC — and what to look for beyond just numbers and returns.

Keep going — you’re building strong financial habits!

VIII. Practical Tips for Beginners: Choosing the Right Fund Managers or AMCs

Now that you know who manages mutual funds and what to look for, let’s talk about how to actually choose a good fund manager or AMC.

This section gives you simple, practical steps — even if you’re just starting out — so you can invest with confidence and avoid common mistakes.

1. Research Before You Invest

Before putting your money anywhere, always do a quick check-up — like how you’d read reviews before buying a phone or choosing a doctor.

Here’s how to research

- Use trusted platforms: Try sites like Zerodha, INDMoney, Groww and Kuvera.

- Check past performance: Look at how the fund did over 3–5 years, not just one lucky year.

- See who manages it: Find out who the fund manager is and how long they’ve been managing that fund.

Key takeaway: Doing a little homework before investing can help you avoid poor-performing funds and risky choices.

Let me share a quick example:

My friend Ankit wanted to invest in an equity fund. He checked on Kuvera and found two funds with similar returns. But one had a fund manager who changed every 2 years — while the other had someone who’d managed it for 8 years. He chose the second one — and now feels more confident.

2. Look Beyond Numbers

Just because a fund gave high returns last year doesn’t mean it’s the best choice. There’s more to a fund than just numbers.

Key points

Look at these things too:

A. Fund Manager’s Tenure

Longer experience often means more stability. If a fund manager has been around for 7–10 years, they’ve likely seen market ups and downs — and handled them well.

B. Investment Philosophy

Does the fund manager believe in slow and steady growth? Or are they chasing short-term gains?

You can usually find this info in the monthly factsheet or investor letters from the AMC.

C. Communication Style

Good fund managers regularly update investors through reports. If you see regular communication, it shows transparency.

Key takeaway: A consistent investment style, clear communication, and long tenure matter as much as returns.

Here’s what not to do:

Don’t pick a fund just because it gave 30% returns once. Check if it also performed well during bad years — like the 2020 lockdown crash.

3. Stay Informed

Investing isn’t a “set it and forget it” thing. Keep yourself updated — just like how you track your phone bill or electricity usage.

Important to know

You don’t need to watch the market daily. Just stay informed with simple tools:

A. Read Monthly Factsheets

Every AMC publishes a monthly report called a factsheet. It tells you:

- Which stocks the fund owns

- How it’s performing

- Any changes in strategy or fund manager

You can find these easily on the AMC’s website.

B. Track News About the AMC

If there’s news about the AMC changing leadership or underperforming funds, it might affect your investment.

For example:

Last year, a big AMC faced a scandal about mismanaging funds. People who followed the news early were able to switch funds safely.

C. Ask Questions

If something doesn’t make sense — ask! Talk to your advisor, or reach out to the AMC directly via email or customer care.

Key takeaway: Staying informed helps you act early if something goes wrong — and boosts your confidence as an investor.

By following these three steps — researching before you invest, looking beyond numbers, and staying informed — you’ll be able to choose better mutual funds and feel more confident about your money.

In the next section, we’ll explore what the future holds for mutual fund management in India — including trends like AI, robo-advisors, and how young investors are shaping the game.

Keep reading — it’s exciting stuff!

IX. What’s the Future of Mutual Fund Management in India? – Trends to Watch

So far, you’ve learned who manages your mutual fund, how to choose a good one, and what tools are available to help you invest smartly.

Now let’s look ahead — at what’s changing and what the future holds for mutual fund investing in India.

This section will show you why it’s an exciting time to be an investor — even if you’re just starting out.

1. Technology Changing the Game

Technology is making investing easier, faster, and more user-friendly than ever before.

For example:

Remember when buying a mutual fund used to mean visiting a bank or distributor with paper forms?

Today, you can invest in a few taps using apps like Zerodha, INDMoney, Groww and Kuvera — all from your phone.

Here’s how tech is reshaping mutual funds:

- Robo-advisors: These are digital tools that suggest the right mutual funds based on your goals and risk level — no advisor needed.

- AI-driven platforms: Some apps now use artificial intelligence to track your portfolio and give smart suggestions — like when to switch funds or increase your SIP.

- UPI-based investments: You can now invest small amounts (like ₹500) through UPI — just like paying for food delivery or recharging your phone.

- Smart fund selection tools: Many platforms now offer filters like “Top-performing funds,” “Low expense ratio,” or “Best for beginners” — helping you make better choices fast.

Key takeaway: Technology is making mutual fund investing simple, affordable, and accessible — even for small-town and first-time investors.

Let me share a quick story:

My friend in Pune started investing using a mobile app. He didn’t know much about stocks or funds but used a robo-advisor tool that suggested a good equity fund. Now he adds ₹1,000 every month through UPI — and his money is growing steadily.

2. New Trends Among Indian Investors

More and more Indians are becoming smart investors — and their preferences are changing too.

Here’s what’s trending:

A. Young People Are Starting Early

Earlier, people thought investing was only for older generations. But today, college students and young professionals are starting early — thanks to social media awareness and easy-to-use apps.

For example:

On platforms like Instagram and YouTube, creators explain mutual funds in simple Hindi or English — making it fun and easy to understand.

More investors now care not just about returns, but also about impact.

ESG funds invest in companies that:

- Care for the environment (like renewable energy firms),

- Treat workers well,

- Follow ethical business practices.

These funds allow you to grow your money while supporting responsible businesses.

Key takeaway: With ESG funds, you can invest in a way that matches your values.

C. More People Choosing Direct Plans

Direct plans cost less because they don’t include commissions for advisors.

Thanks to online platforms and financial literacy campaigns like “Mutual Funds Sahi Hai”, more people are now choosing direct plans to earn higher returns.

Key takeaway: Going direct helps you save on fees and keep more money in your pocket.

D. Growth Beyond Metro Cities

Mutual fund investing isn’t limited to big cities anymore.

People from Tier 2 and Tier 3 towns — like Bhopal, Ludhiana, Tirupati — are now investing regularly through SIPs.

Why?

- Better internet access

- Local language content

- Increased trust in SEBI-regulated funds

This means more financial freedom for more Indians — and that’s a great thing!

Key takeaway: Mutual fund growth is spreading across India — giving everyone a chance to build wealth.

As you can see, the future of mutual fund management in India looks bright, inclusive, and tech-driven.

Whether you’re a student, homemaker, salaried professional, or retiree — there’s never been a better time to start investing.

In the next and final section, we’ll wrap up everything you’ve learned and give you a clear roadmap to take action — so stay tuned!

X. Conclusion – Trust the System, Stay Alert, and Empower Your Financial Future

You’ve come a long way — from learning what mutual funds are, to understanding who manages your money, how to choose the right fund, and how to avoid common mistakes.

Now it’s time to wrap up with a quick summary and some final motivation to help you take action confidently.

1. Recap: The Team Behind Your Mutual Fund

Think of your mutual fund like a well-run factory. It doesn’t run on its own — there’s a whole team working behind the scenes to make sure your money is safe and growing.

Here’s who makes it all happen:

- AMC (Asset Management Company): The main organizer that sets up and runs the fund.

- Fund Manager: The expert who picks stocks and decides where to invest your money.

- Trustee: An independent body that keeps an eye on the AMC and ensures everything is fair and legal.

- Custodian: The person or bank that physically safeguards your investments.

- Registrar and Transfer Agents (RTAs): They keep track of your units, process transactions, and manage your records.

- SEBI: India’s financial regulator that sets rules and protects investors like you.

- AMFI: The organization that spreads awareness and promotes ethical practices in the industry.

Key takeaway: Many responsible players work together to ensure your mutual fund investment is professionally managed and safe.

Let me share a quick example:

My friend used to think mutual funds were risky because he didn’t understand who was managing his money. But once he learned about the roles of SEBI, AMFI, and fund managers, he felt much more confident. Now he invests regularly through SIPs and checks the fund manager’s performance every few months.

2. Your Role as an Investor

Even though there’s a strong system in place, your role matters too.

You don’t need to be an expert or watch the market every day. But a little awareness goes a long way.

Here’s what you can do:

- Stay informed: Read monthly factsheets and check your portfolio regularly using apps like Groww or MF Central.

- Ask questions: If something doesn’t make sense, reach out to your advisor or check the AMC’s website.

- Review your investments: At least once a year, see if your funds still match your goals and risk level.

Key takeaway: Small, consistent efforts today — like checking your portfolio or reading a factsheet — can lead to big financial growth over time.

Mutual funds are not magic — they’re smart tools. And just like any tool, they work best when you use them wisely.

So go ahead — start small, stay curious, and trust the system. You now have the knowledge to invest with confidence and build a brighter financial future for yourself and your family.

And remember — the earlier you start, the more time your money has to grow.

You’ve got this! 💪

XI. Frequently Asked Questions (FAQs) – Your Common Doubts Answered!

1. Who is the actual person managing my mutual fund investment?

The fund manager employed by the AMC is responsible for making investment decisions on your behalf.

2. Can I meet or contact the fund manager directly?

Usually, no. Fund managers focus on investments, not individual interactions. You can read their views in monthly factsheets or investor letters.

Yes, but within SEBI-prescribed limits. Each fund has a defined investment objective and risk profile. Always read the SID to understand the risk level.

4. What if my fund manager leaves the AMC?

The AMC will appoint a new fund manager. If you're not comfortable, you can consider switching funds after reviewing the new manager's profile.

5. Do fund managers guarantee returns?

No. Mutual fund returns are **not guaranteed**. They depend on market performance and the fund manager's decisions.

6. What's the difference between an AMC and a bank offering mutual funds?

An AMC creates and manages funds. A bank may distribute mutual funds but does not manage them.

7. Is it safer to go with government-backed AMCs like SBI Mutual Fund?

Not necessarily. Private and public AMCs are equally regulated by SEBI. Choose based on performance, not ownership.

8. How many fund managers typically work on one mutual fund?

Usually, one or two primary fund managers handle a fund. Sometimes, larger funds may have a team approach.

9. How do I complain if I think my money is being mishandled?

You can file a complaint on SEBI SCORES or reach out to the AMC's customer service.

10. Where can I learn more about who is managing my mutual fund?

Check the fund's factsheet, Scheme Information Document (SID), or visit the AMC's official website.